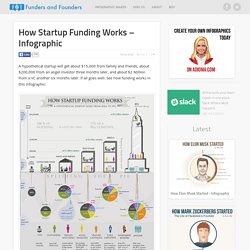

How Funding Works - Splitting The Equity With Investors - Infographic. A hypothetical startup will get about $15,000 from family and friends, about $200,000 from an angel investor three months later, and about $2 Million from a VC another six months later.

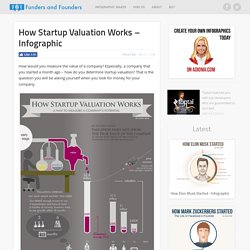

If all goes well. See how funding works in this infographic: First, let’s figure out why we are talking about funding as something you need to do. This is not a given. The opposite of funding is “bootstrapping,” the process of funding a startup through your own savings. If you know the basics of how funding works, skim to the end. Every time you get funding, you give up a piece of your company. Splitting the Pie The basic idea behind equity is the splitting of a pie. When Google went public, Larry and Sergey had about 15% of the pie, each. Funding Stages Let’s look at how a hypothetical startup would get funding. Idea stage At first it is just you. Co-Founder Stage As you start to transform your idea into a physical prototype you realize that it is taking you longer (it almost always does.) The Angel Round. How Startup Valuation Works - Illustrated. How would you measure the value of a company?

Especially, a company that you started a month ago – how do you determine startup valuation? That is the question you will be asking yourself when you look for money for your company. Create an infographic timeline like this on Adioma Let’s lay down the basics. Valuation is simply the value of a company. Why does startup valuation matter? Valuation matters to entrepreneurs because it determines the share of the company they have to give away to an investor in exchange for money. How do you calculate your valuation at the early stages? Figure out how much money you need to grow to a point where you will show significant growth and raise the next round of investment.

Angel Resource Institute. Topics: Angel Research, Angel Groups, Angel Market Data, Valuation Summary: The 2012 Halo Report is a collaborative project of Angel Resource Institute, Silicon Valley Bank, and CB Insights.

The Halo Report provides on-going trends of angel group activities in US companies. ARI (n.d.). 2012haloreportinfographic [Article]. Retrieved from. Determining Valuation Multiples. Last week on MBA Mondays, I talked about valuing an internet marketplace business.

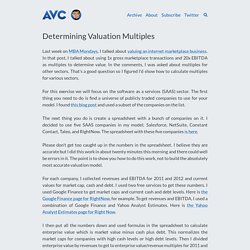

In that post, I talked about using 1x gross marketplace transactions and 20x EBITDA as multiples to determine value. In the comments, I was asked about multiples for other sectors. That's a good question so I figured I'd show how to calculate multiples for various sectors. For this exercise we will focus on the software as a services (SAAS) sector. The first thing you need to do is find a universe of publicly traded companies to use for your model. The next thing you do is create a spreadsheet with a bunch of companies on it. Please don't get too caught up in the numbers in the spreadsheet. For each company, I collected revenues and EBITDA for 2011 and 2012 and current values for market cap, cash and debt. I then put all the numbers down and used formulas in the spreadsheet to calculate enterprise value which is market value minus cash plus debt.

The results of this exercise are as follows: 10 Steps to Starting an Entrepreneurial Venture – Muskblog. SAAS Valuation Multiples. Useful Data Sets. Last Updated: January 2014 This page provides information on how to collect data from a variety of sources. it also allows you to look at and download a number of data sets that you might find useful in corporate finance and valuation.

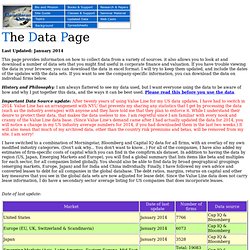

If you have trouble viewing the data in your browser, you can download the data in excel format. I will try to keep them updated, and include the dates of the updates with the data sets. If you want to see the company-specific information, you can download the data on individual firms below. History and Philosophy: I am always flattered to see my data used, but I want everyone using the data to be aware of how and why I put together this data, and the ways it can be best used. Important Data Source update: After twenty years of using Value Line for my US data updates, I have had to switch in 2014.

I have switched to a combination of Morningstar, Bloomberg and Capital IQ data for all firms, with an overlay of my own modified industry categories. David Teten — Founder, Venture Capitalist.