Nokia Patent Portfolio An Untapped Goldmine. Windows Phone Takes Third, but There's More to the Story. Posted by RobbCab on May 17, 2013 03:01 pm I'm sure most of you have read the article about IDC reporting Windows Phone claimed third place over Blackberry. While some may consider it a "hollow victory" in light of Blackberry's recent struggles and some may claim 3.2% is 10 times smaller than Samsung's Android sales alone, there are more signs that Windows Phone is finally gaining traction.

UPDATE: TL;DR added I realize a ~1000 word post may be a lot to digest, so scroll down to the bottom for the TL;DR. Maybe some of the pretty pictures in between here and there will get you to read some of it. My Definitive 17 Cardinal Rules For Investing Success. Many of the comments in my articles have surprised me by asking what are relatively fundamental questions in regards to investing.

It's taught me that the audience of this site is not only financial experts. In my quest to provide alpha for all investors, novice to expert, this is a look into everything I've learned in over thirteen years of being involved with finance and investing, condensed into 17 concise points that all investors can hopefully benefit from.

These are my definitive 17 cardinal rules for investing success. 1. Carry a Considerable Dividend & Cash Position When managing any amount of money, two of the most conservative strategies that you can take are placing money into blue chip stocks that pay out handsome dividends and keeping cash available. Keeping a large cash position can be beneficial for a couple of reasons: Other low risk items you can put into this category include commodities like gold & silver, bonds, and conservative mutual funds. George Kesarios' Articles on NOK: Nokia Corporation. Nokia's First Quarter, From Bad To Worst. Beware Of The Price/Sales Trap. Some stocks go up for years and never look back, while other stocks have not produced any appreciation for investors for a decade or more, even while their fundamentals get better and better.

Microsoft is but just one example of such a stock. It has more cash in the bank than ever before, more sales and a wider Eco footprint and an all time low P/E, yet its stock has been a big disappointment for over a decade now. Today I want to point out what you have to look for, to avoid such stocks, no matter how good they seem, no matter how much they grow per year they and no matter how much analysts say they should be worth. As a side-note, this article is mainly intended for long term investors who buy and hold and don't really trade often.

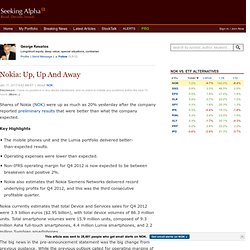

Please note that being a long term investor is not bad, if you have a crystal ball and can see the future price of the stock. Nokia: Up, Up And Away. Shares of Nokia (NOK) were up as much as 20% yesterday after the company reported preliminary results that were better than what the company expected.

Key Highlights The mobile phones unit and the Lumia portfolio delivered better-than-expected results.Operating expenses were lower than expected.Non-IFRS operating margin for Q4 2012 is now expected to be between breakeven and positive 2%.Nokia also estimates that Nokia Siemens Networks delivered record underlying profits for Q4 2012, and this was the third consecutive profitable quarter.

Nokia currently estimates that total Device and Services sales for Q4 2012 were 3.9 billion euros ($2.95 billion), with total device volumes of 86.3 million units. Total smartphone volumes were 15.9 million units, composed of 9.3 million Asha full-touch smartphones, 4.4 million Lumia smartphones, and 2.2 million Symbian smartphones. The big news in the pre-announcement statement was the big change from previous guidance.

Follow George Kesarios. Nokia: The Turnaround Story Continues. Since Nokia (NOK) is a turnaround special situation play, it matters not what the company has done in the past, especially the past year, but what the company does sequentially on a q-o-q basis.

With that in mind, this short presentation places an emphasis on very recent data and especially q-o-q performance. Having said that, while Nokia had a horrible year, q-o-q group revenue was very satisfactory and that leads me to believe we are at a turning point. (click to enlarge) Jacob Steinberg's Articles on NOK: Nokia Corporation (Page 3) Buying Nokia Below $3 Is Like Buying Ford Below $2. A few years ago when I was buying shares of Ford (F) at prices below $2, my friends kept telling me I was crazy.

They told me I was throwing good money after bad money. Then my investment in Ford returned me about 900% in 3 years. Nokia's Turnaround Underway As Lumia 521 Sells Out In Wal-Mart. This Is How Much Nokia Made From Patents Last Year. Disclosure: I am long NOK .

Forum On Nokia, Covering NSN, HERE, IP, And General Discussion. - Seppo2. 'Bye, Bye, Nokia' Or 'Buy, Buy, Nokia'? Many investors today don't know if Nokia (NOK) is coming or going, whether it is nearing its swan song or if it is a phoenix, poised to rise from the ashes of its former self.

If you are in the first camp, then you might have already said "Bye, bye, Nokia! " However, if you believe the once giant of the mobile phone industry is on its way up again, then you are probably yelling, "Buy, buy, Nokia! " Nokia DCF, Multiples Analysis & Rating. Investment and Trading Ideas. Investment and Trading Ideas. With Nokia’s Q1 earnings out of the way, its time to focus on where the company can go from here.

Although their Q1 earnings were a bit of a disappointment, its worthwhile to note that Nokia is just beginning to delve into their product pipeline. With multiple new products released in the past month and many more slotted for May, Nokia is slowly ramping up its marketing efforts and strong sales will likely follow. From this viewpoint, it is clear why their results did not meet expectations for Q1. However the sell off post earnings announcement did present an excellent buying opportunity. Investment and Trading Ideas. After noticing the restructuring that Nokia has completed over the last few years and taking a good look at their current product line, it became clear to me that this company is turning a corner.

My next step was to begin to take a look at the numbers to see if I could find quantitative support for my qualitative hypothesis. This was not an easy project as Nokia is made up of three different businesses and billions of dollars worth of intangibles in the form of Intellectual Property and Patents.

Nokia’s patents alone produce over $500 million in revenues per year, meanwhile the company is beginning to aggressively defend these patents in an attempt to provide even more revenue growth. These patents cover a wide range of technology and incorporate much of the many billions of dollars the firm has spent on Research and Development in the last couple of decades. On to the meat of this case….

With all of this data collected, I began to put together my discounted cash flow model.