Gold standard. All references to "dollars" in this article refer to the United States dollar, unless otherwise stated.

Under a gold standard, paper notes are convertible into preset, fixed quantities of gold. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. Three types may be distinguished: specie, exchange, and bullion. Federal Reserve Act. Federal Reserve.

Woodrow Wilson. In his first term as President, Wilson persuaded a Democratic Congress to pass a legislative agenda that few presidents have equaled, remaining unmatched up until the New Deal in 1933.[2] This agenda included the Federal Reserve Act, Federal Trade Commission Act, the Clayton Antitrust Act, the Federal Farm Loan Act and an income tax.

Child labor was curtailed by the Keating–Owen Act of 1916, but the U.S. Supreme Court declared it unconstitutional in 1918. Wilson also had Congress pass the Adamson Act, which imposed an 8-hour workday for railroads.[3] Although considered a modern liberal visionary giant as President, Wilson was "deeply racist in his thoughts and politics" and his administration racially segregated federal employees and the Navy.[4][5] According to Wilson biographer A. Great Depression. USA annual real GDP from 1910–60, with the years of the Great Depression (1929–1939) highlighted.

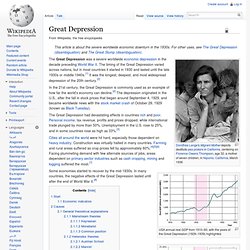

The unemployment rate in the US 1910–1960, with the years of the Great Depression (1929–1939) highlighted. In the 21st century, the Great Depression is commonly used as an example of how far the world's economy can decline.[2] The depression originated in the U.S., after the fall in stock prices that began around September 4, 1929, and became worldwide news with the stock market crash of October 29, 1929 (known as Black Tuesday). The Great Depression had devastating effects in countries rich and poor. Personal income, tax revenue, profits and prices dropped, while international trade plunged by more than 50%. Unemployment in the U.S. rose to 25%, and in some countries rose as high as 33%.[3] Cities all around the world were hit hard, especially those dependent on heavy industry. Some economies started to recover by the mid-1930s. Start Economic indicators Causes General theoretical explanations. The Great Depression.

J. P. Morgan. John Pierpont "J.

P. " Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker, philanthropist and art collector who dominated corporate finance and industrial consolidation during his time. In 1892 Morgan arranged the merger of Edison General Electric and Thomson-Houston Electric Company to form General Electric. After financing the creation of the Federal Steel Company, he merged in 1901 with the Carnegie Steel Company and several other steel and iron businesses, including Consolidated Steel and Wire Company owned by William Edenborn, to form the United States Steel Corporation. Morgan died in Rome, Italy, in his sleep in 1913 at the age of 75, leaving his fortune and business to his son, John Pierpont "Jack" Morgan, Jr., and bequeathing his mansion and large book collections to The Morgan Library & Museum in New York. Childhood and education[edit] J.

Career[edit] Early years and life[edit] J. J.P. Central bank. The primary function of a central bank is to manage the nation's money supply (monetary policy), through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis.

Central banks usually also have supervisory powers, intended to prevent bank runs and to reduce the risk that commercial banks and other financial institutions engage in reckless or fraudulent behavior. Central banks in most developed nations are institutionally designed to be independent from political interference.[4][5] Still, limited control by the executive and legislative bodies usually exists.[6][7] THE FED : The Federal Reserve. The Fed. Rockefeller family. The Rockefellers (Full) The Rockefeller File (1976) by Gary Allen. The Evolution Of Banking. With the exception of the extremely wealthy, very few people buy their homes in all-cash transactions.

Most of us need a mortgage, or some form of credit, to make such a large purchase. In fact, many people use credit in the form of credit cards to pay for everyday items. The world as we know it wouldn't run smoothly without credit and banks to issue it. In this article we'll, explore the birth of these two now-flourishing industries. Tutorial: Introduction To Banking And Saving Divine DepositsBanks have been around since the first currencies were minted, perhaps even before that, in some form or another. Flipping a CoinThese coins, however, needed to be kept in a safe place. Coins could be hoarded more easily than other commodities, such as 300-pound pigs, so there emerged a class of wealthy merchants that took to lending these coins, with interest, to people in need. Central Banking Explained (satan's monetary control) Part 1 of 2.