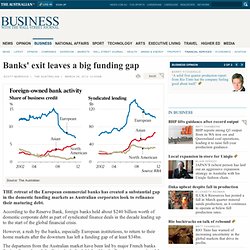

Banks' exit leaves a big funding gap. Source: The Australian THE retreat of the European commercial banks has created a substantial gap in the domestic funding markets as Australian corporates look to refinance their maturing debt.

According to the Reserve Bank, foreign banks held about $240 billion worth of domestic corporate debt as part of syndicated finance deals in the decade leading up to the start of the global financial crisis. However, a rush by the banks, especially European institutions, to return to their home markets after the downturn has left a funding gap of at least $34bn. The departures from the Australian market have been led by major French banks Societe Generale and Credit Agricole, both hit hard by the European sovereign debt crisis.

Canadian bank TD Securities also has left Australia, while Royal Bank of Scotland has dramatically scaled back its local balance sheet. "The Asian banks' share has increased to close to one-fifth. " Chinese banks are also growing participants in Australian debt deals. Deposit competition clouds RBA calls. Foreign bond holders will stick around: RBA. The Villain - Magazine. Pendulum Is Seen in Swing to Stocks. Having a bond moment. The death of bonds is being greatly exaggerated. I wanted to write this piece today to have a look at bond markets globally and what they might, or might not, be trying to tell us about the future not just of the economy but of assets more broadly.

As the recovery in the US economy appears to be gaining traction the bond market has started to sell off a little and I am increasingly reading that the long run secular bond market rally is now at an end. Www.ampcapital.com.au/K2DOCS/site_ampci/C3F8C012-2E07-4D84-9D4F-F691FDE64F6F/2012-Mar-21-Olivers-Insights-Global-recovery-watch.pdf?DIRECT. Aussie equities underperform global peers. PIMCO’s Gross sees lower bond returns. Investors reap rewards of lean times. Bina Brown Investors tired of watching stumbling share prices should take comfort from the rise in dividend payments among major listed companies.

The latest round of dividend payments were up 7.9 per cent on the previous corresponding period as companies increased their payout ratios and earnings per share in an otherwise lacklustre reporting period, according to independent researcher Morningstar. Increases in payout ratios for the six months ended December include BHP Billiton’s lift from 24 per cent to 29 per cent, Boral’s 57 per cent to 87 per cent and Cochlear’s 68 per cent to 85 per cent. Queensland massacres Labor. From left, new treasurer Tim Nicholls, premier-elect Campbell Newman and deputy Jeff Seeney meet for the first time on Sunday.

Photo: Glenn Hunt Mark Ludlow and Geoff Kitney Queensland’s premier-elect, Campbell Newman, plans to join with the other conservative states to “fight for the common cause” against federal Labor on issues such as the carbon tax and the mining levy. The Liberal National Party’s crushing election victory – it won a likely 78 seats in the 89-seat Parliament and reduced Labor to just seven MPs – redraws the balance of federal-state power relations. Labor has been left with only two premiers on the Council of Australian Governments. Proceed with carbon tax at your peril: Newman. Prime Minister Julia Gillard has been told to “think again” about Labor’s incoming carbon tax after the state party was demolished by voters at the Queensland election.

New Queensland Premier and Liberal National Party leader Campbell Newman issued the warning on Tuesday after a new opinion poll showed federal Labor had fallen further into the electoral doldrums. The man who led the LNP to a stunning majority at Saturday’s election said the carbon tax was extremely unpopular with Queenslanders and implied that the antipathy was reflected across the country. Victoria axes emissions target. CLIMATE SPECTATOR: Carbon target scrapheap. Costello to audit Qld finances. RBA more upbeat on world economy. The RBA acknowledged that Australia’s banks were still grappling with high funding costs, although the central bank said these institutions had made significant inroads into their expected wholesale funding needs, which put them in a better position to cope with any renewed funding strains.

Photo: Peter Braig John Kehoe and Michael Dwyer. Europe needs ‘mother of all firewalls’: OECD. Trichet gives insight into crisis. Crying out for nanny rebate. Symantec pulls out of Huawei venture. Huawei has already laid off several workers in Huawei Symantec’s Silicon Valley offices this month and plans to move its entire operation out of the United States, largely because of increased American government oversight.

WESTPAC Grounded by winds of change. Westpac tech chief comes out swinging. Westpac’s new chief information officer Clive Whincup . . . priority was on the customer side.

Paul Smith Westpac Banking group’s new technology chief says that, despite the spate of redundancies in his department, the bank is forging ahead with ambitious IT plans and is determined to right a market perception that it has been left languishing in the wake of Commonwealth Bank of Australia’s headline-grabbing core banking modernisation program.

In his first interview since taking the technology reins at Westpac in December, chief information officer Clive Whincup told The Australian Financial Review that Westpac had taken an opposite approach to CBA with its plans to upgrade its technology capabilities and put in place new customer facing systems, ahead of a core systems replacement project. It had focused on areas such as online systems, a new contact centre application, data centre infrastructure and new mobile banking platforms, before replacing the core. Mobile banking pays small merchants. The new PayPal Here card reader plugs into a smartphone.

Photo: Simon Cardwell Jessica Gardner Payment services providers are targeting small businesses with new mobile banking technology. In the past fortnight, online payment provider PayPal unveiled a credit and debit card reader that can be fitted to a smartphone, while National Australia Bank announced a mobile-optimised version of its web-based merchant service NAB Transact that will allow merchants to take credit card payments via mobile phones and tablets.

Research from PayPal found that 50 per cent of micro-businesses (those with four employees or fewer) already used their smartphones for business tasks, such as email, calendar and maps. Note to job seekers: close your Facebook. Illustration: Karl Hilzinger Brian Corrigan Recruiters, lawyers and academics say job seekers should resist a worrying trend for potential employers to demand Facebook account details for a pre-hire peek into their personal lives.

BoQ plans $450m raising, flags $91m loss. BOQ shares take a leap after capital raising. BOQ shares have not touched these levels since early December. Photo: Glenn Hunt. Shareholders suffer in BoQ's highly dilutive $450m equity raising. New boy starts revolution at Bank of Queensland. Size of Bank of Queensland's capital raising a surprise. BOQ protected against future shocks. BANK of Queensland (BOQ) says it is now protected from future shocks to its balance sheet after more than doubling its bad debt provisions and flagging a first half net loss. BOQ today said impairment costs on loans will be $328 million for the six months to February, up from $134 million in the same period in the previous year. That will lead to a $91 million loss for the first half, down from a $48 million profit in the previous corresponding period. Anger at Goldman still simmers. JetStar HK. Rio, BHP Lose Faith in Diamonds Even as Prices Rise: Commodities.

Rio Tinto Group (RIO) and BHP Billiton Ltd. (BHP) are looking to exit the diamond industry even as prices head for a fourth year of gains, because they see little prospect of repeating the dominance they hold in iron ore. Rio is considering options for its diamond mines because they may no longer fit with strategy and they don’t have the required scale, the London-based company said yesterday. BHP Billiton Ltd. has sought bids for its diamond assets. BHP and Rio, which together accounted for about 16 percent of global diamond production by value in 2010, have failed to match the output of industry leaders De Beers and OAO Alrosa of Russia. That contrasts with the position in iron ore, where along with Brazil’s Vale SA, they have a market share of about 63 percent, according to estimates from Bloomberg Industries.

Diamonds: no longer Rio’s best friend. Rio Tinto tipped to float diamond business. Rio Tinto may move to replicate its aluminium divestment plans by breaking off and floating its diamond business, while retaining some sweet spots, analysts speculate in the wake of the major's intentions to focus on its lucrative iron ore portfolio. Drug companies. Future budgets offer super reasons for wholehearted tax reform. Super: retail outshines industry funds. BT Financial Group head of Superannuation Melanie Evans says the integration of superannuation with banking is helping retail superannuation funds claw back market share. Super funds won’t yield on strategy. Big banks kiss ‘glory days’ goodbye. Andrew Cornell and Patrick Durkin Major banks are unlikely to witness a return to the “glory days” when they could rely on markets and treasury income to deliver almost 15 per cent of group revenue, dashing hopes of a turnaround.

This windfall revenue for the banks, underpinned as companies and investors reacted rapidly to falling interest rates and currency fluctuations during the crisis, peaked at $4.2 billion, or 14.2 per cent of revenue, in the first half of 2009. By the second half of 2011 it had fallen to $2.4 billion, or 7.4 per cent. BNP joins attack on ‘cult of equities’