Era of excessive CEO pay is over, says BCA president. Perpetual pay cuts avert a 'second strike' UBS Moves Quickly on Job Cuts, Revamp. Catastrophe Bonds Reach Highest Level Since Japan Earthquake. Demand for bonds designed to protect insurers from payouts on natural disasters is increasing, with an index tracking the debt at the highest level since prices plummeted in March 2011 after Japan’s earthquake.

Catastrophe bonds returned 0.33 percent last week, boosting the Swiss Re Cat Bond Price Return Index to 94.12, the highest in 18 months. ++ Estimate of Economic Losses Now Up to $50 Billion. What The Insurance Companies Don't Tell You. This Government Needs Disaster Relief. Federal politics 7 Feb 2011. ++ Cost of Sandy's fury may top $US50b.

In the Breezy Point section of Queens, fire followed wind and rain.

Photo: AFP THE damage bill inflicted by Hurricane Sandy could reach $US50 billion, and economists warn that the storm could shave half a percentage point off US economic growth in the current quarter. Losses from the storm could reach $US50 billion, according to EQECAT, which tracks hurricanes and analyses the damage they cause. Www.Artemis.bm The Alternative Risk Transfer, Catastrophe Bond, Insurance-Linked Securities and Weather Risk Management Blog. Catastrophe bonds unbowed by Hurricane Sandy. New Orleans - Hurricane Katrina - Housing - Insurance - Natural Disasters and Storms - Real Estate. New York stock markets close as insurers calculate hurricane damage. Hurricane Sandy has closed New York's stock markets as the city prepares for the worst – but although finance chiefs may be sitting it out at home they are already trying to calculate the costs.

Les marchés financiers, victimes indirectes de l'ouragan Sandy. Le Monde.fr | • Mis à jour le | Par Mathilde Damgé Effet collatéral de l'arrivée de l'ouragan Sandy sur la côte est des Etats-Unis, les cat bonds (catastrophy bonds, "obligations" liées aux catastrophes naturelles) marquent le pas : ces produits financiers, inconnus du grand public, ont connu un recul avec l'arrivée de la dépression.

Cat Bonds Likely Safe From Superstorm Payouts, Armored Wolf Says. Bonds designed to protect insurers such as Chubb Corp.

(CB) and Travelers Cos. (TRV) from natural disaster costs are signaling superstorm Sandy probably won’t trigger payouts, according to John Brynjolfsson of Armored Wolf LLC. The Trouble with Catastrophe Bonds. It's not easy hedging against Armageddon.

Consider the case of catastrophe bonds designed to provide capital to insurance companies when extreme, big-scale disasters occur. Japan's mid-March earthquake, tsunami, and ongoing nuclear reactor crisis would seem to qualify. The economic toll from these catastrophes may run between $200 billion and $300 billion and could cost the global insurance industry anywhere from $21 billion to $34 billion, according to an Apr. 12 estimate by risk-modeling research firm Risk Management Solutions.

Yet it turns out the cat bond market won't be of much help in covering Japan-related insurance losses. Www.Artemis.bm The Alternative Risk Transfer, Catastrophe Bond, Insurance-Linked Securities and Weather Risk Management Blog. Once again a northeast U.S. hurricane has been a major flood catastrophe event.

This happened last year with hurricane Irene which saw the U.S. National Flood Insurance Program, pick up a significant portion of the economic losses from the storm. It’s expected that this will also happen with Sandy and this has once again highlighted the need for the NFIP to cede risk to the private reinsurance and risk transfer markets, with catastrophe bonds one potential tool at their disposal. Cat Bond Returns Accelerate as ‘Frankenstorm’ Bears Down. Bonds designed to protect insurers from payouts on natural disasters are headed for the best returns since 2009 as a superstorm expected to develop from Hurricane Sandy threatens to strike the U.S.

Northeast. Catastrophe bonds, which lose money if they’re triggered, have returned 10.3 percent this year through last week, more than triple the 2.79 percent gains in the corresponding period of 2011, according to the Swiss Re Cat Bond Total Return Index. The measure, which tracks dollar-denominated debt sold by insurers and reinsurers, includes bonds linked to potential storm damage in the U.S. Investor demand for the securities has grown with yields on speculative-grade corporate bonds hovering at record lows as the Federal Reserve holds down interest rates to boost the economy. Sigma 2/2012: Natural catastrophes and man-made disasters in 2011. Natural catastrophes and man-made disasters caused not only human hardship and the loss of thousands of lives, but also staggering overall economic and insured losses in 2011.

Throughout these events, the insurance industry solidified its key role in risk management and post-disaster recovery financing. Sigma 2/2012, “Natural catastrophes and man-made natural disasters in 2011,” details a year that saw the highest economic losses in history, the highest insurance earthquake losses, and the highest insured losses ever for a single flood event. Earthquakes in Japan, New Zealand, and Turkey, as well as floods in Australia and Thailand brought massive destruction and loss of life in 2011. In total, economic losses totaled USD 370 billion and of that, insured losses of USD 116 billion. Media.swissre.com/documents/sigma2_2012_en.pdf. Banksia cleared of pretending to be bank.

Capital flaw breaks Banksia. Parliamentary secretary to the Treasurer Bernie Ripoll’s office says the MP is satisfied the current regulatory regime for lenders such as Banksia is adequate.

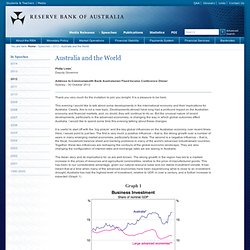

Photo: Glenn Hunt Jonathan Shapiro and Matthew Drummond Collapsed property lender Banksia Financial Group had less than half the capital to protect against bad loans recommended by the Australian Securities and Investments Commission. Banksia accused of taking illegal deposits. Australia and the World. Philip Lowe* Deputy Governor Address to Commonwealth Bank Australasian Fixed Income Conference Dinner Sydney - 30 October 2012.

Bill Clinton Presses On in Campaign for Barack Obama. The Hewson legacy that should worry the Libs. Abbott cold shoulders Asian Century white paper. It’s Labor’s Parliament, for now. Australia in the Asian Century. Chinese demand not so great: Garnaut. Elders comes to a sorry end. Virgin buys into Tiger, builds Singapore ties. Virgin chief executive John Borghetti said the deal would give his airline greater access to the budget market. Apple iPhone software, retail chiefs leave. Scott Forstall, senior vice president of iOS Software at Apple during the iPhone 5 launch in San Francisco in San Francisco.

Reuters Apple said its iPhone software chief and its head of retail would leave, a major executive shake-up that follows embarrassing problems with the company’s new mapping software and disappointing quarterly results. The moves, which come a little more than a year into Tim Cook’s tenure as Apple’s chief executive, were described by the company as a way to increase “collaboration” across its hardware, software and services business. +++ Bendigo CEO paints ‘gloomy’ outlook for banks. NAB’s Clyne: I just get on with the job. BT Investment Management shares fall on $21m profit. Www.afr.com/rw/Wires/Stories/2012-10-29/ASXAnnouncements/BEN_01349033.pdf. Www.afr.com/rw/Wires/Stories/2012-10-29/ASXAnnouncements/BEN_01349038.pdf.