SUper CPA. Make super payments annual, not lump sum: CPA. The world knows what you’re reading. Aisha Sultan Washington University law professor Neil Richards worries about a day when everyone knows what everyone else is reading.

From social reader apps, which automatically share what users are reading on Facebook to tablets and e-reading devices, which store detailed reading data, the laws protecting individuals haven’t kept up with technology, he says. Media reports from earlier this northern hemisphere summer documented a sharp decline in the numbers of people using news social reader apps. Online retail sales grow at double-digit pace.

Woolworths unveils property spin-off. ECB, BoE leave rates on hold, but stimulus goes on. Hollande has a second look at austerity push. Spanish splits deepen in bailout debate. Draghi says ECB primed to buy bonds. + Foreign cars catching up. ++ CAR sales as a speedo check for the economy - ABC. Find More Stories Car sales as a speedo check for the economy. New Car Sales Figures September 2012. September 2012 Australian New Car Sales Figures (units sold – market share) Light Car Segment Winners : Mazda2 (1,801 – 16.4%)Toyota Yaris (1,330 – 12.1%)Suzuki Swift (1,152 – 10.5%)

The Rich World's 'Peak Car' Moment: Car-Sharing, Carpooling, Car-Ignoring - Derek Thompson. Today's news of explosive car-pooling companies in Europe is a glimpse into a broader trend: Car-driving and car-owning metrics are peaking across the developed world Reuters When it comes to cars and young people in America, every trend line is pointing down-right.

Car sales? Down 11 percentage points. Future Vision: Will Driving Become Too Safe to Insure? What would happen to the auto insurance industry if automobile safety improves to the point that vehicle collisions become relics of the past?

That’s the question explored by global consulting and research firm, Celent, in a new report that envisions a future of increasing emphasis on safety in the automobile industry and among government entities that leads to a massive drop off in auto insurance premium for U.S. property/casualty insurance companies. In its own introductory words, “A Scenario: The End of Auto Insurance — What Happens When There Are (Almost) No Accidents,” by Celent Senior Analyst Robert Light, “describes a provocative, but plausible, scenario for the not distant future of the US property/casualty market, and explores that scenario’s implications.

The future of driving: Seeing the back of the car. Have we passed peak travel? Most economists understand is that growth in mobility and travel has for centuries signalled growing prosperity.

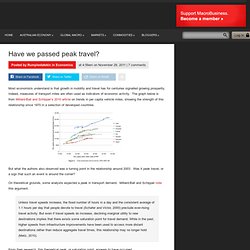

Indeed, measures of transport miles are often used as indicators of economic activity. The graph below is from Millard-Ball and Schipper’s 2010 article on trends in per capita vehicle miles, showing the strength of this relationship since 1970 in a selection of developed countries. But what the authors also observed was a turning point in the relationship around 2003. Was it peak travel, or a sign that such an event is around the corner? On theoretical grounds, some analysts expected a peak in transport demand. The end of the road for motormania - opinion - 16 August 2011. Read full article Continue reading page |1|2 Something unexpected is happening to our car-crazy culture.

What are the forces driving us out of motoring? IS THE west falling out of love with the car? Web.mit.edu/vig/Public/peaktravel.pdf. Deloitte Cars BRIC. BITRE Modelling. Transport emissions projections.

Shadow RBA plumps for rates on hold. At the Holden plant ... manufacturing has continued to decline for a seventh consecutive month.

Photo: Nic Walker Joanna Heath and Jacob Greber An influential group of former Reserve Bank of Australia board members, academics and market economists has urged the central bank to shun calls for an interest rate cut today. A nine-member board acting as a “shadow” RBA said on Monday that the best option would be for the bank to keep the benchmark cash rate at 3.5 per cent. The recommendation belies the expectations of financial markets, where the chance of a rate cut stands at 68 per cent. RBA board members have signalled in recent weeks they are increasingly concerned about falling commodity prices and the high dollar, which might be squeezing the economy more than expected.

Treasurer Wayne Swan said the government’s fiscal strategy has “given the RBA room to cut interest rates substantially” over the next 12 months. Investing in the post-boom world. Bina Brown Ashift from steel production to pig farming by one of China’s largest steel producers was never going to be a positive sign for the already faltering mining sector.

When Wuhan Iron & Steel decided this year that pork held better prospects than steel production that was, until recently, earning Australian miners record prices, the market for iron ore was already well off its highs. China ushers in ‘dog days’ for Australia. Economist and Labor government advisor Ross Garnaut says Australia needs to reconsider the “taxation largesse of the easy years of money” that began in 2004, as China’s moderating economic fortunes bring about “dog days” of faltering incomes and living standards in Australia.

Photo: Arsineh Houspian Jacob Greber Economics correspondent Prominent Labor government adviser and noted economist Ross Garnaut has warned of a long and tough China-induced downturn in Australia that will require restraint in government spending and wages growth for the rest of the decade. Cubbie conundrums: the foreign investment debate - The Drum. Updated Tue 2 Oct 2012, 7:07am AEST The sale of Cubbie Station to a Chinese-led consortium has divided the country on the issue of foreign investment.

In part one of her special investigation, ABC's Ticky Fullerton examines genuine concerns around Chinese investment, which go directly to national interest. Australia plays second fiddle as miners eye Africa. China’s new team needs to rock the boat. Team Korea arrives in force. Arrium bid flags shift in Korea Inc investment. Local steel industry starts to buckle. Business Spectator End Boom. Business Spectator Double Dutch. Room for further interest rate cuts: Swan. Risk seen in short-term bonds. + RBA pushed for fee on banks. China’s Communist Party humbly woos the masses. Food and wine sales to China. The rise of the Chinese consumer. Tasty and safe . . . Chinese are happy to pay $6.50 a litre for imported milk.

Photo: Bloomberg. Smith brings ANZ Wealth into the light. NAB suit heads to New York. QBE on track in steps to prune costs. Bank of Queensland to make H2 profit, FY loss amid higher bad debts. BOQ to post first bank loss in 20 years. BoQ set to post landmark loss. BlueScope protection slammed. Protected species ... rolled steel at BlueScope’s Port Kembla manufacturing plant. Photo: Louie Douvis Gemma Daley, Joanna Heath and Mathew Dunckley A plan to impose a punitive tariff of up to 15.45 per cent on imported steel to help BlueScope Steel against foreign competition has sparked warnings of price spikes across the economy, including for new buildings, consumer goods and manufactured components. The heavily subsidised car industry is leading the fight.