Penfolds’ $168,000 tipple. Penfolds Winery in South Australia.

Katarina Kroslakova Penfolds limited edition wine ampoule. Penfolds chief winemakers Peter Gago. Glass artist Nick Mount creates the limited edition wine ampoule. Fewer able to afford homes, COAG finds. Ben Hurley Housing has become less affordable despite the federal government pumping $1.3 billion annually into state and territory programs, the COAG Reform Council has found.

The council’s 2010-11 report on affordable housing to the Council of Australian Governments throws into question the effectiveness of rental assistance programs and incentives for first home buyers. Around 45 per cent of the poorest households in capital cities, defined as the lowest 40 per cent by income, were paying more than 30 per cent of their income towards rent in 2009-10, the report says. Builders depressed by property blues. Weak commercial property markets, delays in big mining projects, wet weather and funding issues are among the factors crippling building companies.

Photo: AP Michael Smith and Michael Hobbs The Australian building sector faces its toughest year in decades, with hundreds of contractors struggling to survive as weak residential housing and stiff competition force builders to price jobs below cost to win business. Weak commercial property markets, delays in big mining projects, wet weather and funding issues are also crippling building companies, according to industry leaders who cannot see any sign of relief.

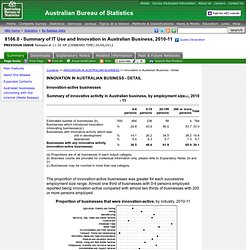

Shares in large listed building products companies are near record lows, with Boral yesterday downgrading earnings for the second time in three months and rivals CSR and Fletcher Building expected to follow. Uncertainty kills innovation. ABS – Less Than One Third Of Micros Businesses Are “Innovation-active”: Innovation. The proportion of “innovation-active” businesses fell 5% in 2010-11 to 39%, according to the Australian Bureau of Statistics, with micro businesses among the least likely to innovate.

The ABS defines innovation-active businesses as those which have undertaken innovative activity, including any of the four types of innovation. The four types of innovation, as defined by the ABS, are new or significantly improved goods or services, operational processes, organisational/managerial processes, and marketing methods. During the year ended June 30 2011, 33% of Australian businesses reported introducing at least one type of innovation, a decrease of 6% from the previous year. 8166.0 - Summary of IT Use and Innovation in Australian Business, 2010-11. Innovation-active businesses The proportion of innovation-active businesses was greater for each successive employment size range.

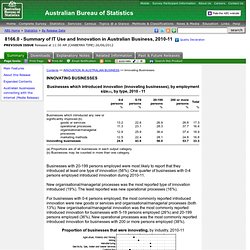

8166.0 - Summary of IT Use and Innovation in Australian Business, 2010-11. Businesses with 20-199 persons employed were most likely to report that they introduced at least one type of innovation (56%).

Qantas debt insurance soars sky high. Woolies ignites corporate bond market. Jonathan Shapiro Woolworths has returned to the domestic corporate bond market for the first time in five years, lured by greater institutional demand and cheaper borrowing costs.

The blue chip retailer was able to attract more than $2 billion of orders for its $500 million bond sale as investors sought to increase their exposure to non-bank corporate debt. And the appetite of bond fund managers for Woolworths bonds allowed the company to raise five-year debt at a lower rate than the major domestic banks, which have higher credit ratings. “It’s good to see solid, highly rated domestic issuers coming to the Aussie credit market against the allure of the much larger US private placement market,” said head of income at BT Investment Management, Vimal Gor.

The strong state of the Australian economy means that highly rated companies such as Woolworths are able to sell bonds relatively cheaply. Woolworths Ltd launched and priced the 6.75 per cent $500 million domestic bond issue yesterday. Goldman at top of league table in tough times for M&A. AMP muscles up in DIY super. NAB takes bigger steps into Asian market.

IAG hits back over flood of claims. Plug tax loopholes, retailers urge. Sue Mitchell Katie Page addresses the Australian National Retail Association’s annual Retail Nation forum in Sydney . . .

‘the world has changed’. Photo: Michel O’Sullivan Big retailers have called on governments to protect the local market from international online rivals by plugging GST and duty-free loopholes and making it easier for consumers to shop around the clock by liberating trading hours and cutting penalty rates. Harvey Norman, Big W, Bunnings, Coles and Super Retail Group said trading hours restrictions, the $1000 tax- and duty-free threshold for imported purchases and penalty rates were no longer appropriate when internet retailing enabled consumers to shop 24 hours a day, seven days a week anywhere in the world.

“The world has changed,” Harvey Norman managing director Katie Page told the Australian National Retail Association’s annual Retail Nation forum in Sydney. Mine ‘nannies’ a productivity boost. Shelley Harms is one member of the ‘mummy crew’ driving and ‘taking better care of’ 200-tonne trucks.

Photo Collie Mail. A shameful day in Parliament. Just 10¢ more carbon taxes the cake. Collaborative consumption: Wheel-time sharing. WORLDWIDE CARSHARING. Onlinepubs.trb.org/onlinepubs/tcrp/tcrp_rpt_108.pdf. Is GoGet for me? - GoGet CarShare - Sydney and Melbourne CarSharing. Does Car Sharing Really Reduce Vehicle Ownership? With rapid growth and significant user communities, the car sharing industry in North America has been hailed as a solution to traffic, parking, and pollution problems in urban areas.

Supporters say that with enough convenient and affordable ways to rent a car when they need it, people will find owning a vehicle to be redundant, and eventually choose to go car free. With companies like Zipcar leading the way, the car sharing industry has quickly gone global, branching out into peer-to-peer avenues and community-centric solutions. There's no denying that these services meet an urban need and have potential for significant economic and environmental improvements, but the question remains: does car sharing really mean less cars on the road?

Researchers at the University of California recently published the results of a nationwide survey of over 6,200 carsharing members designed to answer that and other pressing questions about this new industry. Key Findings: Enthusiastic About Car Sharing? Your Insurer Isn’t. People with idle cars (and most cars are idle most of the time) can make some money by renting them out to others who need a car sometimes but not often enough to own one. At some point, the world would ultimately need fewer cars and places to park them. It feels greener, and sharing is polite and all that. But then the grown-ups show up, in the form of companies. Car-Sharing Companies Link Owners With Renters.