NBN paying Optus to destroy infrastructure. In no other industry would the ACCC approve such an agreement not to compete.

THE Optus high-speed cable internet network is a national asset. Comprising 25,000 kilometres of coaxial cable strung across 550,000 poles in Sydney, Melbourne and Brisbane supported by 7000 kilometres of fibre, it provided Telstra with its first genuine competition, putting its own wires directly into half a million homes. Telstra fought back with FoxTel, Optus got burnt and has probably never recovered the cost of stringing the cables. But from an economic point of view, what's important is that the asset exists. Its costs have been sunk. Banking bubble (charts) GE checks non-bank sectors. Lenders insurer in downgrade territory. BUPA service pact with Healthscope. ANZ falls short on Asia target. Capital levels, market power limit disaster impact. The insurance sector recorded massive losses in 2011 due to numerous natural disasters including the Christchurch earthquakes, but 2012 has been relatively calmer.

Photo: AP Shaun Drummond Despite record losses for the insurance sector in 2011 due to catastrophes, the high capital levels of insurers and reinsurers and concentration of the local insurance market should limit the impact, according to analysis by a credit ratings agency. Wesfarmers Insurance goes for brokers. EMAs crucial for Australian jobs: Ferguson. Resources ‘free lunch’ finished. Boom under threat from higher costs. Louise Dodson, Jamie Freed and Jacob Greber High labour, energy and transport costs have made mining projects in Australia among the most expensive in the world to develop, throwing into doubt mega-projects such as BHP Billiton’s Olympic Dam copper uranium mine expansion.

A report by consultants Port Jackson Partners published today for the Minerals Council of Australia shows the loss of competitiveness means Australia lost market share in the decade from 2000 to 2010 in nearly all metals markets, despite a big increase in the volume of exports. China gets serious about growth again. A food stall in Beijing on Monday . . .

China appears ready to risk overcapacity to preserve growth. Photo: AFP Lisa Murray and Angus Grigg AFR correspondentsShanghai The Chinese government appears to be refocusing on economic management after months of political tension and there is speculation Beijing may initiate a fresh round of stimulus spending after implementing financial market reforms yesterday. Labor’s China food bowl plan.

Angus Grigg and Lisa Murray AFR correspondentsShanghai The federal government is seeking billions in Chinese investment to open up land for farming in northern Australia in a plan designed to help feed China’s 1.3 billion citizens, which could reshape the global food market.

Trade and Competitiveness Minister Craig Emerson initiated a joint study with the Chinese Government last May to examine the policy changes needed to facilitate large-scale investment by Chinese agricultural interests in undeveloped land in northern Australia. The Chinese side of the study is being led by the powerful Commerce Minister Chen Deming – a sign of the better relations between the two governments. It is the first time Australia and China have co-operated on such a project.

The report is expected to be released mid-year, possibly in conjunction with the white paper policy document on engagement with Asia being prepared by former Treasury secretary Ken Henry. Food security nudges China to new lands. Buttonwood: A contrarian moment. Clifford Chance M&A Toolkit : Global M&A Trends. Investment banking: the year that was (not) Despite market volatility and uncertainty stemming from Europe and a weak US economy, investment bankers were kept busy throughout 2011 and revenue is on par with the year earlier.

Mitra Tabrizian Anthony Macdonald and Brad Hatch As battle-weary investment bank chiefs switch off the office lights and head off for a break over Christmas, they will reflect on a surprisingly busy year – and hold out hope for a better 2012. In 2011, Australia experienced lacklustre equity capital markets volumes, a patchy but ultimately good year in mergers and acquisitions, and a busy time in debt markets.

Markets: Australia To Drift For A While. But with signs that Greece will get its risky bond exchange done and dusted Friday night, markets in Europe and the US rose strongly on Thursday night.

The chief economist and strategist of AMP Global Investors, Dr Shane Oliver explains: There was plenty of nervousness going into the February profit reporting season in Australia. A betterment levy: a cure to current ills - On Line Opinion - 12/2/2009. Exactly 100 years ago Winston Churchill and Lloyd George introduced a radical budget even by today’s standards.

The budget introduced a high land tax, while severely reduced all other taxes. However, it was rejected by the House of Lords (or rather Landlords) for obvious reasons. I argue that a 100 per cent betterment levy with income, GST, capital gains, superannuation taxes, tariffs, dividends and corporate taxes, all abolished, or at least severely reduced, can simultaneously cure unemployment and budget deficits. M&A : TheEconomist - Surf’s up. Uncertain times hobble mergers and acquisitions. Norton Rose Australia - Australian Private M&A trends in a record-breaking year for Australian M&A activity. Surprises that shift the economic cycle. OVER the many years of taking an interest in investments, I have learned and re-learned three key lessons.

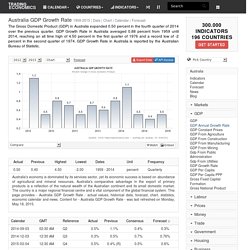

First, investment markets and the economy all move in cycles. And there's a common cause: we're human and tend to share the general optimism or pessimism of others. At times, too, governments widen cycles by changing the settings of economic policies "too much and too late". Second, investment markets often "overshoot", that is, they move by more than changes in the fundamental influences would seem to require. Australia GDP Growth Rate. Australian GDP advanced 0.5 percent in the fourth quarter of 2014, rising from upwardly revised 0.4 percent expansion reported in the previous three month period and matching market estimates.

Net exports and consumption contributed the most to the growth while changes in inventories dragged the expansion down. Net exports contributed 0.7 percentage points to GDP growth. Household final consumption expenditure contributed 0.5 percentage points to GDP growth and Total dwelling construction 0.1 percentage points to GDP growth. Australian National Accounts – I wouldn’t say the economy is great. The on-going rhetoric being used to push the federal budget into surplus is that the Australian economy is growing so fast as a result of the mining boom (record commodity prices) that we are in danger of an inflationary break-out. This is at a time when 12.5 per cent of our labour resources are idle (unemployed or underemployed). Today’s Australian Bureau of Statistics release of the National Accounts data for the December quarter shows that the mining sector is making a zero contribution to real GDP growth.

Overall, the data shows that the Australian economy grew by 0.7 per cent in the December quarter giving an annual growth of 2.7 per cent. This is not enough to eat into the pool of idle labour given that productivity growth is around 1 per cent per annum and labour force growth is around 1.7 per cent. Downside to global retailers. Online sales down but beat retailers.

Key Economic News to Watch This Week: May 28. Monday, May 28 The African Development Bank begins its annual meetings in Arusha, Tanzania. This year’s theme is ‘Africa and the Emerging Global Landscape: Challenged and Opportunities, where distinguished speakers and thinkers will debate Africa’s growth and political landscape. Indian Prime Minister Manmohan Singh visits Myanmar, the first official visit by an Indian premier since 1987. He is expected to meet with the country’s leaders and develop stronger trade and investment ties. Related Story: International Sanctions May Ruin Myanmar’s Opportunity For Change: Joseph Stiglitz Related News: U.S. Tuesday, May 29 A report, “Golden rules for a golden age of gas”, published by the International Energy Agency, outlining the benefits and risks of shale and other forms of unconventional gas. Much more than Greece in the mix. What you need to know about the next Greek election.

Very bad things ... A screen grab of the Credit Suisse chart giving probabilities for the outcome of the next Greek election. Source: Business Insider A new poll suggests Greece’s anti-bailout Syriza party has taken the lead in the race to form the next Greek government when Greeks head back to the voting booth on June 17. According to the Epikaira magazine poll, Syriza has 30 per cent of the vote, ahead of the pro-bailout New Democracy party on 26.5 per cent. Syriza’s platform supports continued euro membership for Greece but proposes scrapping the country’s current financial aid program.

A move by a new Greek government to dump the country’s hard won bailout support could have dire consequences for Greece, the euro zone and, by extension, the global economy. Irish referendum: secret polls predict Yes vote despite low turnout. Seeing the wood for the GDP: facts on the stats - The Drum Opinion - Time for the national accounts ... time to dig deep into our GDP. Find More Stories Seeing the wood for the GDP: facts on the stats Greg Jericho. Sales take first drop in ten months. Unexpected ... consumers cut spending at department stores and on household goods.

Shares in Spain's Bankia plunge on bailout plan. Spain likely to need bailout. Spanish central banker quits as bailout threat builds. Doom and gloom could go boom. Who Moved My Weekend? Making a call on digital wealth. Facebook Might Have a Smartphone in Its Future. Qantas adds seats to fight air wars. Qantas partners, staff a priority for numbers man. Way off our game. Qantas scours the world for the right allies. Tech core to Suncorp’s $275m program.

Paul Smith. CBA ‘streets ahead’ of rivals on tech. Analysts challenge CBA to hold tech lead. Just how safe is your superannuation? Big banks corner advice. ASIC wants SMSFs regularly warned. Why retirees overlook lifetime annuities. Super funds could back cheap homes.