Hauptman essay: why student loan interest rate debate focuses. The current debate over the student loan interest rates is a perfect example of how crazy our national politics have become.

Leaving aside the differences in how Democrats and Republicans would pay for continuing this questionable subsidy, both parties are striving to appeal to students in this election year by keeping interest rates low while ignoring the economic reality that this move will further balloon student debt and could lead to higher tuitions as well. How did we get to this perilous spot? The answer lies in the desire of politicians not to offend key constituencies no matter how much it might cost in the short run and no matter how little it may improve things in the long run. And keeping the interest rates low now makes it even more difficult to achieve the kinds of student loan reforms we need to put the system on a solid footing for the future.

Of course, the Republicans are doing no better on the honesty and consistency meter. Debate on student loan debt doesn't go far enough - The Hill's Congress Blog. The Student Loan Forgiveness Act of 2012 is not a free ride, nor is it a bailout.

It’s a recognition that millions of Americans have grossly overpaid for their educations, due in part to governmental interference in the marketplace. With the availability of so much seemingly “free money” available to anyone with a pulse who wants to take out a student loan, colleges and universities have had no incentive to keep costs down – and they haven’t. The outrageous costs of obtaining a college education or beyond today have very little to do with the inherent value of the degrees sought; rather, it has much more to do with brand new stadiums and six-figure administrative salaries.

After all, if the degrees obtained today were worth the increased cost to obtain them, compared with 30-40 years ago, then shouldn’t those degrees also yield greater salaries upon graduation? Applebaum is founder of ForgiveStudentLoanDebt.com. ‘Don’t Double My Rate’ doesn’t get us anywhere on student loan debt. By Kay SteigerWednesday, April 25, 2012 15:16 EDT In a rare point of commonality, likely Republican nominee Mitt Romney and Democratic President Barack Obama now agree that interest rates on federal student loans should remain at 3.4 percent rather than going up to 6.7 percent on July 1 as scheduled.

Yesterday, Obama got an entire room of students to chant, “Don’t double my rate.” Unfortunately for indebted students, this basically does jack shit for the actual student debt problem. In case you haven’t been paying much attention, here’s the gist of it: Student loan debt has now reached an all-time high of $1 trillion, which is more than Americans owe in credit card debt or auto loan debt. About 40 percent of people under 30 have outstanding student loan debt, and the average student loan bill stands at $23,186.

Add to that that that a recent Medill report found that about half of all recent graduates are unemployed, down from 75 percent employment in 2000. That leaves students in a jam. Student loan bill fails as Senate gears up for protracted battle - Political Hotsheet. Updated: 2:38 p.m.

ET. Keeping Student Interest Rates Low. One step forward, one step back on student loans. Student Loan Interest Rate Bill That Cuts Health Care Program Passes House. WASHINGTON -- The House of Representatives advanced a bill Friday that funds cheaper student loans by cutting a preventive health care program -- sparking a heated battle in which House Speaker John Boehner (R-Ohio) accused Democrats of manufacturing a war on women.

The House passed the bill by a vote of 215 to 195, with 30 Republicans bucking their party to oppose the bill, and 13 Democrats voting in favor. Democrats might have blocked the measure if they had stayed together. The interest rate for federally subsidized student loans is scheduled to jump from 3.4 percent to 6.8 percent for some 7.4 million students on July 1 if Congress does not act. Republicans had voted earlier in the week for a budget that allowed the rate to go up, but under public pressure offered a plan Wednesday to preserve the rate by cutting the Prevention and Public Health Fund created in President Barack Obama's Affordable Care Act. Republicans say the move would save $6 billion. Divided Congress likely to agree on student loans. Sallie Mae Introduces Fixed-Rate Private Education Loan. Sallie Mae Competes with Feds for Fixed-Rate Student Loan.

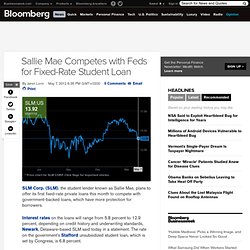

SLM Corp.

(SLM), the student lender known as Sallie Mae, plans to offer its first fixed-rate private loans this month to compete with government-backed loans, which have more protection for borrowers. Interest rates on the loans will range from 5.8 percent to 12.9 percent, depending on credit history and underwriting standards, Newark, Delaware-based SLM said today in a statement. The rate on the government’s Stafford unsubsidized student loan, which is set by Congress, is 6.8 percent. Outstanding education debt in the U.S. has reached about $1 trillion, according to the federal Consumer Financial Protection Bureau.

Sallie Mae, which had a private student-loan portfolio of $37 billion in the first quarter, is seeking to boost originations after federal legislation stopped private companies from issuing government-guaranteed loans as of July 2010. The CFPB is looking into the private student-loan market and has begun accepting complaints about providers.