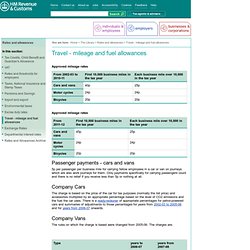

Travel - mileage and fuel allowances. Passenger payments - cars and vans 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them.

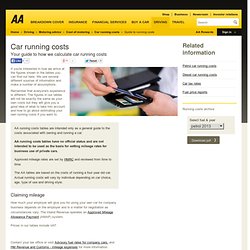

Only payments specifically for carrying passengers count and there is no relief if you receive less than 5p or nothing at all. Car buyers guide. Guide to car running costs. AA running costs tables are intended only as a general guide to the costs associated with owning and running a car.

AA running costs tables have no official status and are not intended to be used as the basis for setting mileage rates for business use of private cars. Approved mileage rates are set by HMRC and reviewed from time to time. The AA tables are based on the costs of running a four year old car. Breakdown advice. The best value new cars to buy and run.