EC201Lecture35-36.pdf (application/pdf-Objekt) Macroeconomic Regimes in Western ... Economics. Theory of Employment. (a) Structural Unemployment: It is also known as Marxian unemployment or long-term unemployment.

It is due to slower growth of capital stock in the country. The entire labour force cannot be absorbed in productive employment, because there are not enough instruments of production to employ them. (b) Seasonal Unemployment: Seasonal unemployment arises because of the seasonal character of a particular productive activity so that people become unemployed during the slack season. Occupations relating to agriculture, sugar mills, rice mills, ice factories and tourism are seasonal.

Economics. Brief Principles of Macroeconomics. Essentials of Economics. A "second edition" of The general theory. Macroeconomics. 17-A-5.pdf (application/pdf-Objekt) Saving Keynes. Investment and Aggregate Demand. Readers Question: What are the effects of increased investment on aggregate demand in the short term and the long term.

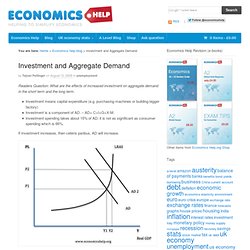

Investment means capital expenditure (e.g. purchasing machines or building bigger factory)Investment is a component of AD. – AD+ C+I+G+X-M.Investment spending takes about 15% of AD; it is not as significant as consumer spending which is 66%. If Investment increases, then ceteris paribus, AD will increase. However, it depends on the economic circumstances. e.g. if there was a situation of falling house prices and lower consumer spending, increased investment may be insufficient to increase AD. In the long term, higher investment may increase productive capacity and increase aggregate supply. Therefore, you could argue, investment enables a more sustainable increase in AD.

Multiplier Effect If there is spare capacity in the economy, an increase in investment could cause a knock on effect throughout the economy. IS/LM model. The IS curve moves to the right, causing higher interest rates (i) and expansion in the "real" economy (real GDP, or Y).

The model was developed by John Hicks in 1937,[4] and later extended by Alvin Hansen,[5] as a mathematical representation of Keynesian macroeconomic theory. Between the 1940s and mid-1970s, it was the leading framework of macroeconomic analysis.[6] While it has been largely absent from macroeconomic research ever since, it is still the backbone of many introductory macroeconomics textbooks.[7] History[edit] The IS/LM model was born at the econometric conference held in Oxford during September, 1936.

Roy Harrod, John R. Hicks later agreed that the model missed important points of Keynesian theory, criticizing it as having very limited use beyond "a classroom gadget", and criticizing equilibrium methods generally: "When one turns to questions of policy, looking towards the future instead of the past, the use of equilibrium methods is still more suspect Formation[edit] How to Write a Bibliography - Examples in MLA Style. Please note, all entries should be typed double-spaced.

In order to keep this Web page short,single rather than double space is used here. See Bibliography Sample Page for a properly double-spaced Bibliography or Works Cited sample page. Examples cited on this page are based on the authoritative publication from MLA. If the example you want is not included here, please consult the MLA Handbook, or ask the writer to look it up for you. Format for entries: A single space is used after any punctuation mark. When writing a bibliography, remember that the purpose is to communicate to the reader, in a standardized manner, the sources that you have used in sufficient detail to be identified. Hansjörg HERR. Slides JENA. Real wage - Wiki. TIME: We Are All Keynesians Now. (See Cover) The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood.

Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. —The General Theory of Employment, Interest and Money. Keynesian Economics. Keynesian economics is a theory of total spending in the economy (called aggregate demand) and its effects on output and inflation.

Although the term has been used (and abused) to describe many things over the years, six principal tenets seem central to Keynesianism. The first three describe how the economy works. 1. A Keynesian believes that aggregate demand is influenced by a host of economic decisions—both public and private—and sometimes behaves erratically. The public decisions include, most prominently, those on monetary and fiscal (i.e., spending and tax) policies. Keynesian economics - Wiki. The theories forming the basis of Keynesian economics were first presented by the British economist John Maynard Keynes in his book, The General Theory of Employment, Interest and Money, published in 1936, during the Great Depression.

Keynes contrasted his approach to the aggregate supply-focused 'classical' economics that preceded his book. The interpretations of Keynes that followed are contentious and several schools of economic thought claim his legacy. Keynesian economists often argue that private sector decisions sometimes lead to inefficient macroeconomic outcomes which require active policy responses by the public sector, in particular, monetary policy actions by the central bank and fiscal policy actions by the government, in order to stabilize output over the business cycle.[2] Keynesian economics advocates a mixed economy – predominantly private sector, but with a role for government intervention during recessions.

Overview[edit] Theory[edit] Concept[edit] Excessive saving[edit] Keynes, Wage and Price 'Stickiness,' and Deflation. The General Theory and the Current Crisis: A Primer on Keynes’ Economics Intro | Pt.

I | Pt. II | Pt. III | Pt. IV.