Pfeg. Pensions worries People Management. How can I save on my energy bill? Could you save yourself more than £200 a year by switching supplier?

According to a report from the Competition and Markets Authority on 18 February, 95% of the customers of the big six energy suppliers could save that much by switching tariff and/or supplier. Yet relatively few people bother to switch. Biz3_00_25_11.pdf. FSMQ Level 3 Personal finance - original activities. BBC Consumer - Monthly interest calculator: the payday loan trap.

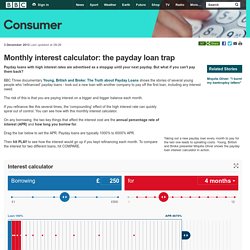

3 December 2013Last updated at 09:26 Payday loans with high interest rates are advertised as a stopgap until your next payday.

But what if you can't pay them back? Taking out a new payday loan every month to pay for the last one leads to spiralling costs. Tax explained — Brightside. Planning to earn some extra cash to fund your way through uni?

Make sure you know your facts about tax otherwise you may end up paying too much. Maybe you got your first pay packet but didn’t take home as much cash as you were expecting. Getting paid — Brightside. So you’ve been working hard and are looking forward to your first paycheque – but there might be a few surprises when the money comes in.

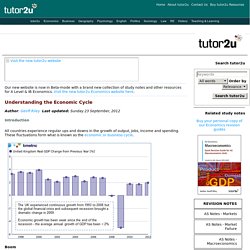

Read on to find out more. When do I get paid? You'll agree when you get paid with your employer before you start. If your job pays an annual salary, you'll normally be paid monthly. If you get paid by the hour, you'll normally be paid weekly. Money — Brightside. Everything you need to know about student finance – icould. N7 using percentages to increase quantities. Ch4 VAT. Tower Hamlets Education Business Partnership - Tower Hamlets EBP. Free & impartial money advice, set up by government - Money Advice Service. Providing lesson plans and teaching resources on money management to help teachers of financial capability. 33063-Resource_Sheets_Downloadable.pdf. Introducing Financial Mathematics Pfeg. Module 7 Dev task Number Vocational. Search. Understanding the Economic Cycle. Author: Geoff Riley Last updated: Sunday 23 September, 2012 All countries experience regular ups and downs in the growth of output, jobs, income and spending.

These fluctuations form what is known as the economic or business cycle. Boom A boom occurs when real national output is rising at a rate faster than the trend rate of growth. Financial Cycle BIS work395. Economy tracker: Inflation. 15 April 2014Last updated at 06:06 ET Continue reading the main story Latest news: The UK inflation rate as measured by the Consumer Prices Index (CPI) fell to 1.6% in March from 1.7% in February, according to the Office for National Statistics (ONS).

Financial Maths. Note: this information is subject to continuing review and development.

Please check regularly to ensure that you are using the current versions. Students require real experiences with situations involving finance and with situations involving data. They will learn best about these concepts on an intuitive or informal level rather than standard lessons. MMM_1 - OpenLearn - Open University - MMM_1. Gain the skills to manage your personal finances: managing budgets, debts, investments, property purchase, pensions and insurance.

With real incomes falling and personal debt at a record high, there has never been a better time to improve your personal financial skills – Managing my money aims to do just that. You'll start by learning how to compile a budget and use it to make good decisions about your spending. You’ll explore debts and investments, and find out how mortgages are used to finance home ownership.

Europe's lost art of money-making. Creative commons image Credit: Gary Edwards It’s a sign of the Eurozone’s financial plight that it’s preparing to start a Quantitative Easing (QE) programme just as America’s is drawing to a close 11.

But this monetary expansionism has, in another form, already appeared at the heart of Europe, courtesy of artist Axel Stockburger. His Quantitative Easing (for the Street) 12 has given residents of Vienna an early chance to reflect on their (and their governments’) response to the Global Financial Crisis, and the role of money more generally in establishing (or eroding) social values. Support for teachers and students. Citizens Advice consumer education. In April 2013 the Citizens Advice service became the Government-funded provider of consumer education in Great Britain, bringing consumer advice, advocacy and education under one roof.

Our new role means we can make sure consumers are represented and supported in the best way possible. Through our evidence base of client issues, our campaigning and our education work, we want to empower consumers to stand up for what matters most to them. Accounting and financial statements. Three core financial statements. Accounting and financial statements. Math_handbook.pdf. Talk_money_talk_maths.pdf. Financial_Maths_Introduction. Lgr-combo-ch5.pdf. Uni of Leeds Financial maths notes-all.pdf.