Iceland jails former Kaupthing bank bosses. 12 December 2013Last updated at 13:32 ET Kaupthing was the largest of the Icelandic banks to go into administration in 2008 Four former bosses from the Icelandic bank Kaupthing have been sentenced to between three and five years in prison.

They are the former chief executive, the chairman of the board, one of the majority owners and the chief executive of the Luxembourg branch. They were accused of hiding the fact that a Qatari investor bought a stake in the firm with money lent - illegally - by the bank itself. Icelanders Overthrow Government and Rewrite Constitution After Banking Fraud-No Word From US Media. Can you imagine participating in a protest outside the White House and forcing the entire U.S. government to resign?

Can you imagine a group of randomly chosen private citizens rewriting the U.S. constitution to include measures banning corporate fraud? It seems incomprehensible in the U.S., but Icelanders did just that. Icelanders forced their entire government to resign after a banking fraud scandal, overthrowing the ruling party and creating a citizen’s group tasked with writing a new constitution that offered a solution to prevent corporate greed from destroying the country. The constitution of Iceland was scrapped and is being rewritten by private citizens; using a crowd-sourcing technique via social media channels such as Facebook and Twitter. These events have been going on since 2008, yet there’s been no word from the U.S. mainstream media about any of them. Profitability, the euro crisis and Icelandic myths. As I have said in a previous post (see Slovenia is likely to be the next Eurozone state that will require a bailout after Cyprus.

Slovenia’s banks need €1bn for recapitalisation after taking heavy losses on the commercial property development bust and on falling government debt prices (Italy?). And the new centre-left coalition needs about €3bn to cover the budget deficit and debt repayments this year. It does not look like it can find this money from the country’s own taxpayers and banks. So watch this space. How did Iceland recover? Report from Davos. What is actually going on in Iceland. Because I’m tired of you people spreading untruths Since people continue to spread the factually dubious statement that Iceland “told creditors & IMF to go jump, nationalised banks, arrested the fraudsters, gave debt relief and is now growing very strongly, thanks” I find I have to write this here thing.

(This specific example comes from twitter but is almost identical, word for word, to the standard ‘Iceland is an economic utopia’ mantra that is being repeated ad nauseam.) Because, for some reason, people won’t believe Icelanders when they say that the above is not quite the reality as most Icelanders experience it. 1. Iceland told IMF to go jump, go away, left the IMF program etc. Positive Money » Icelandic Parliament investigating Full Reserve Banking. Written by Positive Money on .

Is Iceland – the wonderful island with just 300 thousand citizens – going to be the first country seriously questioning the privatized money creation and considering Full Reserve Banking proposals? Iceland’s boom and bust: a valuable environmental lesson. Photo by Tristan Ferne (tristanf on Flickr CC) Starting in the mid 1990s, economic liberalization, rampant privatization and a radical neoliberal agenda transformed Iceland from a nation of fishing to a wealthy finance center built on credit.

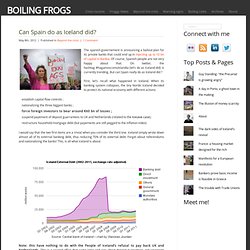

Iceland became somewhere for foreigners to put their money and collect high rates of interest. Until the bubble burst in 2008. I will not pretend I have any in-depth understanding of economics (it’s too bloody confusing) but one thing seems clear: When Iceland was riding the bubble its natural environment suffered. Since Iceland defaulted and its nouveau riche found itself ‘nouveau in debt’, people have driven less, produced less waste and elected a greener government. Can Spain follow the Icelandic example? The spanish governement is announcing a bailout plan for its private banks that could end up in injecting up to 10 bn of capital in Bankia.

Of course, Spanish people are not very happy about that. The relationship of materialism to debt and financial well-being: The case of Iceland’s perceived prosperity 10.1016/j.joep.2011.12.008 : Journal of Economic Psychology. Abstract In Iceland, levels of debt had risen to an unprecedented extreme in the years prior to the country’s economic collapse in October 2008.

This rise occurred in the context of a consumer culture highlighting supposed psychological benefits of consumer goods. This paper reports findings from two studies, conducted during an economic boom in Iceland, examining the association of materialism and indicators of financial well-being: amount of debt, financial worries, spending tendency, money-management skills and compulsive buying. Study 11 (N = 271) showed that people who endorse materialistic values have more financial worries, worse money-management skills and greater tendency towards compulsive buying and spending.

Study 2 (N = 191) replicates the findings of Study 1 and further shows that amount of debt, including mortgage, can be directly linked to materialism, controlling for income and money-management skills. Highlights.