Attempts to Suppress Volatility Could Lead to a Crash in Existing Economic and Political Systems. Financial analyst and author Nassim Taleb demonstrated that suppressing market volatility in the short-run leads to much more violent bursts of dislocation and chaos in the long run.

Taleb learned many of his ideas from mathematician Benoit Mandelbrot (who discovered fractals). As Scientific American noted in 2008: One of those long-time market watchers is fractal pioneer Benoit Mandelbrot. In 1999, Scientific American published an article by Mandelbrot that showed how fractal geometry can model market volatility, while revealing the intrinsic deficiencies of a cornerstone of finance called modern portfolio theory (for which there has been awarded more than one Nobel Prize in Economics).

The Black Swan of Cairo. Why is surprise the permanent condition of the U.S. political and economic elite?

Great Moderation or Great Delusion. A recent (December 2011) paper published by CEPR offers a very interesting analysis of the macroeconomic risks propagation in the current crisis.

The paper, titled Great Moderation or Great Mistake: Can rising confidence in low macro-risk explain the boom in asset prices?

Repo market... Dot.com bubble. 1997 asian crisis. An apocalyptic end to world’s biggest bubble. By Paul B.

Why Identifying a Bubble Is So Much Trouble: John H. Cochrane. Randy Wray: The Biggest Bubble of All Time – Commodities Market Speculation. By L.

Randall Wray, a Professor of Economics at the University of Missouri-Kansas City and Senior Scholar at the Levy Economics Institute of Bard College. Cross posted from EconoMonitor Sorry, this is a day late (but hopefully not a dollar short). Back in fall of 2008 I wrote a piece examining what was then the biggest bubble in human history: Say what?

No, folks, those were child’s play. “According to an analysis by market strategist Frank Veneroso, over the course of the 20th century, there were only 13 instances in which the price of a single commodity rose by 500 percent or more. The commodities crash - macrobusiness.com.au. No doubt you will have noted the collapse in commodity prices that accelerated on Friday night, even as equity markets remained flat.

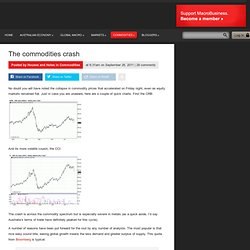

Changing behavior of crude oil futures prices. I’ve just finished a new research paper with my former student (and now University of Chicago Professor) Cynthia Wu.

In our new paper, we study how increased purchases of crude oil futures contracts by financial investors may have affected the prices on those contracts. A crude oil futures contract is an agreement between two parties to purchase oil at a future date at a price agreed upon today. For example, on Friday the November contract closed at a price of $88.18, meaning that if both parties were to hold on to the contract until expiry (which for this contract happens to be October 21), the seller would be obligated to deliver 1,000 barrels of crude oil to the buyer some time in November at a location in Cushing, Oklahoma at a price of $88.18 per barrel.

Most people who buy or sell these contracts don’t actually hold them to expiry, but sell their positions to somebody else between now and then. Web IPO Boom: Is This Time Really Different? The trading floor of the New York Stock Exchange just after the crash of 1929.

/Public domain. Robert Brenner · Towards the Precipice: The Continuing Collapse of the US Economy · LRB 6 February 2003. At 6 a.m. on 12 June 2002, four FBI agents barged into the SoHo loft of Samuel Waksal, the former CEO of the biotech company ImClone Systems Inc, and led him away in handcuffs: he was charged with insider trading.

His father and daughter had dumped nearly 175,000 ImClone shares only days before the Food and Drug Administration announced that it had rejected Erbitux, the compay’s cancer drug, leading to a steep price fall. (Waksal himself had netted $57 million on an ImClone share deal the previous September, and had made an additional $72 million in 2001 from his stock options.) On 25 July, John Rigas, the former head of Adelphia Communications, was arrested, along with his two sons, on corporate crime charges. Why the Clean Tech Boom Went Bust. Wind Power: Plummeting natural gas prices now make this option comparatively expensive.Photo: Dan Forbes John Doerr was crying.

The billionaire venture capitalist had come to the end of his now-famous March 8, 2007, TED talk on climate change and renewable energy, and his emotions were getting the better of him. Doerr had begun by describing how his teenage daughter told him that it was up to his generation to fix global warming, since they had caused it. After detailing how the public and private sectors had so far failed at this, Doerr, who made his fortune investing early in companies that became some of Silicon Valley’s biggest names—Netscape, Amazon.com, and Google, among others—exhorted the audience and his peers (largely one and the same) to band together and transform the nation’s energy supply.

Financial Crisis' Crise et recrises. Fin du capitalisme, crises et alternatives. Vous avez dit crise ? La solution par défaut!