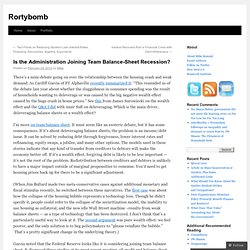

Household Deleveraging Slows Recovery. Click to enlarge: Source: Bloomberg BRIEFs Economic Newspaper February 28, 2012 Why has the recovery been so weak?

The short answer is Household Deleveraging. Its why post credit crisis recoveries are so much slower across the boards. Deleveraging prevents the virtuous cycle from beginning. Which is pretty much what we have seen: Weak holiday retail sales, soft spending (other than Autos and Gasoline), mediocre (but improving) NFP, flat wages, mild inflation, ok GDP. This is what a post credit crisis recovery is supposed to look like. Category: Bailouts, Credit, Economy. Is the Administration Joining Team Balance-Sheet Recession? There’s a mini-debate going on over the relationship between the housing crash and weak demand.

As Cardiff Garcia of FT Alphaville recently summarized it: “This reminded us of the debate last year about whether the sluggishness in consumer spending was the result of households wanting to deleverage or was caused by the big negative wealth effect caused by the huge crash in home prices.” See this from James Surowiecki on the wealth effect and the Q&A I did with Amir Sufi on deleveraging. Which is the main driver, deleveraging balance sheets or a wealth effect? I’m more on team balance sheet. It must seem like an esoteric debate, but it has some consequences. (When Jim Bullard made two meta-conservative cases against additional monetary and fiscal stimulus recently, he switched between these narratives.

Garcia noted that the Federal Reserve looks like it is considering joining team balance sheet. The White House also looks to be on team balance sheet. Like this: Like Loading... Deleveraging and Growth: is the developed world following Japan’s long and winding road? - 01 - 2012. Asia Research Centre and STICERD public lecture Date: Tuesday 10 January 2012 Time: 6.30-8pm Venue: Old Theatre, Old Building Speaker: Masaaki Shirakawa Chair: Professor Lord Stern Until a few years ago, the long stagnation of the Japanese economy after the bursting of a credit-fuelled asset bubble in the late 1980s was regarded as an episode that would never be replicated elsewhere in the world.

Quite a few commentators argued that the recovery became unnecessarily drawn-out and painful because policy responses were ill-timed and inadequate. Many experts believed that prompt and massive policy responses would save any other economy from the same fate as Japan. Three years after the global economy had nearly suffered a meltdown in late 2008, following the collapse of Lehman Brothers, growth, especially in the developed economies, remains anemic, in spite of the huge fiscal stimulus and decisive monetary easing quickly introduced by governments and central banks. Transcript. Come Undone: Kyle Bass redux. The Age of Deleveraging. Given the strong rebound in the equity markets since March 2009, "most investors believe that 2008 was simply a bad dream from which they've now awoken," starts Gary Shilling in his newly-released tome on deflation, The Age of Deleveraging.

"But the optimists don't seem to realize that the good life and rapid growth that started in the early 1980s was fueled by massive financial leveraging and excessive debt, first in the global financial sector, starting in the 1970s, and later among U.S. consumers. That leverage propelled the dot-come stock bubble in the late 1990s and then the housing bubble. " Dr. Shilling has had a long and wildly successful career as an economic forecaster. Shilling was one of the few voices of reason that foresaw the busting of the Japanese bubble of the late 1980s, and he also correctly forecasted the bursting of the 1990s Internet bubble and the mid-2000s housing and financial sector bubble. It can be a bit lonely here in the deflation camp. All About Deflation.

READING ROOM: Adair Turner on Debt and Deleveraging. DEBT & DELEVERAGING.