'How Much Unemployment Was Caused by Reinhart and Rogoff's Arithmetic Mistake?' The work of Reinhart and Rogoff was a major reason for the push for austerity at a time when expansionary policy was called for, i.e. their work supported the bad idea that austerity during a recession can actually be stimulative. It isn't as the events in Europe have shown conclusively. To be fair, as I discussed here (in "Austerity Can Wait for Sunnier Days") after watching Reinhart give a talk on this topic at an INET conference, she didn't assert that contractionary policy was somehow expansionary (i.e. she did not claim the confidence fairy would more than offset the negative short-run effects of austerity).

What she asserted is that pain now -- austerity -- can avoid even more pain down the road in the form of lower economic growth. PERI: : Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogo ff. Does High Public Debt Consistently Stifle Economic Growth?

A Critique of Reinhart and Rogo ff Abstract:Herndon, Ash and Pollin replicate Reinhart and Rogoff and find that coding errors, selective exclusion of available data, and unconventional weighting of summary statistics lead to serious errors that inaccurately represent the relationship between public debt and GDP growth among 20 advanced economies in the post-war period. They find that when properly calculated, the average real GDP growth rate for countries carrying a public-debt-to-GDP ratio of over 90 percent is actually 2.2 percent, not -0:1 percent as published in Reinhart and Rogo ff. That is, contrary to RR, average GDP growth at public debt/GDP ratios over 90 percent is not dramatically different than when debt/GDP ratios are lower.

Mgi_debt_and_deleveraging_uneven_progress_to_growth_report. Government Debt and Deficits Are Not the Problem. Private Debt Is. There are two quite different perspectives in the set of speeches at this conference.

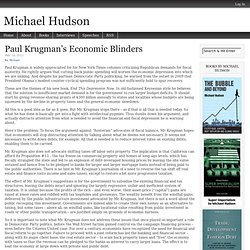

Many on our morning panels – Steve Keen, William Greider, and earlier Yves Smith and Robert Kuttner – have warned about the economy being strapped by debt. The debt we are talking about is private-sector debt. But most officials this afternoon focus on government debt and budget deficits as the problem – especially social spending such as Social Security, not bailouts to the banks and Federal Reserve credit to re-inflate prices for real estate, stocks and bonds. To us this morning, government deficit spending into the economy is the solution. A Conversation with Ray Dalio (Video) The IMF Goes All-Out on Balance-Sheet Recessions, Providing Sanity on Economic Policy. The literature summary I just put out on balance-sheet recessions examines the recent April 2012 World Economic Report by the IMF.

It is remarkable how important this report is. The relevant part is Chapter 3, Dealing with Household Debt. This IMF report is well to the Keynesian side of almost all major US debate, and its recommedations and observations are incredibly sensible. You should read it all, but I want to point out five few high-level arguments they make: 1. Here's a graph they include, comparing increases in household debt-to-income ratios from 2002-2006 against consumption collapses in 2010. The (other) deleveraging: What economists need to know about the modern money creation process. One of the financial system’s chief roles is to provide credit for worthy investments.

Some very deep changes are happening to this system – changes that surprisingly few people are aware of. This column presents a quick sketch of the modern credit creation and then discusses the deep changes are that are affecting it – what we call the ‘other deleveraging’. In the simple textbook view, savers deposit their money with banks and banks make loans to investors (Mankiw 2010). The textbook view, however, is no longer a sufficient description of the credit creation process.

The Dangers of Pricing the Infinite. “The notion of infinite debt comes in when this logic slams up against the Absolute, or, one might perhaps better say, against something that utterly defies the logic of exchange.

Because there are things that do. This would explain, for instance, the odd urge to first quantify the exact amount of milk one has absorbed at one’s mother’s breast, and then to say that there is no conceivable way to repay it.” – David Graeber, Debt “Could all of this be thought ‘a normal upbringing’? Everyone seemed to think so and my parents, bless them, paid for it. So much that my father proudly presented me with a complete set of receipts on my twenty-first.” – Derek Jarman, At Your Own Risk. Nobody Understands Debt. "Does Debt Matter?" by Robert Skidelsky. Exit from comment view mode.

Click to hide this space LONDON – Europe is now haunted by the specter of debt. All European leaders quail before it. To exorcise the demon, they are putting their economies through the wringer. It doesn’t seem to be helping.

Paul Krugman’s Economic Blinders. Paul Krugman is widely appreciated for his New York Times columns criticizing Republican demands for fiscal austerity.

He rightly argues that cutting back public spending will worsen the economic depression into which we are sinking. And despite his partisan Democratic Party politicking, he warned from the outset in 2009 that President Obama’s modest counter-cyclical spending program was not sufficiently bold to spur recovery. These are the themes of his new book, End This Depression Now. In old-fashioned Keynesian style he believes that the solution to insufficient market demand is for the government to run larger budget deficits. It should start by giving revenue-sharing grants of $300 billion annually to states and localities whose budgets are being squeezed by the decline in property taxes and the general economic slowdown.

All this is a good idea as far as it goes. Here’s the problem: To focus the argument against “Austerian” advocates of fiscal balance, Mr. Mr. Debt dynamics for dummies. Krugman again does a great job showing that the risks of explosive debt are way overblown.

Debt Arithmetic (Wonkish)

The importance of debt maturity. The Declining Marginal Productivity of Consumer Debt. World debt comparison: The global debt clock. Reinhart, Rogoff: Debt Endangers Growth. As public debt in advanced countries reaches levels not seen since the end of World War II, there is considerable debate about the urgency of taming deficits with the aim of stabilizing and ultimately reducing debt as a percentage of gross domestic product.

Our empirical research on the history of financial crises and the relationship between growth and public liabilities supports the view that current debt trajectories are a risk to long-term growth and stability, with many advanced economies already reaching or exceeding the important marker of 90 percent of GDP. Nevertheless, many prominent public intellectuals continue to argue that debt phobia is wildly overblown.

Countries such as the U.S., Japan and the U.K. aren’t like Greece, nor does the market treat them as such. Indeed, there is a growing perception that today’s low interest rates for the debt of advanced economies offer a compelling reason to begin another round of massive fiscal stimulus. Changing Interest Rates. Michael Hudson: Debt and Democracy – Has the Link Been Broken? By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City and a research associate at the Levy Economics Institute of Bard College A longer version of this article in German was published in the Frankfurter Algemeine Zeitung on December 5, 2011 [the FAZ provided this anachronistic note].

Book V of Aristotle’s Politics describes the eternal transition of oligarchies making themselves into hereditary aristocracies – which end up being overthrown by tyrants or develop internal rivalries as some families decide to “take the multitude into their camp” and usher in democracy, within which an oligarchy emerges once again, followed by aristocracy, democracy, and so on throughout history.

Debt has been the main dynamic driving these shifts – always with new twists and turns. Since the Renaissance, however, bankers have shifted their political support to democracies. The balance sheet recession in the US. Economic issues Welcome.

If you have yet to register on FT.com you will be asked to do so before you begin to read FT blogs. However, our posts remain free. On this blog, I will open the discussion of a topic that I am thinking about. My aim will be to elicit views of readers. Martin Wolf is chief economics commentator at the Financial Times, London. Martin was made a Doctor of Letters, honoris causa, by Nottingham University in July 2006 and a Doctor of Science (Economics) of London University, honoris causa, by the London School of Economics in December 2006. To comment, please register for free with FT.com and read our policy on submitting comments. All posts are published in UK time. Contact martin.wolf@ft.com.

On the burden of government debt. The scourge of government debt - macrobusiness.com.au. Is debt a burden on future generations? It depends. Does government debt impose a burden on future generations? Paul Krugman says no. Nick Rowe says yes. But they're talking about different things. Paul Krugman asks: If we wake up in 2012 and find ourselves with $9 trillion in government debt, are we any worse off than if we wake up and find ourselves with zero government debt?