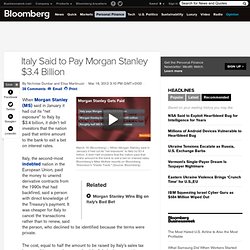

Italy Said to Pay Morgan Stanley $3.4 Billion. When Morgan Stanley (MS) said in January it had cut its “net exposure” to Italy by $3.4 billion, it didn’t tell investors that the nation paid that entire amount to the bank to exit a bet on interest rates.

Italy, the second-most indebted nation in the European Union, paid the money to unwind derivative contracts from the 1990s that had backfired, said a person with direct knowledge of the Treasury’s payment. It was cheaper for Italy to cancel the transactions rather than to renew, said the person, who declined to be identified because the terms were private.

The cost, equal to half the amount to be raised by Italy’s sales tax increase this year, underscores the risk of derivatives countries use to reduce borrowing costs and guard against swings in interest rates and currencies can sour and generate losses for taxpayers. ‘Need to Know’ Morgan Stanley said in a Jan. 19 filing with the U.S. Mary Claire Delaney, a spokeswoman for the New York-based firm, declined to comment further. Close. Mafia now Italy's No.1 bank as crisis bites: report. Italy’s very own special liquidity programme? [Updated] 27/11/2011: Even with IMF's €600bn - Italy is too big to bail. There are some interesting reports in the media over the weekend, speculating that the IMF is preparing a super package for Italy, rumored to reach €600 billion.

Here's a link from zerohedge that outlines the details of these rumors (here). There are several reasons to be skeptical as the feasibility of such a package and the potential effectiveness of it. French exposure in pictures. Italy hails businessman a hero after he launches appeal to save the economy. Silvio Berlusconi, the Italian prime minister, is struggling to tackle the country's debt, but businessman Giuliano Melani has suggested that ordinary Italians could pay for it out of their own pockets.

Photograph: David Gadd/Allstar/Sportsphoto Ltd A businessman has become an unlikely national hero after urging Italians to buy up government bonds to help drag the country back from the brink of an economic meltdown. As the prime minister, Silvio Berlusconi, scrambles to deliver key reforms, the Tuscan financial services entrepreneur Giuliano Melani announced his appeal with a full-page ad in the leading daily Corriere della Sera, complete with his telephone number and email address.

Berlusconi pourrait quitter le gouvernement en 2012. Living 'La Vita Bella': Italians Leave Fears of Debt Crisis to Others - SPIEGEL ONLINE - News - International. After so many centuries, the secret door sticks a bit.

But it still exists, hidden behind an image of Italy in the "Hall of Maps" of Florence's Palazzo Vecchio. "Eccolo," says Francesca, the custodian. "It happened here. " This is where it all began. Starting sometime in the mid-14th century, the leather-bound ledgers the city of Florence used to record its debts were kept hidden in this secret place. Italy 'has been in decline since the 1980s' On a bright Sunday morning terrace on the Piazza San Domenico – smartly turned-out Neapolitan families strolling animatedly past on their way home from mass, a clown entertaining the children on the Via Benedetto Croce – Gia Caglioti isn't mincing her words.

"To be frank," she said, "we've been a country in decline since the 1980s – had we but seen it. Actually, there are plenty of people, including in government, who still won't see it. Italie : le plan draconien d'austérité est voté. Madrid et Rome, deux façons d’être en crise.

Italy Announces Austerity Plan 2.0 As Local Protests Spread, Turn Violent. After Berlusconi was scolded by everyone, but most importantly by backstop solvency provider ECB, for his bull in a China shop maneuver of the first, now defunct, Italian Austerity plan, here are the details from the next, soon to be gutted "Austerity", which readers may be forgiven, if they take it with just a grain of salt.

According to Bloomberg, the details are as follows: Plan to to include higher retirement age for women from 2014To add 3% tax on income over 500k eurosItaly to approve constitutional law for budget balance SeptTo increase VAT from 20% to 21%. Will anyone take this latest attempt to appease the ECB seriously? Eurozone crisis: Italy's debt pile comes under scrutiny. 4 August 2011Last updated at 10:30 Silvio Berlusconi was forced to defend his economic strategy before parliament on Wednesday Just a few months ago, international investors were fairly relaxed when they considered Italy's debt mountain - the second highest in the eurozone.

La bataille d’Italie sera cruciale. La péninsule n'est pas la pire économie de l'UE, mais sa dette publique et sa faible croissance en font une cible pour la spéculation.

Et maintenant que ce nouveau front est ouvert, c'est ici que pourrait se jouer l'avenir de la monnaie unique. La bataille de l’euro a commencé pour de bon. Dette: Une crise avant tout politique en Italie. Italy's 'nepotism' fuels supply of young, middle class and educated émigrés. Pierenrico Martino is scarcely your typical economic migrant.

He comes from one of the richest towns in Italy: Treviso, near Venice, home of the Benetton fashion empire. His family is well off, he says. His father is an accountant; his mother a teacher. Martino, 30, is himself a graduate of the university of Trieste. After college, he did some travelling. "The more I saw, the more I realised that the society from which I came had shut itself off within very limited parameters. Moody’s warns on Italian banks. L'imposture de la dette publique italienne. En quelques mois, le débat sur la dette souveraine s’est orienté principalement à sur le risque de défaut de la Grèce et au problème relatif à une « aide » au Portugal et à la situation irlandaise.

L’anagramme PIGS |1| a été crée pour désigner les pays (Portugal, Irlande, Grèce, Espagne (Spain en anglais) potentiellement déstabilisateurs pour l’économie européenne et pour le futur de l’Euro. Italy: Silvio Berlusconi pressed to make tax cuts by rightwing partner. The threat of a new crisis on the eurozone's southern flank loomed on Sunday as a crucial ally of Silvio Berlusconi demanded that the government cut taxes, despite the serious implications that this would have on Italy's public finances.

Umberto Bossi, the Northern League leader and arbiter of the prime minister's fate, brushed aside concerns that Italy could go the way of Greece when he told cheering supporters in Pontida that the tax burden in Italy had gone "beyond all limits". Is Italy Not Spain The Real Elephant In The Euro Room? Looking through the latest round of EU GDP data, one thing is becoming increasingly obvious: when it comes to future monetary policy decisions at the ECB, and to exactly how many more interest rate hikes we are going to see, then the performance of the Italian economy is going to be critical. The growth pattern now is clear enough: Germany and France move forward at a lively pace, while the so called “peripheral” economies (Portugal, Ireland, Greece, and Spain) either remain in or continually flirt with recession.

They are constrained bythe combined burden of their lack of international competitiveness, their over-indebtedness and the contractionary impact of their austerity programmes. In this sense, given its size, Italy is in a key position to tip the balance between core and periphery one way or the other. #ItalianRevolution: l'indignation gagne la jeunesse italienne. Les difficultés des banques italiennes vont peser sur le FSTE MIB. Les banques italiennes commencent à donner des sueurs froides aux marchés, alors que la situation économique de plusieurs pays européens en difficulté est toujours loin d’être réglée. Flash Eco : Moody's baisse la dette de Florence. L'agence de notation financière Moody's a abaissé vendredi d'un cran la note de la dette de la municipalité de Florence (centre de l'Italie) après que la ville eut cessé de rembourser les banques UBS, Bank of America et Dexia dans le cadre d'un contentieux sur des produits dérivés.

Florence and the derivatives machine [updated] Une crise de la dette italienne se profile-t-elle à l’horizon? - Démystifier la finance - Blog LeMonde.fr. Italy sucked into the crisis one way or another « Euro Area Debt Crisis by Economist Meg. Italy has quickly been drawn into the euro crisis over the past few days as prime minister Silvio Berlusconi and minister of finance Giulio Tremonti have openly fought over the austerity package put before parliament. Ten year Italian government bond spreads over the comparable German bunds hit a record high of 236 basis points last Friday and the FTSE MIB index fell sharply. The eurogroup has decided to hold an emergency meeting this morning to discuss, among other things, recent developments in Italy. Un nouveau domino va tomber en Europe. Depuis le début de la crise grecque, les gouvernements de la zone euro et la BCE essaient de faire croire que le risque est sous contrôle, qu’il n’y aura pas de contagion aux autres pays européens.

Pendant un temps, cette propagande a fonctionné. Mais aujourd’hui, la fiction se craquelle sous nos yeux.