California Governor Approves Bitcoin for Transactions. [Editor's note: The original version of this article carried the headline “Bitcoin becomes legal tender for transactions in California.”

The use of the phrase “legal tender” overstated the extent of the new legislation, and was inaccurate. Although alternative currencies are now legal for transaction in California, there is no legal obligation for their acceptance in transactions. CoinTelegraph is sorry for the error.] Bitcoin can be accepted and used for transactions in the US state of California as of yesterday, following the ratification of a new finance bill. Previously, only US Dollars were officially recognized, but the new bill allows for the use of other national and digital currencies. The Bitcoin Revolution Is Just Beginning (Full Interview) Bitcoin For Brownstones: You Can Now Use Digital Currency To Buy New York Real Estate. Having doubled off the post-PBOC-ban-and-Fed-Taper lows, Bitcoin, trading at USD910 currently is becoming increasingly ubiquitous as a payment method for many businesses.

The latest, as NY Post reports, is Manhattan-based real-estate broker Bond New York, is "using Bitcoins to help facilitate transactions. " With overseas money-laundering as a key support, and Manhattan apartment sales setting a record in Q4 for volume of transactions (+27% YoY), we suspect the acceptance of Bitcoin will merely ease the Chinese (or Russian) ability to transfer funds directly into NYC housing - blowing an even bigger bubble. Via NY Post, The bitcoin has gained a foothold in one of the hottest business sectors in the country: Manhattan real estate. Bond New York, a Manhattan-based real estate broker, has started accepting the digital currency for real estate transactions, The Post has learned.

Germany: Bitcoin is legal – just don't try paying your taxes with it. Germany may be one of the first countries to give Bitcoin an official legal and tax status but don’t try paying your taxes with it just yet.

The alternative currency – the world’s “first decentralised digital currency” – hit headlines earlier this year when its value spiked during the Cyprus banking crisis. Active users are a tiny fraction of the world’s population but interest is growing, with dedicated investment funds, trading marketplaces, clusters of shops who accept payments and at least one company about to start shipping Bitcoin ATMs. Most countries still haven’t figured out exactly how to deal with it. In the US, a federal district judge recently ruled that Bitcoin should be considered a form of money – at least when it comes to prosecuting securities fraud. Thailand just banned it. Bitcoin is a legitimate form of 'currency,' a federal judge rules. The digital currency Bitcoin gained a measure of legitimacy this week when a federal judge ruled in a fraud case that Bitcoins are "a currency or form of money" and are therefore subject to U.S. laws.

The virtual currency has gained traction with investors during recent economic uncertainty in Europe. But frequent outages of Bitcoin exchanges -- blamed on hackers -- and volatile market trading have led some to declare the currency unstable. Those investor concerns aside, U.S. District Court Judge Amos L. Mazzant ruled Monday that the virtual currency constituted a real-life form of currency in the case against Trendon T.

However, according to the SEC, Shaver was running a Ponzi scheme in which he used Bitcoin from his new investors to cover interest payments and withdrawals on outstanding investments, to trade in his own personal account, and to pay off his own personal expenses. eBay May Begin Accepting Bitcoin for Online Payments. What's the Latest Development?

The online commerce giant eBay is considering accepting the virtual currency Bitcoin. The retailer would use its Paypal payments network to exchange the currency online for goods and services. Chief executive John Donahoe said that because the currency is a disruptive innovation, eBay was looking at it closely. "Integration into PayPal’s network would give Bitcoin some much-needed legitimacy. Accepted by few retailers, the currency is held mostly by speculators hoping to profit from price fluctuations, which have been particularly volatile in recent weeks. " What's the Big Idea? Unheard of just a few years ago, virtual currencies are gaining legitimacy with official organizations, public and private.

Photo credit: Shutterstock.com Read it at the Wall Street Journal. Economic Affairs / Bitcoin: Virtual currency gets boost from eurozone troubles. Berlin - The eurozone crisis and its latest Cyprus episode has led to a boost in the value of an Internet-based currency known as bitcoin, with Finns now the largest per capita users.

Bitcoin's value has soared in the past month (Photo: Zach Copley) One bitcoin was trading at over €100 on Wednesday (3 April), a tenfold increase compared to only three months ago. The hike happened largely during the month of March, when the small island of Cyprus - a tax haven and banking hub for Russian oligarchs - shut down its banks for two weeks while negotiating the terms of a bailout which led to the restructuring of its two largest lenders and the imposition of capital controls. But bitcoin's gain is not only due to Cyprus' pain, says Jon Matonis, the board director of Bitcoin Foundation - an outfit promoting the virtual currency. "The story is mostly perpetrated by the media, but I don't share the view that the bitcoin price rise stems from Cyprus. Yes, you should care about Bitcoin, and here’s why. Everybody’s talking about Bitcoin these days, which is quite remarkable given the highly technical nature of the crypto-currency.

So why is it such a big deal? To explain why, I’m going to start with the implications of Bitcoin, then get into the technical nitty-gritty. Why that way round? Because there’s more to Bitcoin than the technical wow-factor, or indeed the crazy speculation that’s going on now. Even if Bitcoin itself fails, it’s a sign of things to come. Finnish development firm offers to pay salaries partly in Bitcoins.

Bitcoin exchange wins right to operate as a bank. A website that swaps real-world currencies for decentralised virtual bitcoins has been granted the status of a bank.

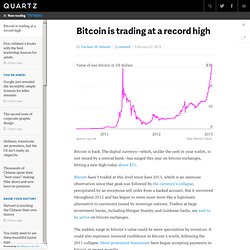

Bitcoin-Central made a deal with French financial companies Aqoba and Credit Mutuel to grant it the status of a "payment services provider". This makes it easier for its customers to use bitcoins, and gives the exchange a series of protections. The website will now be able to issue debit cards and carry out real-time transfers to and from other banks. Mega accepte la monnaie virtuelle Bitcoins. Bitcoin is trading at a record high - Quartz. Bitcoin is back.

The digital currency—which, unlike the cash in your wallet, is not issued by a central bank—has surged this year on bitcoin exchanges, hitting a new high today above $31. Bitcoin hasn’t traded at this level since June 2011, which is an ominous observation since that peak was followed by the currency’s collapse, precipitated by an enormous sell order from a hacked account. But it recovered throughout 2012 and has begun to seem more more like a legitimate alternative to currencies issued by sovereign nations. Traders at large investment banks, including Morgan Stanley and Goldman Sachs, are said to be active on bitcoin exchanges. The sudden surge in bitcoin’s value could be mere speculation by investors.

New bitcoins are generated through intensive computer processing, which is intended to control their release into the open market. Bitcoin grows up, gets its own hardware. The big news in the Bitcoin world is that there are several Bitcoin-mining ASICs (custom chips) already shipping or about to be launched.

Avalon in particular has been getting some attention recently. Bitcoin mining moved long ago from CPUs to GPUs, but this takes it one step further. The expectation is that very soon most mining will be done by such specialized hardware; general-purpose machines will be too inefficient to be profitable. This development raises a whole host of interesting questions. First, if ASIC mining is indeed so much faster than any current method, and can recover the hardware cost in just a few days as claimed, why are the creators selling them, or even talking about them?!

None of these reasons are fully convincing to me. Une banque française autorisée à utiliser Bitcoin. Grâce à un partenariat entre le prestataire de paiment Aqoba et startup Paymium, la monnaie virtuelle Bitcoin va pouvoir transiter légalement au sein du système bancaire. Une première mondiale. « Avec Bitcoin, payer et vendre sans les banques » titrait en novembre dernier Le Monde, dans un article décrivant le fonctionnement de cette monnaie virtuelle cryptée et anonyme, dont le fonctionnement repose sur un logiciel open-source et en peer-to-peer.

Certes, le projet de bitcoin, né en 2009, se voulait au départ d’inspiration sinon anarchiste, au moins anti-banque, mais les choses sont peut être en train de changer. Victoire made in France C’est en effet un véritable coup de force que la startup française Paymium a annoncé le 6 décembre dernier sur l’un des forums de la communauté de bitcoin : En fait, il s’agit d’une victoire d’un duo français acquise dans le cadre d’un partenariat entre Paymium, qui développe la plateforme Bitcoin Central et le prestataire de paiement en ligne Aqoba. Virtual cash exchange becomes bank. 7 December 2012Last updated at 12:07 ET The deal means more protection for cash created by bitcoin dealing A currency exchange that specialises in virtual cash has won the right to operate as a bank.

Bitcoin-Central got the go-ahead thanks to a deal with French financial firms Aqoba and Credit Mutuel. The exchange is one of many that swaps bitcoins, computer generated cash, for real world currencies. The change in status makes it easier to use bitcoins and bestows national protections on balances held at the exchange. Federal protection Bitcoins, and the global network of computers that supports them, first appeared in 2009 and since then it has become a very widely used alternative payments system. Bitcoin: Is the cryptocurrency Bitcoin a good idea. The Information Policy Case For Flat Tax And Basic Income. I’ve spent the last week experimenting with Bitcoin.

Like with any new technology that fundamentally shifts perspectives, there are both zealots and luddites, there are Pollyannas and there are Valentis. I will be returning to deeper analysis in a series of posts. Weed As Surprise Driver For Mass Cryptoproficiency. Ever since the e-mail encryption PGP was created, civil liberties activists have wondered how to get people in general to care about cryptography and protecting their rights on the net. What would make them care? The answer appears to come from a totally unexpected direction.

A marketplace called Silk Road has been making headlines lately. It is a marketplace for plants and plant parts; plants that are banned, but that people still want to acquire, and quite frequently do. Previously, there has been no real use case for learning cryptography and anonymity for the average citizen. Cryptography and cipherproficiency has been limited to a small technically and mathematically interested subgroup who sees quite clearly how this technology and these skills are necessary to safeguard civil liberties against governments, but getting it to the masses just hasn’t happened. Screenshot from Silk Road. We need mass cryptoproficiency to justly keep secrets from rightshostile politicians. Wikileaks veut être payé en bitcoins.