First State Bank And Trust (firststatebankandtrust) What Should You Do To Increase Your Odds of Qualifying for a SBA Loan… First State Bank And Trust on HubPages. 4 Steps to Getting a Small-Business Loan: firststatebank — LiveJournal. Banks in Stillwater give loans to assist businesses in meeting their financial requirements for succeeding.

But, sometimes, the qualifications and requirements for getting small business loans in MN can throw you off track. What Should You Do To Increase Your Odds of Qualifying for a SBA Loan? by firststatebankandtrust. How to Retire Well in Minnesota? When people think about their retirement, Minnesota probably is not the first place that comes to mind.

However, North America has a lot to offer. If you believe this place is the perfect place for you to settle after retirement, here are a few things you should know to retire well in Minnesota: #1. Cost of living. First State Bank And Trust (@firststatebankandtrust) on We Heart It. Is Minnesota A Good Place to Retire?: firststatebank — LiveJournal. When people think about their retirement, Minnesota probably is not the first place that comes to mind.

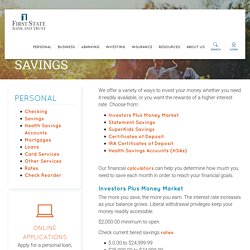

However, North America has a lot to offer. If you believe this place is the perfect place for you to settle after retirement, here are a few things you should know to retire well in Minnesota: #1. Cost of living Before you make a plan to settle on a place after your retirement, consider the cost of living in that specific area. . #2. Whether your budget is tight or ample, understanding your tax obligations is a must. Personal Savings Account MN. We offer a variety of ways to invest your money whether you need it readily available, or you want the rewards of a higher interest rate.

Choose from: Our financial calculators can help you determine how much you need to save each month in order to reach your financial goals. The more you save, the more you earn. The interest rate increases as your balance grows. Liberal withdrawal privileges keep your money readily accessible. $2,000.00 minimum to open. The Ultimate Homepage of Fsbt! Bookmark with All My Faves. The Ultimate Homepage of Fsbt! Bookmark with All My Faves. Is Buying a House Worth It? Tips to Boost Your Chances of Obtaining a Small Business Loan: firststatebank — LiveJournal. A credit score is not the only single factor that lenders consider to approve your small business loans.

Security. Security First State Bank and Trust holds security in the highest regard.

All of our Internet Banking features are run over secure connections and data is monitored 24 hours a day, 7 days a week. The Internet Banking feature of our web site requires you to use a 128-bit encryption browser. For security reasons, we do not specify our exact security measures, but we want to make sure you feel secure when doing your banking online. First State Bank and Trust will never ask for your password, account number or other personal information over the phone, text message or by email.

Phishing scams try to trick you into giving away your passwords, account numbers and other personal information. What Should You Do To Increase Your Odds of Qualifying for a SBA Loan? A credit score is not the only single factor that lenders consider to approve your small business loans.

They also pay closer attention to managing your finances, how you run your business, and how you’re planning to return the approved loan. Steps to Financial Security: firststatebank — LiveJournal. The number of borrowers has increased significantly over the past two decades.

It may be due to the preference of instant gratification over delayed gratification, the rising numbers of start-ups, changing lifestyles or a number of other reasons. Loans have become quite the norm in today’s society. The rising number of borrowers have given a boost to the number of moneylenders. They are ready to finance every person who asks for just about any reason. How to Build Good Credit Score? by DeanWinchester.

Community Involvement. Community Outreach First State Bank and Trust encourages a culture of caring and commitment, demonstrated through community outreach and development. It is important to both employees and the Board of Directors that the Bank support nonprofit organizations and community projects, some which are: Financial Solutions Partnership First State Bank and Trust partners with FamilyMeans Consumer Credit Counseling Service (CCCS) to provide customers with access to financial counseling and education services. The following services are provided free of charge or at a minimal cost to all First State Bank and Trust customers. Budget & Credit Counseling (In-person, telephone, mail or online)Debt Management PlanCredit Report Review CounselingFinancial EducationOnline financial tools and information.

Online and Mobile Banking: firststatebank — LiveJournal. The technological advancements within the last few decades have affected nearly all the industries.

The banking industry has adapted to the changing technologies and used them to simplify the banking process for the bankers as well as the customers. After the introduction of the ATMs in the late 1960s, perhaps the most significant addition to the banking process is the internet and mobile banking. Through mobile banking customers can conveniently do business with the bank. It also makes the whole banking process very efficient and minimizes the chances of error significantly. Banks, such as Minnesota bank and trust, are providing proactive and flexible mobile apps through which the customer can access the digital facilities. Coronavirus (COVID-19) Information. Quick and Convenient Mobile Banking. The technological advancements within the last few decades have affected nearly all the industries.

The banking industry has adapted to the changing technologies and used them to simplify the banking process for the bankers as well as the customers. After the introduction of the ATMs in the late 1960s, perhaps the most significant addition to the banking process is the internet and mobile banking. Through mobile banking customers can conveniently do business with the bank. It also makes the whole banking process very efficient and minimizes the chances of error significantly. Banks, such as Minnesota bank and trust, are providing proactive and flexible mobile apps through which the customer can access the digital facilities.

Steps to Financial Security: firststatebank — LiveJournal. A Step Towards Financial Protection - First State Bank and Trust - Medium. The number of borrowers has increased significantly over the past two decades. It may be due to the preference of instant gratification over delayed gratification, the rising numbers of start-ups, changing lifestyles or a number of other reasons. Loans have become quite the norm in today’s society. The rising number of borrowers have given a boost to the number of moneylenders. Bayport Bank and Trust in MN. Additional information about individuals registered with FINRA can be found on FINRA'S BROKERCHECK . Life Insurance Protecting your family from major financial risks is one of the cornerstones of any sound financial program. Benefits That You Have With Bayport Online Banking : firststatebank — LiveJournal.

Tips To Protect Your Finances: firststatebank — LiveJournal. Financial planning is very important these days, especially if you want to secure your funds and earn more revenue. A solid, strong financial foundation will protect you from many common financial pitfalls and give a feeling of mastery. You can use these ways to protect yourself financially. 1. Save For Emergencies. 5 Ways to Protect Yourself Financially - First State Bank and Trust - Medium. Financial planning is very important these days, especially if you want to secure your funds and earn more revenue. A solid, strong financial foundation will protect you from many common financial pitfalls and give a feeling of mastery.

You can use these ways to protect yourself financially. The most important thing you could do to protect yourself financially is to save some amount of money in some form so that you can use that money to save yourself from small emergencies and problems. The importance of insurance cannot be overstated. The Difference Between Credit Card and a Debit Card: firststatebank — LiveJournal. Many people don’t see the difference between a credit card and a debit card. Because they believe both cards provide almost the same financial output for them; let them buy things. How to Choose a Reliable Banking Service? : firststatebank — LiveJournal.

The widespread use of the internet and mobile phones transformed banking. We are now firmly entrenched in the world of digital banking. Mobile Banking. Download the Android Mobile Banking App Download the iPhone Mobile Banking App Download the iPad App. Improved Banking With Online And Mobile Services - First State Bank and Trust - Medium. The widespread use of the internet and mobile phones transformed banking. We are now firmly entrenched in the world of digital banking. Aspiring customers are demanding an improved set of services. Community Activities. Reasons to Use Mobile Banking: firststatebank — LiveJournal. The innovations that take place in technology every single year, as well as the new ways of conducting business that has emerged, are soon becoming a crucial part of how organizations and businesses operate themselves across a wide range of industries. This not only helps the businesses to secure themselves on their financial front but also helps them stay on top of their respective competitive markets.

The same can be said for the banking sector that is embracing innovations with passion. Why You Should Use Mobile Banking? The innovations that take place in technology every single year, as well as the new ways of conducting business that has emerged, are soon becoming a crucial part of how organizations and businesses operate themselves across a wide range of industries. This not only helps the businesses to secure themselves on their financial front but also helps them stay on top of their respective competitive markets. The same can be said for the banking sector that is embracing innovations with passion.

Commercial Insurance. Commercial Insurance. 5 Health Savings Account Rules You Need to Know: firststatebank — LiveJournal. You must be wondering where you would get the extra money for a health plan when you are living on a tight budget, and most of your earning goes into paying the bills. 5 Things You Need to Know About Health Savings Accounts. You should be aware that health care cost is growing rapidly in America. Steps to Improve Your Finances: firststatebank — LiveJournal. Money cannot buy happiness, but it can surely pull you out of troublesome situations and offer you a better quality of life. Financial Planning Services in Bayport. How To Focus On Improving Your Finances? Why Do I Need Business Insurance? : firststatebank — LiveJournal.

Business Insights. Why You Must Have Insurance For Your Business? - First State Bank and Trust - Medium. Why Minnesota is Good Place To Live After Retirement. About Small Business Twin Cities Loans: firststatebank — LiveJournal. Health Savings Accounts. Business Insights. Steps to Improve Your Credit Score: firststatebank — LiveJournal. Simply Stated. Best Credit Cards of 2019: firststatebank — LiveJournal. Best Credit Cards in USA. Understanding The Mortgage Loan Process in Twin Cities: firststatebank — LiveJournal.

Documents Required For Mortgage Loan Approval in Twin Cities. List Of Questions Regarding Financial Management: firststatebank — LiveJournal. Importance of Maintaining a Good Credit Score: firststatebank — LiveJournal. 3 Tips to Build Good Credit Score. Average Student Loan Debt in the U.S.: firststatebank — LiveJournal. Student Loan Debt Statistics In 2019. First State Bank And Trust Bayport — When Are Personal Loans a Good Idea? When Are Personal Loans a Good Idea?: firststatebank. When Should You Get A Personal Loan? How do I Transfer a Personal Loan from One Person to Another?: firststatebank. How a Personal Loan can Improve your Credit Score?: firststatebank. Steps to Buy a Car with Bad Credit Score: firststatebank.

Does A Personal Loan Affect Your Credit? 3 Best Credit Cards Of 2018. How to Build Good Credit Score? by DeanWinchester0429. Why Good Credit Score Is Important? – Dean Winchester. 4 Health Insurance Options If You Find Yourself Uninsured – Bayport Banks. TOP 3 STILLWATER MINNESOTA BANKS PowerPoint Presentation - ID:7688905. Tumblr. Some Common FAQS To Get House Loan In Stillwater MN. Some Common FAQS To Get House Loan In Stillwater MN. 5 facts you need to know about loan for home in stillwater. 3 Pros And Cons Of Debt Settlement – Bayport Banks. Some Common FAQS To Get House Loan In Stillwater MN. Top 3 Stillwater Minnesota Banks. 3 Mistakes You Must Avoid Using Online Banking. Few things you must know about small business loans. Things To Know About Home Equity Loans – Dean Winchester. Things you should know before changing your home loan lender by DeanWinchester0429 - Issuu. Services offered by banks to their customers.

6 Important Services Offered By Banks to Their Customers – Bayport Banks. Why You Need Insurance For a Business?- Bayport Online Banking by DeanWinchester0429 - Issuu. Read about Rules and guidelines for general financial planning. Five Important Things You Should Know About Loan for Home In Stillwater: firststatebank. Why You Must Have Insurance For Your Business?- Bank Stillwater. Consult Baport Banks Stillwater Minnesota Banks - 2135722. Five Things You Should Know About Loan For House In Stillwater: firststatebank. Business insurance mistakes. Business insurance mistakes. Box. Read about Rules and guidelines for general financial planning. Rules And Guidelines For General Financial Planning. Consult Bank Stillwater. 3 common business insurance mistakes by DeanWinchester0429. Bayport Banks — 3 Common Business Insurance Mistakes.

Waco Foundation Repair (@wacofoundation) Get Loan From FSBT Bank Bank Stillwater - 2132727. Contact Us - Investing.