La «corporation tax», icône sacrée de l’Irlande. Google unit back in profit as turnover soars - Irish, Business. John Mulligan – Updated 04 December 2012 01:29 AM Turnover at the subsidiary jumped nearly 28pc to €6.7bn from €5.28bn in 2007.

The company said the boost was a result of the "continued rapid growth" of the online advertising market and the continued emphasis on developing the business in the European market. It added that the revenue growth primarily resulted from increases in the total number of paid clicks and ads displayed via Google, rather than from changes in the average fees realised.

"The increase in the number of paid clicks was due to an increase in aggregate traffic both on Google's websites and those of Google network members ... and certain improvements in the monetisation of traffic on Google's websites," the accounts note. It uses its AdSense and AdWords platforms to generate income. Cost of sales The cost of sales rose €353m during 2008 to €2.06bn, due primarily to traffic acquisition costs; while administrative expenses climbed to €4.67bn from €3.59bn in 2008. Why would Google not pay as little tax as possible? Whoever is in charge of European tax governance, whether it is by the countries themselves or the European Union, is, well, crazy.

They’ve made it entirely possible for pan-European companies to funnel back profits into EU jurisdictions which have a low corporation tax regime. And yet the press in each country bleats like a sheep, every time someone points this fact out. Today’s controversey was that Google, which has around 90% market share of the UK search market and a large share across other European countries, will not pay any corporation tax on its £1.6bn advertising revenues in Britain. It has a network of subsidiares across Europe, all of them feeding back to its European HQ in Ireland where it does pay corporation tax.

In Britain, corporation tax is levied at between 28% and 30%. Operations in London and Manchester have “administrative expenses” of £177m last year, and a wage bill of £70m. Le développement du commerce électronique : quel impact sur les finances publiques ? 2.

L'impôt sur les sociétés : le problème de la localisation de la création de richesse et de l'optimisation fiscale L'impôt sur les sociétés est au coeur des difficultés soulevées par la localisation de la richesse créée par le commerce électronique. En effet, le système international en vigueur pose le principe selon lequel les revenus produits sur un territoire y sont taxés. Irlande, Pays-Bas, Bermudes : guide du roublard fiscal selon Google. C’est un cocktail d’un nouveau genre.

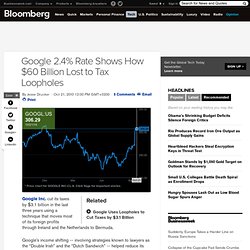

Il encore méconnu mais susceptible d’attirer des amateurs du monde entier. À la différence de l’Irish Coffee, le «Double Irish» ne se boit pas et se prépare en toute discrétion. Pas dans les pubs, mais dans les bureaux capitonnés des meilleurs avocats fiscalistes de la planète. Une disposition qui participe activement aux charmes fiscaux de l’Irlande. Et que le gouvernement, dont le budget d’austérité est en discussion au Parlement depuis mardi, ne souhaite surtout pas remettre en cause. Google 2.4% Rate Shows How $60 Billion Lost to Tax Loopholes. Google Inc. cut its taxes by $3.1 billion in the last three years using a technique that moves most of its foreign profits through Ireland and the Netherlands to Bermuda.

Google’s income shifting -- involving strategies known to lawyers as the “Double Irish” and the “Dutch Sandwich” -- helped reduce its overseas tax rate to 2.4 percent, the lowest of the top five U.S. technology companies by market capitalization, according to regulatory filings in six countries. “It’s remarkable that Google’s effective rate is that low,” said Martin A. Sullivan, a tax economist who formerly worked for the U.S. Treasury Department. “We know this company operates throughout the world mostly in high-tax countries where the average corporate rate is well over 20 percent.” If Google is in Ireland for tax reasons, why are most of its profits in Bermuda?

WPP chief executive Sir Martin Sorrell revealed on Thursday that he was probably going to return the firm's tax base to the UK, three years after it moved to Dublin in an apparent bid to profit from Ireland's controversial low corporate tax rate.

Corporate tax – which is 12.5% in Ireland, less than half the current UK level of 28% – has been the subject of some blunt discussion in Europe in the past few weeks: with Nicolas Sarkozy and Angela Merkel have demanded that Ireland increases the rate in return for a renegotiation of its IMF/EU bailout. But any compromise on the corporate tax rate is off the agenda at today's European summit. In a change of strategy, Enda Kenny has decided to hold off on demands for lower interest rates on its repayments until stress tests on the four main Irish banks are completed in March. In Ireland it is widely feared that the tests will show a further black hole in the banks that could require another mini-bailout.

Google Ireland's 2009 accounts. Double Irish Arrangement. The double Irish arrangement is a tax avoidance strategy that multinational corporations use to lower their corporate tax liability.

The strategy uses payments between related entities in a corporate structure to shift income from a higher-tax country to a lower-tax country. It relies on the fact that Irish tax law does not include US transfer pricing rules.[1] Specifically, Ireland uses territorial taxation, and hence does not levy taxes on income booked at subsidiaries of Irish companies that are outside of the state. In the late 1980s, Apple Inc. was among the pioneers in creating this tax structure.[2] Overview[edit] Typically, the company arranges for the rights to exploit intellectual property outside the United States to be owned by an offshore company. It is called double Irish because it requires two Irish companies to complete the structure. Dutch sandwich[edit] Double Irish With a Dutch Sandwich – example 1. Companies using the arrangement[edit] Countermeasures[edit] ‘Dutch Sandwich’ saves Google billions in taxes - Business - Bloomberg Businessweek.