The Investment Reporter. “Try” The Investment Reporter today for only $5.83 a week!

Try The Investment Reporter today for just $5.83 a week billed monthly to your credit card. Cancel whenever you want. There’s no fixed term. You decide how long you wish to subscribe. Cancel whenever you wish and we will immediately stop billing you! The Wall Street Journal has recently carried a report from Hulbert Financial Digest pointing out that The Investment Reporter is rated #1 on the Hulbert Honor Roll.

Hulbert is owned by Dow Jones Co. as is The Wall Street Journal and it is the prime, independent measuring service of the performance of about 200 investment advisory newsletters. The Hulbert Honor Roll recognizes those investment advisory services that have beaten the average return of their peers in both up and down phases of the last three market cycles over the last 12 years. Advice for Investors. Investor's Digest of Canada Investor’s Digest of Canada has been named “The World’s Best Investment Advisory” — five times — by the Specialized Information Publishers Association of Washington, D.C.

Published bi-weekly, this information-packed advisory … View all posts by this Author The Investment Reporter Canada’s most consistently successful stock market advisory, The Investment Reporter has been steering a steady, profitable course for Canadian investors since 1941. View all posts by this Author Money Reporter The Money Reporter is Canada’s leading personal finance advisory for investors interested in earning more income. Every two weeks, the Money Reporter updates subscribers on the latest developments in every area of income investment —… View all posts by this Author. The Investment Reporter. Subscribe To TSI The Successful Investor - TSI Wealth Network. The Successful Investor Inc. and its affiliate Successful Investor Wealth Management (referred to hereafter as TSI Network) know that you care how information about you is used and shared, and we appreciate your trust that we will do so carefully and sensibly.

This notice describes our privacy policy. By visiting websites owned by or associated with TSI Network, you are accepting the practices described in this Privacy Policy. This privacy policy is applicable to all TSI Network Visitors, Clients, Employees, Suppliers, Web sites, Management, and all other interested parties. Linde Equity Report Investment Newsletter. ShareOwner - Why Model Portfolios. Sort through the wealth of information on the Internet to get what is pertinent to your investments. 5iResearch. Who owns 5i Research®?

5i Research is privately owned, with the majority owned by Peter Hodson, CFA, former Chairman of Sprott Asset Management L.P. 5i Research Inc. is also the owner of Canadian Money Saver, a fully-independent financial magazine, published since 1981. How to Beat Procrastination. Procrastination comes in many disguises.

We might resolve to tackle a task, but find endless reasons to defer it. We might prioritize things we can readily tick off our to-do list—answering emails, say—while leaving the big, complex stuff untouched for another day. We can look and feel busy, while artfully avoiding the tasks that really matter. And when we look at those rolling, long-untouched items at the bottom of our to-do list, we can’t help but feel a little disappointed in ourselves. Investing, Economics Mostly. There is always something to buy in the stock market.

On Tuesday, I put out a list of the stocks that I covered and showed what stock might be a good deal based on dividend yield. Now I am trying to categorize what sorts of stocks may be a good deal based on dividend yield. The advantages to using dividend yield to judge how cheap or expensive a stock is, is that you are not using estimates or old data (like last reported quarter's data).

You are using today's stock price and today's dividend yield. For other testing, like using P/E Ratios and Price/Graham Price Ratios, you use EPS estimates or from the last reported financial quarter. Triage Investing Blog – Dividend Investing & Business Fundementals. Viewing Company Transalta Corp. Viewing Company Transalta Corp.

Top 4 Stock Portfolio Management Websites and Apps – AdvisoryHQ. Intro: 2016’s Top 4 Stock Portfolio Management Websites The decision to invest your money, particularly in the stock market, isn’t likely one you took lightly.

With that in mind, you probably want the best tools and resources to ensure you’re adequately monitoring your investments and that they’re growing. When it comes to stock trading and investment, perhaps the best way to do that is through the use of a stock portfolio app or investment tracking software. This method of portfolio tracking is different from a personal financial software solution, which only provides you with a means of tracking your daily income, spending, and general budgeting. There may be personal finance software options and apps that also integrate the capacity to track stocks, although not all do.

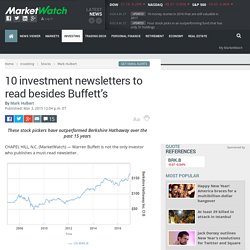

Savings Rates in Your Area No Matches Found. Most professional traders (and even enthusiastic amateurs) rely on investment tracking software specifically designed for that purpose. Investing Made Better! Personal Capital. Stock Analysis Software for Value Investors. 10 investment newsletters to read besides Buffett’s. CHAPEL HILL, N.C.

(MarketWatch) — Warren Buffett is not the only investor who publishes a must-read newsletter. It seems almost sacrilegious to point this out at a time when the rest of the investment community is fawning over Buffett’s latest letter, released over the weekend. Stock Research.