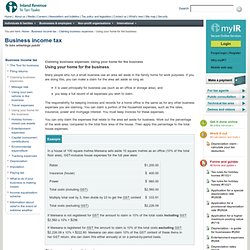

When companies make losses (Find out about) Find out about: Tax rates and codes When a company has a loss If a company's total expenses exceed its total income, it will generally have a loss for tax purposes.

Companies in a loss position do not have to pay income tax. Unless the company is a loss attributing qualifying company, the company will not be able to pass this loss to shareholders who are individuals. However, if certain requirements are met the company may be able to: transfer the loss to another company or carry it forward to the next tax year for offset against the company's income in that year. Back to top ^ Carrying losses forward to future tax years For a company to be able to carry forward a loss to a future tax year it must meet the shareholder continuity test. The “continuity period” is the period from the beginning of the tax year in which the loss was incurred until the end of the tax year in which it offset.

Here is an example of how the shareholder continuity rules work: Example 1 Answer Example 2 Chains of Companies. Using your home for the business (Claiming business expenses) Claiming business expenses: Using your home for the business Many people who run a small business use an area set aside in the family home for work purposes.

If you are doing this, you can make a claim for the area set aside so long as: it is used principally for business use (such as an office or storage area), and you keep a full record of all expenses you wish to claim. The responsibility for keeping invoices and records for a home office is the same as for any other business expenses you are claiming. You can claim a portion of the household expenses, such as the rates, insurance, power and mortgage interest. You can only claim the expenses that relate to the area set aside for business. Claims on mortgage interest You may also claim a proportion of the mortgage interest (not principal) paid during the year. Telephone costs. Dowse Murray Chartered Accountants Wellington. Baubre Murray started the business in 2001 with the idea of providing a different sort of accountant experience, one with a focus on three areas important to clients: Knowing how much the work was going to cost in advance Knowing when it would be done, and Getting a quick response to queries.

She recognised that business is only part of an individual’s personal happiness and that one size, solution was never going to fit everyone. Embracing the electronic age she created a virtual office, offering clients the opportunity to “meet” via phone, email, Skype or in person. Costs were kept to a minimum by operating the business from a home office allowing plenty of family time and engaging staff on contract who also wanted flexibility for their families. Clients have come from a range of businesses and investment. Growth has been organic and an office opened in central Wellington in 2013 for those clients who like to meet in the central city.

Susan Drew - CA Lucy Spencer - CA Maryanne Irving. Tool for business (Business income tax) Tool for business An online interactive tool to help you get all your small business tax issues sorted quickly and simply.

Start the Tool for business | Flash | 250KB Transcript View the text version of the Tool for business (HTML). © Copyright 2009 Inland Revenue. Submit your GST return (Filing your GST return with us) Your GST return will either: be available in myIR Secure Online Services, or be mailed to your postal address.

Complete and submit your GST return online through your myIR Secure Online Services account You can submit your GST return online through myIR. This is made available in your account usually at the end of your taxable period. Once you've completed your first GST return through myIR you will no longer have a paper return mailed to you. The following personal details will be included in your return: your name (title, surname, last name) your trade name if applicable your IRD/GST Number your contact details your bank account details your ratio percentage (if applicable) taxable period.

The benefits of filing your GST return through myIR You’ll receive email reminders (Alerts) when your GST returns are due for filing to help you to do your GST on time You can delegate someone else to do your returns on your behalf. If you don’t have a myIR account, register for one today. Note Important.