How Interest Rates Affect The U.S. Markets. Changes in interest rates can have both positive and negative effects on the U.S. markets.

When the Federal Reserve Board (the Fed) changes the rate at which banks borrow money, this has a ripple effect across the entire economy. Below, we will examine how interest rates can have an effect on the economy as a whole, the stock and bond markets, inflation and recessions. Tutorial: Economics Indicators To Know How Interest Rates Affect SpendingWith every loan, there is a possibility that the borrower will not repay the money.

To compensate lenders for that risk, there must be a reward: interest. The existence of interest allows borrowers to spend money immediately, instead of waiting to save the money to make a purchase. The Effect of Interest Rates on Inflation and RecessionsWhenever interest rates are rising or falling, you commonly hear about the federal funds rate. These changes can affect both inflation and recessions. Conversely, falling interest rates can cause recessions to end. Europe's four big dilemmas. The Eurozone debt crisis: Facts and myths. Like any crisis, the new one generates myriads of misguided comments and reactions by journalists, financiers and policymakers.

Ten myths that are frequently heard clash with ten facts that are frequently overlooked. Myth 1: Greece is bankrupt. Countries cannot be bankrupt; their governments can only default on their debts. In the absence of internationally recognised resolution mechanisms, government defaults open up a messy situation as governments negotiate with their creditors. Fact 1: There is no reason for the Greek government to default. Fact 2: This crisis started as a panic reaction to fears of default but, as usual, some market players now also bet on a default. Myth 2: Greece is being singled out because it cheated repeatedly. Myth 3: The Greek government is particularly vulnerable because its debt is widely held internationally, in contrast with the Japanese debt. Fact 3: The monetary union is an agreement to take monetary policy out of national sovereignty.

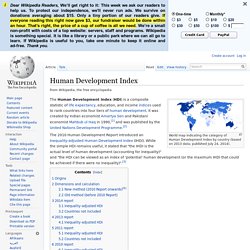

OECD (2010). Timeline: The unfolding eurozone crisis. Felix Zulauf talks to James Turk. Human Development Index. World map indicating the category of Human Development Index by country (based on 2013 data; published July 24, 2014).

The 2010 Human Development Report introduced an Inequality-adjusted Human Development Index (IHDI). While the simple HDI remains useful, it stated that "the IHDI is the actual level of human development (accounting for inequality)" and "the HDI can be viewed as an index of 'potential' human development (or the maximum IHDI that could be achieved if there were no inequality)".[3] Origins[edit] Dimensions and calculation[edit] New method (2010 Report onwards)[6][edit] Published on 4 November 2010 (and updated on 10 June 2011), starting with the 2010 Human Development Report the HDI combines three dimensions: A long and healthy life: Life expectancy at birthEducation index: Mean years of schooling and Expected years of schoolingA decent standard of living: GNI per capita (PPP US$) In its 2010 Human Development Report, the UNDP began using a new method of calculating the HDI. 1. Measuring GDP. Gross domestic product, GDP, is defined as the total value of all goods and services produced within that territory during a given year.

GDP is designed to measure the market value of production that flows through the economy. Includes only goods and services purchased by their final users, so GDP measures final production.Counts only the goods and services produced within the country's borders during the year, whether by citizens or foreigners.Excludes financial transactions and transfer payments since they do not represent current production.Measures both output and income, which are equal. Distinguish between GDP and Gross National product GNP[edit] GDP differs from Gross National Product (GNP), in excluding inter-country income transfers, in effect attributing to a territory the product generated within it rather than the incomes received in it. Essentially, GNP = GDP + NFP. Economic integration. Economic integration is the unification of economic policies between different states through the partial or full abolition of tariff and non-tariff restrictions on trade taking place among them prior to their integration.

This is meant in turn to lead to lower prices for distributors and consumers with the goal of increasing the combined economic productivity of the states. The trade stimulation effects intended by means of economic integration are part of the contemporary economic Theory of the Second Best: where, in theory, the best option is free trade, with free competition and no trade barriers whatsoever. Free trade is treated as an idealistic option, and although realized within certain developed states, economic integration has been thought of as the "second best" option for global trade where barriers to full free trade exist. Etymology[edit] Objective[edit] There are economic as well as political reasons why nations pursue economic integration. Stages[edit]