Convert your Credit Card Transaction into EMI - ICICI Bank. Instant Savings Account Online From ICICI Bank. Wedding Loans: Smart Ways To Finance A Wedding Costs. Credit Card Against Fixed Deposit From ICICI Bank. Regular Savings Account - ICICI Bank. Tax Saving Fixed Deposit - ICICI Bank. What are the different types of Savings Accounts? FD Calculator - Calculate Fixed Deposit Interest Rates Online 2021. Why Paying the Rent With a Credit Card is a Rewarding Idea. ICICI Bank - Corporate Salary Saving Account. Secured vs Unsecured Loans: Which One Should You Opt For? ICICI Pru iProtect Smart Life Insurance Plan From ICICI Bank. How to Avail of the Free-Look Period Benefit on Insurance? Savings Account - Open High Interest Rate Savings Account With ICICI Bank. What Is the Process of Pre-Approved Home Loan? - ICICI Bank. Instant Savings Account Online From ICICI Bank. Do's and Don'ts When Buying Life Insurance Cover. Young Stars Account - Kids Savings Account From ICICI Bank.

Gold Privilege Savings Account From ICICI Bank. Open Fixed Deposit Account Online - ICICI Bank. Get Instant Home Loan Sanctioned Online From ICICI Bank. How to Benefit from Low Home Loan Interest Rates - ICICI Bank. Fixed Deposit: How to Choose the Best FD Scheme with High-interest Rate. Pre-Approved Balance Transfer on Home Loans & Loan Against Property From ICICI Bank. Pre-Approved Balance Transfer on Home Loans & Loan Against Property From ICICI Bank. Know What is Loan Prepayment. 4 Unknown Credit card Loan Benefits. Investment Schemes for Senior Citizens. It is the innate desire of everyone to save money for the future.

With age being a major constraint for senior citizens, it is vital for them to choose the best investment option that provides valuable returns and guarantees the safety of the capital investment. Today, senior citizens in India have a wide array of investment options to choose from. So, if you are looking for the right investment scheme for senior citizens, here are a few options that you can consider. Bank Fixed Deposit and Recurring Deposit Many senior citizens in India prefer investing in bank FDs and RDs mainly because they get a higher interest rate than ordinary citizens. Senior Citizen Savings Scheme (SCSS) Senior Citizen Savings Scheme is one of the most secure government savings schemes. How Do I Apply for a Public Provident Fund (PPF) Account? Tax Saver Fixed Deposit - Open Tax Saver FD Online with ICICI Bank. Apply for Instant Loan Against Credit Card with ICICI Bank.

Home Loan: Apply Home Loan Online - ICICI Bank. Personal Loan – Apply personal loan online at Lowest Interest Rates & EMIs - ICICI Bank. • How can I apply for a Personal Loan?

With ICICI Bank Personal Loans, you can get instant money for a wide range of your personal needs like renovation of your home, marriage in the family, a family holiday, your child's education, buying a laptop, medical expenses or any other emergencies. With minimum documentation, you can now avail a personal loan for an amount up to Rs. 20 lakhs at attractive rates of interest. Please click here if you want to apply for ICICI Bank Personal Loans. Alternatively, the forms are available at our Branches. You can fill the form out and submit it at the nearest Branch. • What are the required documents under each program? The documents required are KYC Documents + Income Documentation.

Advantage Woman Savings Account. Two Wheeler Insurance: Buy / Renew Bike Insurance Online, Get Bike Insurance Quote. Policy Coverage What does two wheeler insurance cover Loss or Damage to your vehicle against Natural Calamities Fire, explosion, self-ignition or lightning, earthquake, flood, typhoon, hurricane, storm, tempest, inundation, cyclone, hailstorm, frost, landslide, rockslide.

Home Insurance - Buy or Renew Home Insurance Policy Online at ICICI Bank. The advertisement contains only an indicative of cover offered.

For more details on risk factors, terms, conditions and exclusions, please read the terms & conditions/policy wording carefully before concluding a sale. Insurance is underwritten by ICICI Lombard General Insurance Company Limited. Home Insurance Policy Misc 13 IRDAN115P0003V01200203 ICICI Bank Limited (“ICICI Bank”) with registered office at ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, 390 007, Gujarat (CIN: L65190GJ1994PLC021012) Toll Free No. 1860 120 7777 is only a Corporate Agent (Composite, IRDAI Regn No.: CA0112 valid till March 31, 2022) of ICICI Lombard General Insurance Company Limited having its registered office at ICICI Lombard House, 414, Veer Savarkar Marg, Near Siddhivinayak Temple, Prabhadevi, Mumbai 400025.

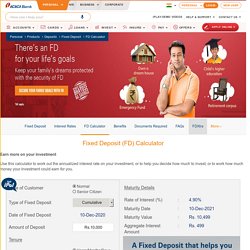

IRDAI Reg. Open Savings Account For Your Family. Current Account Opening - ICICI Business Banking. Current Account Opening - ICICI Business Banking. Recurring Deposit (RD), RD Interest Rates up to 7.75% in 2016 - ICICI Bank. FD Calculator: Calculate Fixed Deposit Interest Rates & Maturity Amount Online - ICICI Bank. The data generated herein is completely and solely based on the information/details provided by you in response to the questions specified by ICICI Bank Limited ("ICICI Bank").

These questions and the calculations thereon resulting in specific data are developed and based on certain tools and calculators that are made available to ICICI Bank and are based on pre-determined presumptions/assumptions. ICICI Bank, while providing and developing these tools, has relied upon and assumed, without independent verification, the accuracy and completeness of all information made available to it from public / private sources and vendors or which has otherwise been reviewed by ICICI Bank.

Such information and the resultant data is provided only for user's convenience and information purposes. Nothing contained herein shall amount to an offer, invitation, advertisement, promotion or sponsor of any product or services of ICICI Bank/third party and is not intended to create any rights or obligations. Unifare Metro Cards. Heart & Cancer Insurance Policy Online In India - ICICI Bank. #Only doctor’s certificate confirming diagnosis needs to be submitted.

The benefit is payable only on the fulfillment of the definition of the diagnosed level of listed condition *Rs 20 lakh cancer cover at Rs 99 p.m. - This premium rate is for a 24 year old healthy non-smoker male for a term of 20 years, monthly premium payment frequency and without any additional benefits and is inclusive of all taxes. ~A lump sum is paid out on diagnosis of any of the listed conditions. This payout is based on the level of the condition. In any case, the total payout in the policy cannot exceed 100% of the Sum Assured of the cover selected. ^The Company shall waive all future premiums on a claim of Minor condition under the chosen cover; or on the diagnosis of Permanent Disability (PD)of the Life Assured due to an Accident. 1Source: 2Source: Higher Sum Insured at premium starting at Rs. 7 per day – Health Insurance Top Up – ICICI Bank.

The advertisement contains only an indicative of cover offered.

For more details on risk factors, terms, conditions and exclusions, please read the terms & conditions/policy wording carefully before concluding a sale. Insurance is underwritten by ICICI Lombard General Insurance Company Limited. GROUP HEALTH INSURANCE. (UIN - ICIHLGP02001V030102) ICICI Bank Limited (“ICICI Bank”) with registered office at ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, 390 007, Gujarat (CIN: L65190GJ1994PLC021012) Toll Free No. 1860 120 7777 is only a Corporate Agent (Composite, IRDAI Regn No.: CA0112 valid till March 31, 2022) of ICICI Lombard General Insurance Company Limited having its registered office at ICICI Lombard House, 414, Veer Savarkar Marg, Near Siddhivinayak Temple, Prabhadevi, Mumbai 400025.

Online Outward Money Transfer. NEFT - Transfer Money Using National Electronic Funds Transfer (NEFT Transaction) - ICICI Bank. What is National Electronic Funds Transfer (NEFT) system?

National Electronic Funds Transfer (NEFT) is a nation-wide centralised payment system owned and operated by the Reserve Bank of India (RBI). Funds are transferred to the Credit Account with the other participating Bank using RBI's NEFT service. RBI acts as the service provider and transfers the credit to the other bank's account. As per RBI guidelines, NEFT is available 24x7 with effect from Dec 16, 2019. What are the advantages of using NEFT system? Credit Card Offers. Should I Get A Credit Card? – How to Evaluate Your Requirements – ICICI Blog. September 29, 2020 If you are not a Credit Card holder yourself, but know someone who is, chances are that you’ve noticed how much they love using their Credit Cards.

You may also have wondered why it is that every time a payment opportunity arises, they are quick to offer their Credit Cards more than any other payment method. Well, there are some very good reasons for their decision and once you find out about the benefits that Credit Cards in the market offer, you might get on-board too. From the numerous Credit Card offers to matters of convenience and security, there are a variety of reasons why a Credit Card can be suitable for your specific needs. If you find yourself having the following requirements, you should think about opting for a Credit Card: You value the safety and security of your transactions: There is the main factor of security when it comes to making purchases with Credit Cards.

The contents of this document are meant merely for information purposes. What is Single Premium Life Insurance & How it Works? - ICICI Blog. October 02, 2020 Single Premium Insurance allows you to pay a premium amount for an insurance cover at one-go.

Read further to know what the policy is and how it works. Today, consumers look for the flexibility factor while buying any product or service. Get Instant Personal Loan Online. Deals & Offers, Discount Coupons & Vouchers - ICICI Internet Banking. Responsibilities of Co-Signer in Home loan. Posted by scottneha01 on October 5th, 2020 If you're assigned a co-signer role, you will be liable to pay the debt if the other borrower's default in paying the credit. What Are Some Ways to Save Income Tax In India? Everyone is liable to pay income tax based on the pre-defined tax slab rates.

But there are ways through which you can save on taxes. The Indian government offers some concessions to the taxpayers based on the investments. Read to know more. Whenever the tax season kicks in, people always look for opportunities to save income tax provided they have made the required investments. As an investor, you wouldn't want to miss out on any scheme that enables you to save as much taxes as possible. Provisions under Section 80C: There are many plans as prescribed under Section 80C of the Income Tax act. Though dealing with tax planning and saving may be difficult to manage, but you can ward off your worries using the above mentioned tax deduction strategies.

Fixed Deposit. What Are The Best Alternatives For A Fixed Deposit In India? What Are The Best Alternatives For A Fixed Deposit In India? Get Instant Personal Loan Online. How to Choose the Best Credit Card for Me? - ICICI Blog. September 24, 2020 India’s payment industry is wide in scope and full of numerous benefits for consumers. While there exist a number of digital payment apps, mobile wallets, UPI facilities, and more such cashless modes of payment, Credit Card still remains one of the more popular options, due to the several customised benefits they offer to consumers. While each Credit Card comes with its own set of unique benefits, one must choose a card tailored to their specific needs and usage patterns.

One would need to compare cards on various parameters in order to determine the best Credit Card for them. Some of the parameters to take into consideration are: Spending habits: Different Credit Cards suit different sets of spending habits. Thus, one’s spending habits should be factored in while settling on the best Credit Card option. Interest rate: While some banks come with a uniform rate of interest that applies to all cards, others come with different rates for different cards. Factors That Affect Your Personal Loan Interest Rates: Know How? - ICICI Blog. September 24, 2020 It is easy to avail of a Personal Loan as it helps you to meet diverse financial needs. You can avail of the deal only if you meet the lender’s eligibility criteria that affects the interest rate. Whether you want to buy a car, fund your child’s higher studies, meet wedding expenses, or are looking to fulfil any other financial obligation, a Personal Loan is the right choice.

You can use it for any purpose and the disbursement process is quick. It is an unsecured loan type that never requires you to pledge any collateral or security. Five different types of Home Loans in India - ICICI Blog. August 27, 2020 With the rising real estate prices in India, a Home Loan is the only way through which most people fulfil their dream of buying a home. To better meet the needs of the borrowers, lenders in India now offer different types of Home Loans. Purchasing a home has now become a benchmark for settling down in India. Pension Plan: A Best Way to Secure Your Retirement - ICICI Blog. August 28, 2020 Enjoy your post-retirement life without any financial strain.

Start investing in a pension plan, which is a great way to have secured golden years of life. Read further to know about the pension plan. Successful financial planning is one that covers all aspects of your life, right from marriage, starting a family, buying a home or a car and most importantly, your retirement. Not many understand the seriousness of planning for retirement, which is the most common reason for people facing financial troubles. Apply online for a Home Loan. Personal Loan Balance Transfer - Everything You should Know. Finance — What Is Regular Premium Insurance, And How It... Online Banking Services.

Interesting Facts to Know About Recurring Deposits. Recurring Deposits or RD is a traditional form of investment schemes. The scheme, which was only offered by banks initially, today, many private financial companies offer this facility. Low risk profile and valuable returns on the investments make it a preferred choice. Read on to know more interesting facts about RD. 5 Money Management Tips When Travelling Abroad. Credit Score for Personal Loan: How Much and Why? 5 Types of Insurance Policies That Cover Natural Disasters? Credit Card. How online banking is helping customers to overcome lockdown amid Coronavirus. The novel-COVID-19 is a worldwide emergency. As the infection rates continue to rise in India, millions of people are worried about their finances and investments. One of biggest hurdles individuals are facing is access to banking services amidst the nationwide lockdown.

Read further to know how the banks are encouraging people to use digital banking in the times of Coronavirus. In the past few months, the deadly coronavirus has disrupted business operations and day-to-day lives of individuals. Due to the lockdown, the pandemic crisis has forced the country’s population to stay indoors with many people losing their jobs, raising hunger concerns, business losses and much more. In the light of the ongoing lockdown, where people are urged to stay at home due to which they are unable to physically visit the banks to access various services. Can I take Personal Loan to Invest in Mutual Funds?