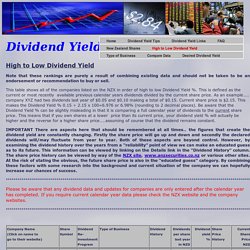

Keith Fitz-Gerald, Author at Money Morning - We Make Investing Profitable. Options Trading Explained - Free Online Guide to Trading Options. Currency Charts - free. How the Economic Machine Works [Animation] by Ray Dalio. Show me. Market Realist. The National Bureau of Economic Research. Weiss Ratings - Weiss Ratings. High to Low Dividend % High to Low Dividend Yield Note that these rankings are purely a result of combining existing data and should not be taken to be an endorsement or recommendation to buy or sell.

This table shows all of the companies listed on the NZX in order of high to low Dividend Yield %. The Secret Ingredient for Higher Stock Prices. Basic Wall Street Lingo The bulls want the market (or a stock) to go higher, and the bears want the market (or a stock) to go lower.

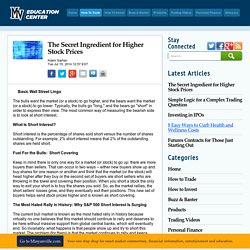

Typically, the bulls go "long," and the bears go "short" in order to express their view. The most common way of measuring the bearish side is to look at short interest. What Is Short Interest? Short interest is the percentage of shares sold short versus the number of shares outstanding. Fuel For the Bulls: Short Covering Keep in mind there is only one way for a market (or stock) to go up: there are more buyers than sellers. The Most Hated Rally in History: Why S&P 500 Short Interest Is Surging The current bull market is known as the most hated rally in history because virtually no one believes that this market should continue to rally and deserves to be here without massive support from global central banks, which will eventually end.

S&P 500 Short Interest Is at Record Highs. Sweden stock market data - prices and news - FT.com. Stockholm - Listed Companies - Nasdaq. Nasdaq Nordic - Share quotes - Indexes - Company news - Nasdaq. The 2 Main Ideas From "The Little Book That Beats the Market" The Little Book That Beats the Market is a classic book on investing in the stock market.

Author Joel Greenblatt gives an innovative method for choosing stocks. It’s pretty impressive, honestly. Here are his main ideas, and the “magical formula” he uses. He actually refers to it as “the magic formula,” and it just may be. Main Idea #1: Invest in Index Funds, If You Don’t Want to Put in the Work I’ve said this before. Let’s be honest, you really have two reasonable options when it comes to investing in the stock market: Spend a lot of time finding individual stocks.Invest in index funds if you don’t have the time for option one. That pretty much sums it up. That’s exactly what an index fund does. Feel free to go read about it and see for yourself, but you’ll find it to be true.

Top Gold Producers - Australian Gold. The Aftermath of Financial Crises. NBER Working Paper No. 14656Issued in January 2009NBER Program(s):International Finance and Macroeconomics This paper examines the depth and duration of the slump that invariably follows severe financial crises, which tend to be protracted affairs.

We find that asset market collapses are deep and prolonged. On a peak-to-trough basis, real housing price declines average 35 percent stretched out over six years, while equity price collapses average 55 percent over a downturn of about three and a half years. Not surprisingly, banking crises are associated with profound declines in output and employment. The unemployment rate rises an average of 7 percentage points over the down phase of the cycle, which lasts on average over four years.

Acknowledgments Machine-readable bibliographic record - MARC, RIS, BibTeX Document Object Identifier (DOI): 10.3386/w14656. The 2 Main Ideas From "The Little Book That Beats the Market" Is Silver Undervalued? 3 Reasons it Could Be. The silver price has dropped drastically over the last five years, but is silver undervalued?

Here are three reasons it could be. The silver price has dropped significantly over the past five years, falling from around $35 per ounce in 2012 to just over $16 today. But many experts anticipate a rally.Analysts polled by FocusEconomics expect a minor silver price uptick in the short term — they see silver averaging $17.60 in the fourth quarter of 2017 and $17.80 in 2018.

Silver’s rise is expected as part of a larger precious metals rebound caused by geopolitical developments and a weaker US dollar.Other silver market watchers are even more optimistic. For instance, Keith Neumeyer of First Majestic Silver (TSX:FR,NYSE:AG) has said in the past that if gold hits $10,000 per ounce, silver could reach $1,000. 1. Over half of all silver is consumed for industrial purposes. ING Group, N.V. (ING) Guru Stock Analysis. Edit Symbol List Enter up to 25 symbols separated by commas or spaces in the text box below.

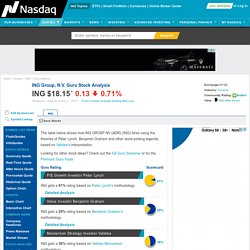

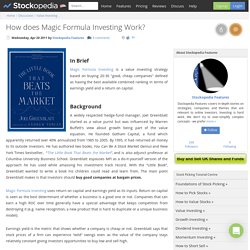

These symbols will be available during your session for use on applicable pages. The table below shows how ING GROEP NV (ADR) (ING) fares using the theories of Peter Lynch, Benjamin Graham and other stock-picking legends, based on Validea's interpretation. Looking for other stock ideas? How Does Magic Formula Investing Work? In Brief Magic Formula Investing is a value investing strategy based on buying 20-30 "good, cheap companies" defined as having the best available combined ranking in terms of earnings yield and a return on capital.

Background A widely respected hedge-fund manager, Joel Greenblatt started as a value purist but was influenced by Warren Buffett's view about growth being part of the value equation. He founded Gotham Capital, a fund which apparently returned over 40% annualized from 1985 to 2005. By 1995, it had returned all money to its outside investors. Magic Formula Investing uses return on capital and earnings yield as its inputs. Earnings Whispers.