Timeline: Here’s how the federal public corruption probe unfolded. Real estate News: How Detroit's bankruptcy will hit the housing market. Detroit constitutes the biggest municipal bankruptcy in US history.

What will the move mean for the beleaguered city's housing market? Detroit filed for Chapter 9 bankruptcy protection Thursday, paving the way to start managing the city’s estimated $20bn in outstanding debt. Get news stories like this straight to your inbox with our FREE newsletter. Welcome to Forbes. In Detroit, you can purchase a three-bedroom home for only $1,000. NEW YORK (CNNMoney) — Antjuan Wyatt and his wife recently closed on a three-bedroom, 1,500-square-foot house in a leafy, middle class Detroit neighborhood.

The house needs some work — new furnace, new plumbing, new windows. But that’s OK, because Wyatt bought the place at auction for $1,000. “We were looking for a home in the suburbs, but the prices were too high,” said 27-year old Wyatt, who works at a local Chrysler plant and dabbles in real estate on the side. “I was surprised I got this for $1,000.” In four months (and $30,000 in repairs), Wyatt hopes he can move into the refurbished gem with his wife and their two kids.

Union Attorney: Pensions In Jeopardy After Detroit Bankruptcy Filing. DETROIT (WWJ) – A union attorney says pensions of Detroit city workers are in jeopardy after the city filed for Chapter 9 bankruptcy.

Bankruptcy documents show two public employee pension systems are Detroit’s top unsecured creditors. The city general retirement system’s claim is about $2 billion. The police and fire retirement system is owed more than $1.4 billion. There are more than 100,000 other creditors that include individual retirees, city workers, banks and property owners. Richard Mack, Jr., an attorney for AFSCME Council 25, said it’s “shameful” that the Gov. Timeline of Detroit's financial crisis. DETROIT (AP) - A timeline of Detroit’s financial troubles: - Detroit issues $1.44 billion of new debt in the form of pension obligation certificates to fund the city’s two retirement systems.

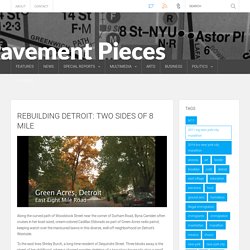

A 30-year repayment schedule is negotiated. For Detroit, a Crisis Born of Bad Decisions and False Hope. Rebuilding Detroit: Two sides of 8 Mile. Along the curved path of Woodstock Street near the corner of Durham Road, Byna Camden often cruises in her boat-sized, cream-colored Cadillac Eldorado as part of Green Acres radio patrol, keeping watch over the manicured lawns in this diverse, well-off neighborhood on Detroit’s Westside.

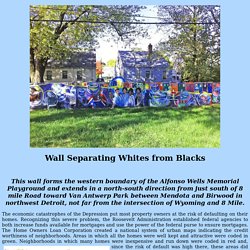

To the east lives Shirley Burch, a long-time resident of Dequindre Street. Three blocks away is the street of her childhood, where a charred wooden skeleton of a two-story house sits atop a small plot of twigs and tumbleweeds, its shingles dangling from a sagging roof, the outer wall pried away from the gutter like a shoulder pulled out of its socket. Wall Separating Whites from Blacks. This wall forms the western boundary of the Alfonso Wells Memorial Playground and extends in a north-south direction from just south of 8 mile Road toward Van Antwerp Park between Mendota and Birwood in northwest Detroit, not far from the intersection of Wyoming and 8 Mile.

The economic catastrophes of the Depression put most property owners at the risk of defaulting on their homes. Recognizing this severe problem, the Roosevelt Administration established federal agencies to both increase funds available for mortgages and use the power of the federal purse to ensure mortgages. The Home Owners Loan Corporation created a national system of urban maps indicating the credit worthiness of neighborhoods. Detroit's wall of racism: Six-foot barrier that kept black children away from middle-class whites is chilling reminder of segregated America. The 6ft high wall was erected in 1940 in Birwood, Detroit, U.S.Separated homes built for middle-class whites from black familiesRacial dividing lines no longer exist, but the wall still stands By Associated Press Reporter Published: 08:24 GMT, 1 May 2013 | Updated: 15:55 GMT, 1 May 2013 Half a mile long and a foot thick, this concrete wall was built to separate black and white families living in the same Detroit neighbourhood in the 1940s.

More than 70 years on, the six-foot high wall still stands in Birwood - a chilling reminder of segregated America, and a physical embodiment of racial attitudes the country has long since tried to forget. A View from Both Sides of Eight Mile Road: Introducing a New Series about Detroit. Woodward Avenue, looking north toward Eight Mile Road, in Detroit, Michigan, c. 1965 Woodward Avenue, the boulevard of my youth If I had a nickel for every time I drove on (or walked on, or crossed) Woodward Avenue, I used to say, I would be a wealthy woman.

That’s because I was born mere blocks from Detroit’s main drag, and lived my first forty years within a couple of miles away, at the farthest, from it. Report2.pdf. M-102 (Michigan highway) This article is about the Michigan state trunkline highway.

For the former U.S. Highway, see U.S. Route 102. The 8 Mile Road Divide: Detroit's Bankruptcy and its Wealthy Neighbour. In the 2000 U.S.

Census, Oakland County, Michigan, was by one measure the fourth-wealthiest in the U.S.; although the county slipped somewhat in 2010, Bloomfield Hills – its most prosperous section – remains one of the most affluent half a dozen suburbs in America. This is the terrain of exclusive country clubs and private academies, where the multi-millionaire presidential candidate Mitt Romney went to school, and banks advertise openings for ‘Wealth Relationship Associates.’ Cross its southern border – the 8 Mile Road – and you enter Detroit, which yesterday became the largest ever U.S. city to file for bankruptcy. With debts of $15bn, 70,000 abandoned properties, and well over a third of its residents living below the poverty-line, the Motor City stands in stark juxtaposition to its well-heeled next door neighbour.