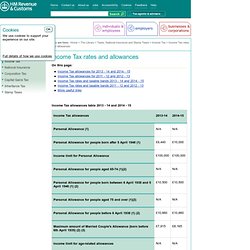

Income Tax allowances. On this page: Top The Personal Allowance reduces where the income is above £100,000 - by £1 for every £2 of income above the £100,000 limit.

This reduction applies irrespective of age or date of birth. These allowances reduce where the income is above the income limit by £1 for every £2 of income above the limit. This applies until the level of the personal allowance for those aged under 65, or from 2013-14, for those born after 5 April 1948, is reached. Income Tax rates, allowances and tax bands for 2008-09 to 2010-11 (Opens new window) Income Tax rates and taxable bands * The 10 per cent starting rate applies to savings income only. The rates available for dividends are the 10 per cent ordinary rate, the 32.5 per cent dividend upper rate and the dividend additional rate of 42.5 per cent (the dividend additional rate is 37.5 per cent from 2013-14). More useful links Find out more about Personal Allowance Find out more about Income Tax Introduction to tax allowances and reliefs. The Pay As You Earn (PAYE) system. What is the Pay As You Earn (PAYE) system The Pay As You Earn (PAYE) system is a method of paying income tax and national insurance contributions.

Your employer deducts tax and national insurance contributions from your wages or occupational pension before paying you your wages or pension. Wages includes sick pay, maternity or paternity pay and adoption pay. You pay tax over the whole year, each time you are paid, rather than paying tax in one lump sum. Your employer is responsible for sending the tax on to HM Revenue and Customs (HMRC). At the end of the tax year, you will get a form P60 which sets out the total amounts paid to you and deducted from you for the previous tax year. If you pay tax on your wages or occupational pension under PAYE, the PAYE system can also be used to collect the income tax on any other taxable income you have. For more information about national insurance, see National insurance - contributions and benefits.

Back to contents The letter in the tax code. Calcul des impôts à Londres, Au Travail au Royaume-Uni. Vous aurez à payer des impôts sur le revenu et cotisations sociales utilisés ensuite pour financer les services publics du pays.

Le plus souvent, les impôts sont prélevés directement à la source (sur salaire) par votre employeur. Il s'agit de l'Impôt sur le revenu et des cotisations sociales (NI). Impôts sur le revenu Si vous vivez et travaillez en Angleterre, vous aurez à vous acquitter d'impôts sur le revenu. Il existe différentes tranches d'imposition basées sur les revenus annuels. Salaires Revenus et bénéfices si vous êtes à votre compte Retraites (d'état, d'entreprise, privée) Produits d'épargne Dividendes perçus (actions, placements boursiers) Revenus issus de la location d'un bien Revenus perçus d'une société privée (trust) Certaines allocations Intérêts de comptes exonérés d'impôts Working Tax Credit (WTC, crédit d'impôt) Dividendes issus du Premium bond Revenus non-imposables Pour la plupart des résidents du Royaume-Uni, il existe un seuil de revenus non-imposables.