Aisect is the one of the [url= mba colleges in Jharkhand.[/url] They offer many courses such as BBA, MBA, PhD. etc. For more details check out the eligibility criteria, and duration.

How Does A Rojgar Mela Work? A Rojgar Mela is basically a job fair, where a large number of job seekers and employers come together with the purpose of applying and selecting the right candidates for the various job profiles for jobs.

This employment strategy fast tracks the whole process of job seekers meeting potential employers. Rojgar Melas are usually held in large assembly halls with separate booths for each employer. The booths have tables with all the relevant information laid out on them in the form of brochures. Cement Manufacturers Association in India. Leadership Development Training Programs. Home - Wildvoyager. Cloud Server – Cloud Services. Online Business Fundraising Ideas for Startups. Fundraising stages of a startup Fundraising happens in multiple stages:

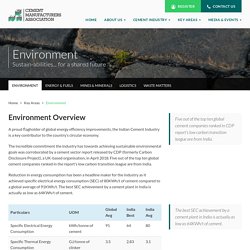

Cement Industry Contribution to Environment. The spectacular accomplishment in energy consumption is a result of continuous work on optimising cost of operations with a distinct emphasis on energy efficiency as a driver to competitiveness and profitability.

With about 50% of the industry’s manufacturing cost attributed to power and fuel, focused efforts at reducing its energy footprint was the key to converting possibilities into reality. A top scorer in India’s Bureau of Energy Efficiency’s (BEE) Perform, Achieve and Trade (PAT) scheme for energy savings, In fact, the Indian cement industry over achieved its energy consumption targets, accomplishing 0.815 million tonnes of oil equivalent (mtoe) with 1.48mtoe, higher by almost 82% during PAT Cycle I. The industry uses Computational Flow Dynamics (CFDs) model simulations to improve the performance of plant equipment such as kilns and boilers and heat recovery equipment among others.

AISECT - Education. Best MBA College in Jharkhand. Bachelor of Business Administration Eligiblity Creteria : - 45% (40% for SC/ST) Marks in 10+2 or equivalent Duration : - 3 Year Program Outcome The students who earn the BBA degree will be able to: Work well in teams, including virtual settings.

Program Specific Outcome After completing BBA students should be able to demonstrate functional knowledge and skills in accounting, ethics, finance, strategy, leadership, economics, global business, information management systems, legal environment, management, marketing, and quantitative research/statistics. Overview: Bachelor of Business Administration is a 3-year degree programme that is one of the most preferred graduation programme at present. Procedure: On the basis of merit/AJEE Master of Business Administration Eligiblity Creteria : - Graduation in any Stream with 45%marks for Gen. and 40% for OBC/SC/ST Duration : - 2 Year Inculcate a global mindset. Overview Procedure Post Graduation Diploma in Rural Management Duration : - 1 Year.

Fresh Gravity. Online Partnership Firm Registration. An overview of Trust Registration in India. Trust Registration is done for several purposes and is proved to be an effective channel for succession and property planning.

In 1882, the Indian Trust Act has governed the Private Trust, which is applicable to entire India except for Jammu and Kashmir state and the Andaman and Nicobar Islands. Furthermore, this act is not applicable to Hindu Undivided Family, Waqf, charitable funding, etc. Online Learning Platform. How to Get an Import Export License in India? – Free legal advice for startups and SMEs online. The Import Export License is required by a person or a business to import and export goods and services.

The Import Export Code or IEC is a 10-digit code that is issued in India by the Director-General of Foreign Trade (DGFT) that comes under the Ministry of Commerce and Industries, GOI (Government of India). The code has lifetime validity and does not need to be renewed. The IEC is important for importers and exporters if they want to clear customs and shipment or send them abroad and send and receive payments from foreign banks. Copyright Registration in India - vakil-search. Copyright, like patents and trademarks, offers legal protection for the intellectual property of the creator.

The copyright is applicable for entities like computer software, sound recordings, literary work, musical work, pictorial work, dramatic work, cinematographic work, and architectural work. It declares that only the creator has the exclusive right to distribute, replicate, reproduce the particular entity, or allow someone else to do the same. 1. Candidate’s Details: This covers details for registration like the name of the candidate, their address, and nationality. 2. 3. 4.

Process of Copyright Registration in India 1. 2. 3. 4. 5. 6. Shop and Establishment Registration. Are you filing your income tax returns properly within the due date?

Failure to comply with the laws listed in the Income Act leads to the levying of various penalties which differ in severity as per the severity of the default. The Indian Income Tax Act, 1961 lays down all the laws related to the payment and filing of taxes in India and is a very important piece of legislation. Here’s a look at all the income tax penalties specified under the Income Tax Act.

Default in paying Self Assessment Tax According to section 140A(1), any tax leftover after crediting TDS must be paid before filing IT returns. As per Section 234F, the penalty is: INR 5000 if ITR is filed before 31 December INR 10,000 if otherwiseIf total income is less than INR 5 lakhs, then the fee is INR 1000. Default in Paying Tax According to Section 220(1), an individual must pay tax within 30 days of receiving a notice under Section 156.

Late filing of TDS/TCS statement. Partnership Firm and How to Register It. Are you filing your income tax returns properly within the due date?

Failure to comply with the laws listed in the Income Act leads to the levying of various penalties which differ in severity as per the severity of the default. The Indian Income Tax Act, 1961 lays down all the laws related to the payment and filing of taxes in India and is a very important piece of legislation. Here’s a look at all the income tax penalties specified under the Income Tax Act. Default in paying Self Assessment Tax According to section 140A(1), any tax leftover after crediting TDS must be paid before filing IT returns. Non-Cognitive Skills That You Should Possess to Excel in Your Career – AISECT Org. Non-cognitive skills are behavioural traits or attitudes such as motivation, self-control, perseverance, etc. and all other socioemotional factors that play an important role in the workplace, school or college.

These factors can also decide our rate of success in all walks of life. The corporates and markets all around the world have become highly competitive. Skills That Will Lead To Your Success – AISECT Jharkhand. We have always looked up to people like A.P.J. Abdul Kalam, Ratan Tata, and Mahendra Singh Dhoni in our times of struggle. These personalities did everything in there power and trusted themselves until they got their success. And we all want to be like them. AISECT University.