Emma D Enriquez

IP lawyer with a fascination in the ever changing intersections between art, copyright and law

Music. Superheros and IP. Blogging/Publishing. Domain Names. Art Law. Domain Names. Facebook. Music. Cool sites. Related Areas of Law. Cases to track. Development of IP Law. Cool new company and gadgets. Social media development. New technology and platform development. Women in gaming and entertainment. Marketplace. Venture capital. Greylock: $1 billion more and new fund for “winner’s circle” Venture capital firm Greylock Partners said today it would expand an early-stage fund to $1 billion and start a growth fund to usher in the next phase of its investment strategy.

The new funds show that while angel investors like Chris Sacca and Mike Maples have managed to take on impressive stakes by betting on startups like Twitter when they’re still quite young, the conventional venture-capital model as practiced by Greylock and a few other elite firms is still going strong. While venture-capital fundraising last year was at a record low since 2003, according to the National Venture Capital Association and Thomson Reuters, several firms have been surging forward to raise large funds. Accel is in the process of raising $2 billion for four different funds in the U.S. and China. Sequoia Capital recently raised $1.3 billion for investments in Silicon Valley and Chinese companies. Is a “huge wave” of M&As, financing deals about to hit Silicon Valley? VCs say they’ll invest, hire and sell more in 2011. Venture capitalists say they will invest more in 2011 as hiring in the sector heats up and selling begins to shake off the lingering woes of the financial crisis, according to a study released today by the National Venture Capital Association (NVCA) and Dow Jones VentureSource.

The survey polled 330 venture capitalists in the U.S. and 180 CEOs of U.S. -based venture-backed companies between Nov. 29 and Dec. 10, 2010, looking for their views on where they see VC investment headed in the coming year. Still, despite the initial upbeat nature of the report, it is clear that many venture capitalists remain worried about a bubble developing in Silicon Valley and are divided about how fundraising will shape up over 2011. Future of Money & Technology Summit. Invalid quantity.

Please enter a quantity of 1 or more. The quantity you chose exceeds the quantity available. Please enter your name. Please enter an email address. Please enter a valid email address. Please enter your message or comments. Please enter the code as shown on the image. Please select the date you would like to attend. Please enter a valid email address in the To: field. Groupon’s non-IPO raises $500 million, with $450 million to go. Welcome to the age of the stealth IPO.

Groupon, the fast-growing purveyor of online discounts from local businesses, has confirmed through a filing with the Securities and Exchange Commission, that it has authorized a new $950 million financing round. (Groupon’s plans first came to light earlier this week through a related filing in the state of Delaware, where Groupon is incorporated, discovered and analyzed by VC Experts.) Of the $950 million, $500 million has already been raised from new and existing investors. New investors, Fortune reports include, T.

Virtual currency transaction provider Tapjoy raises $21M. Tapjoy, a transaction provider for games and sites that use virtual currencies, announced today that it has picked up $21 million in its third round of fundraising after shedding a bit of a dirty image in its old incarnation.

Tapjoy was originally called Offerpal — a name synonymous with somewhat shady deals in social games. Offerpal worked with companies to get users to sign up for deals ranging from credit cards to Netflix subscriptions. 2011 may mark the beginning of a golden era for entrepreneurs. (Editor’s note: Serial entrepreneur Steve Blank is the author of Four Steps to the Epiphany.

A longer version of this story originally appeared on his blog.) As we wrap up 2010, things might seem bleak. Starbucks app will let shoppers pay for coffee with cell phones. Starbucks is announcing an app today that it will let shoppers buy coffee at its stores nationwide with cell phones instead of credit cards or gift cards.

RootMusic Nets $2.3 Million in Funding to Hire Engineers for Facebook App BandPage. RootMusic, developers of the BandPage Facebook Page tab application for musicians, today announced that it has secured $2.3 million in funding from Mohr Davidow Ventures with David Feinleib.

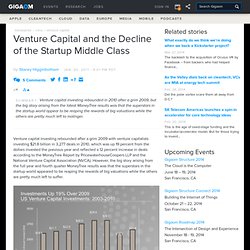

The company’s founder J Sider says the money will go towards “hiring engineers, expanding the team, because were always looking to innovate through technology.” As our profile of RootMusic’s BandPage shows, the company provides cheap and powerful tools for helping artists promote their music on Facebook. Since August, BandPage has exploded in popularity, jumping from 3.15 million MAU and 20,000 artists to 12.7 million MAU and 60,000 artists today according to AppData. Venture Capital and the Decline of the Startup Middle Class: Tech News and Analysis « Venture capital investing rebounded after a grim 2009 with venture capitalists investing $21.8 billion in 3,277 deals in 2010, which was up 19 percent from the dollars invested the previous year and reflected a 12 percent increase in deals according to the MoneyTree Report by PricewaterhouseCoopers LLP and the National Venture Capital Association (NVCA).

However, the big story arising from the full year and fourth quarter MoneyTree results was that the superstars in the startup world appeared to be reaping the rewards of big valuations while the others are pretty much left to suffer.

Hacking. Advertising Law. Infographics.