How will Universal Credit affect me? Some benefits and tax credits are being replaced by Universal Credit.

Calculating costs « Understanding childcare « How do tax credits work? « Guidance « Tax Credits. This section explains how childcare costs are calculated for tax credit purposes.

More information about who can claim help with childcare costs can be found here. You can navigate this section using the quick links below: Amount of childcare supportCalculating average weekly childcare costs Childcare calculatorChange of circumstancesCalculating weekly relevant childcare costsChildcare run-onChildcare compliance checksMore information Amount of childcare support The childcare element provides support of 70% of eligible childcare costs. The 70% rate applies from 6 April 2011. How will the Budget affect my tax credits? Everything you need to know about George Osborne's raid.

They're the words on everyone's lips - tax credits.

George Osborne is slashing the maze of payments for Britain's poorest families to cut £12bn from the welfare bill. He's defended hitting the 'unsustainable' payments while Labour and charities have blasted him for attacking the needy. But after the angry shouting across the Commons , his Budget speech left many people scratching their heads. Here's our definitive guide to answer all your questions about the cuts.

Single Working Parent Benefits and Entitlements. Author: Sarah Knowles BA, MA - Updated: 22 August 2015| Comment There are many types of benefits and entitlements available to parents.

Some are designed expressly for single parents, while others are only for single working parents. Gingerbread Mobile. Work and benefits for single parents. One of the biggest challenges facing single parents is finding suitable work that will fit around new family requirements.

You may no longer be able to work full-time or may have been out of the job market for a whole. Returning to work can seem a very daunting prospect. But there is help available - this page points you in the right direction regarding all things to do with benefits and work, and covers information about the working benefits you may be entitled to.

Getting back into work If your confidence has taken a knock or you've been out of the job market for a while a good first step is to make contact with your local Job Centre Plus. Tax credits entitlement table: working at least 16 hours and no childcare. 1.

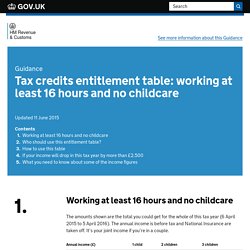

Working at least 16 hours and no childcare The amounts shown are the total you could get for the whole of this tax year (6 April 2015 to 5 April 2016). The annual income is before tax and National Insurance are taken off. It’s your joint income if you’re in a couple. 2. Special Request Collections - Newport City Council. English For a small fee, Newport City Council will arrange collection of unwanted furniture or electrical items that no longer work and are not re-usable.

This form can be used to arrange and pay for the collection of unwanted items by Newport City Council. Most items are charged at £6, however the final price is clearly displayed before payment is requested. Before arranging a special collection please read these notes. How Many Stamps for a Large Letter? Contact Jobcentre Plus. How you contact Jobcentre Plus depends on the help you need, eg finding a job, changing an appointment, checking an existing claim or making a new claim or complaint.

Newport City - Housing. If you are receiving housing benefit but still find it difficult to pay your rent, you may be able to get extra help for housing costs by applying for a Discretionary Housing Payment (DHP).

DHPs are additional payments based on the circumstances of the person applying and are made at the discretion of the authority. A DHP is not a payment of housing benefit but is paid in addition to this benefit. Council and Housing Association Accommodation. Post Office Ltd. 15 16 Bettws Service. Newport to other places bus services routes. Newport bus routes map. Timetables. Local Welsh Dentists & NHS Dentists contacts. Local Welsh NHS Doctors Contacts. NHS Direct Wales. Renting a home. When you are renting a home it is important for you to know what you can afford and understand the kind of rental agreement you are entering into.

Find out about your rights and responsibilities as a tenant so that you can follow the rules. These pages can give you helpful information on problems you may have while renting. Find out what to do if you are facing eviction. Information on tenancy agreements including the rights and obligations of tenants and landlords, and covering sham tenancies and unfair tenancy agreements. Information on secure and assured tenancies for tenants of local authorities, housing associations and housing cooperatives covering rent, repairs, the right to stay in the home and introductory tenancies.

Information on assured tenancies and assured shorthold tenancies for private tenants including rent, repairs and the right to stay in the accommodation. AAV: How Tory immigration rules discriminate against British children. Most people have views on immigration, but the vast majority don't really have a clue how the immigration system actually works. In this article I'm going to explain how some of the most ludicrous elements of the UK immigration system actually end up discriminating against British families.

The Tories make a big show of pretending to clamp down on immigration, and plenty of hopelessly ill-informed people buy into their ludicrous propaganda charade of "Go Home" vans and draconian restrictions on certain demographic groups. The demographic group I'm going to focus on in this article is British people that happen to have fallen in love and married (and perhaps had children with) non-EU citizens. In June 2012 the Tory Home Secretary Theresa May introduced new immigration rules to prevent low-mid income British citizens from bringing their foreign spouses to live in the UK. Her new rules set out stringent family income conditions. Gingerbread - Gingerbread Wales - Gingerbread.

Benefit Calculator - About You - Turn2us. A dependant child is a child that you are responsible for (they usually live with you all or most of the time and you get Child Benefit for them). If your child is away from home temporarily, for example in hospital or on holiday, you should still include them Do not include any child that receives a benefit in their own name, such as Income Support or income-based Jobseeker's Allowance. Find an Adviser. Habitual Residence Test (HRT) - Turn2us. Key information To claim most means-tested benefits in the UK, you have to satisfy the Habitual Residence Test (HRT). This section explains more about this. Please note: the HRT applies to everyone, including British citizens. Applies to: England, Wales, Scotland and Northern Ireland NB: This is a very complex area of the law so it is important that you seek specialist advice.

Cont608420. Newport plusbus zone. Newport PLUSBUS (includes Caerleon) Fare structure Aug 5 0. Newport Bus Fares Review - 6th October 2014. Adult Monthly and Annual multi tickets reduced, Weekly multi tickets frozen Bamboo under 19’s ticketing frozen Newport Bus just completed an extensive fares review in order to be able to offer their customers the very best value public transport options on our network of services covering Newport, Cardiff, Cwmbran, Chepstow and Monmouthshire. Zone 1 Monthly Passport smartcards will be REDUCED from £55 to £45 Zone 2 Monthly Passport Plus smartcards will be REDUCED from £65 to £50. Newport City Council. Newport HomeOptions - Home. DBS Checks & CRB Check - Fast online service.

New CRB info & links when lived abroad in last 5 years... Can I dispute the information on my disclosure? How many documents will I need to provide with my application form? I already have a DBS/CRB disclosure; do I need to obtain another one? I know that I hold a criminal record; what should I do? I am currently living in student accommodation. What address should I list as my current address? I currently live overseas - can I apply for the DBS check? I have lived abroad in the last five years. How do I obtain a 'Certificate of Good Conduct' from any overseas countries that I have lived in? Tax & NI Calculator and Rates for 2014/2015. Disclosure and Barring Service (DBS) checks (previously CRB checks) Citizens Advice - the charity for your community. Newport City Living - Family Information. Newport City Council has an obligation to offer every 3 year old child in Newport a free part-time place in an education establishment in the term following their third birthday*.

These places are offered in Local Authority schools, and registered education providers (also called Non maintained settings – NMS) Newport Jobcentre. Register a birth abroad. Newport Bus. Newport City - Housing Organisations. Welcome to the online passport application service for British nationals. Newport City Council. Cookies Cookies are small files stored in your browser and are used by most websites to personalise your visit. Follow the link to find out how Newport City Council uses cookies . Click the continue button for us to remember your decision. Continue <p>Browser does not support script. British and Irish citizens - claiming benefits. National Express Coaches // Coach, Rail & Bus Travel Throughout The UK. Benefits adviser. Use an independent benefits calculator to find out: Cost of childcare calculator. Child Benefit. Help with childcare costs. Income Tax Offices. Council - Passports etc.