IAS 39 Financial Instruments: Recognition and Measurement. Accounting. Disposal of Fixed Assets Journal Entries. Disposal of a fixed asset is the withdrawal of a fixed asset from use upon the completion of its useful life or due to lower productivity in its later life.

Disposal of an Asset with no Salvage Value In a rare situation where the salvage value of the fixed asset is zero, there will be no terminal cash flow and the journal entry will be as follows: Gain on Disposal However, if an asset has a salvage value; it is likely that the disposal will cause gain or loss. When a fixed asset is sold at a price higher than its carrying amount at the date of disposal, the excess of sale proceeds over the carrying amount is recognized as gain. Standard Costing - AccountingCrosswords.com. Linear programming: Simplex method example.

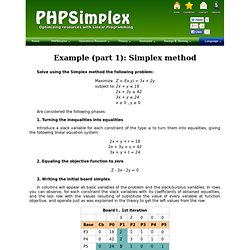

Example (part 1): Simplex method Solve using the Simplex method the following problem: Are considered the following phases:

Ci_nov_02_p24-25. CVs.

Concept-Break Even Analysis with Multiple Products. Process Costing Cost Accounting : Study Notes, Problems Solutions, Question Answers. CIMA - Chartered Institute of Management Accountants. Kaplan Exam Tips.