Colleen Cormier

We transform financial institutions by providing them customized speaking, branding, strategic planning and customer/member experience services. We use our expertise in these areas to guide financial institutions to their full potential by differentiating themselves in the markets they serve.

How To Adjust Your Strategic Plan With the Four S’s. Your strategic plan created last fall is more than likely in a trashcan somewhere.

Thank you, COVID-19. Strategic plans are one of the many casualties left in the pandemic’s wake. The One Leadership Mindset for Growth in Change. Growing Pains.

Or…growing pains. Ah, now didn’t those two things bring two very different visceral responses? The former was a beloved, if not a bit cheesy in retrospect, sitcom chronicling the exploits of the Seaver family, of Long Island, New York. There were the kids: Ben, your stereotypical wildchild third youngling; Carol, the middle kidlet trying her darndest to keep that perfect academic record intact; and of course Mike, the oldest offspring and the one most likely to be into mischief-making. The parents, Maggie and Jason, were a reporter and a psychiatrist, respectively; with Jason working from home while Maggie went to work outside the home. Growing Pains took us on a journey with the Seavers as they navigated the terrain of two parents and three kids all…well…growing together. There were choices different characters faced, jams they got themselves into (and usually, conveniently out of within their 30 minutes of allotted time, of course), and lessons they learned along the way.

Don’t Let Coronavirus Deliver a Knockout Blow to Your Strategic Plan. Boxing legend Mike Tyson once famously said “Everybody has a plan until they get punched in the mouth.”

Sound familiar for your community bank or credit union strategic plan? For most credit unions and community banks, this thought is extremely poignant when thinking about your strategic plan as it existed pre-coronavirus. More than likely, you had what you thought was a functional strategic plan that was serving your goals at some level until earlier this year when it took a vicious right uppercut from the coronavirus. So, there lies your community bank or credit union strategic plan, flat on the mat with the ref working into his ten-count.

What are you going to do? Think like another great boxer (albeit from the world of fiction). That’s right. Revisit Your Strategic Plan. This article originally appeared on cuna.org.

When the coronavirus (COVID-19) pandemic hit, unemployment skyrocketed, the economy suffered, and the strategic plans credit unions put in place at the beginning of the year were no longer relevant. “Your strategic plan is probably in a trash can somewhere,” says Mark Arnold, president/CEO of On the Mark Strategies. However, credit unions can still pivot, salvage their strategic plans, and focus on growth during this period of uncertainty, Arnold said during “How to Salvage Your Strategic Plan During Coronavirus,” a webinar offered as part of CUNA’s Managing Economic and Operational Challenges During COVID-19 eSchool. The key is for leaders to focus their mindset to capitalize on the member service opportunities the pandemic presents, adjust strategy, and then pivot tactics to focus on growth. People’s attention has been scattered in many directions during the past month, Arnold says, due to constant changes. How To Adjust Your Fall Marketing Campaigns. Fall is almost here.

While you may still be experiencing 100-degree heat (like those of us in Texas) and the “dog days of August,” Fall (and Fall marketing campaigns) are just around the corner. Fall has typically meant football, festivals and funnel cakes. Of course, this Fall will look completely different. What Disney+ Teaches Credit Unions and Banks About Branding. Oh yes, I did.

I signed up for Disney+ within the first week. As an avid fan of all things Disney, Star Wars and Marvel how could I not? I mean let’s be real: you had me at Star Wars. But as I come up for air after binging The Mandalorian and The Imagineering Story docuseries, I realized Disney+ actually teaches credit unions and banks several lessons about branding. You often hear consultants talk about how financial institutions need to be more like famous brands like Disney, Starbucks and Southwest Airlines. Everyone Talks or Your Strategic Plan Flops. How many people attend your credit union or bank’s strategic planning session?

Ten? Twelve? More? Regardless of the number of voices, have you ever paused to really consider just how many are actually heard? By “heard” I mean people that, either on their own or at the prompting of others, take the time to speak out and make their opinions heard. 10 Best Practices for a Successful Name Change. Changing your credit union’s or community bank’s name can be as scary as {insert your preferred cuss word here}.

However, fear is often the enemy of risk. While making the strategic decision to update your name is bold, it doesn’t have to be filled with apprehension, dread and anxiety. 10 Things You Need To Examine - 2020 Marketing. January is almost over which means by now you’ve read countless articles on 2020 goals and trends.

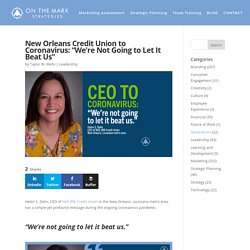

All of those are important. New Orleans Credit Union. Helen S.

Delin, CEO of NAS JRB Credit Union in the New Orleans, Louisiana metro area, has a simple yet profound message during the ongoing coronavirus pandemic: While many credit unions echo this brave message in the face of unprecedented times, two factors are particularly compelling in the case of NAS JRB CU: NAS JRB CU operates in a virus “hotspot,” hard-hit by the coronavirus like other areas including New York City and Detroit.Helen issued her bold statement during a call when we were actively planning for their upcoming strategic planning session in June. That’s right. While most retailers (including some financial institutions) are pulling back on key elements of growth during the coronavirus pandemic (including marketing, training and strategic planning), NAS JRB CU is already actively planning for the post-virus environment.

And it will be the thing that sets them apart for decades to come. Credit Union Strategic Planning Traps. On the Mark Strategies and Four Strategic Planning Myths. In a previous post we talked about Four Branding Myths. While we referenced Big Foot, the Loch Ness Monster and Elvis, we also “myth busted” a few common assumptions when it comes to branding.

The same holds true for strategic planning. There are many myths, half-truths and false assumptions when it comes doing strategic planning. Is there a Difference Between Strategy and Execution? Making Your Marketing Agency Work For You. So you’ve hired a creative marketing agency for your credit union or bank. Congratulations! But now what? It’s not uncommon for financial institutions to see pretty marketing from their competitors, get a little green with envy and think, “We need that too!” So they hire a creative marketing agency to add a little spice to their collateral. The marketing vendor comes on board and…nothing productive happens. Wheels spin. It doesn’t have to be this way. Here are six easy ways to make sure your creative agency works for you, and not the other way around. 1.

Strategy drives creative. Event for Millennials - How Your Credit Union or Bank Can Host it? Branding Meets Reputation Management: A Q&A With Casey Boggs. Get Creative With Member or Customer Service. My family recently went to Home Depot to get paint. It wasn’t just any paint. The die hard “Doctor Who” fan in my home decided to paint his bedroom walls Tardis blue. It was not an existing color, nor was it an easy one to blend. The paint technician, Jason, created it by color matching a game my son brought to the store. Your Brand Goes Beyond Your Walls and Hours. If you work for a credit union or a bank, then you’re a walking billboard for that financial institution—both on and off the clock. So let me ask you, what does your billboard say? I ask because a few days ago, a truck pulled in front of me in the middle of traffic, for no apparent reason, and forced me to hit the brakes.

Shortly down the road, it became apparent we were both headed to the same store. I parked in the front as a customer. The individual with poor driving skills parked in the rear…as an employee. The impression this “billboard” gave was anything but positive. Four Reasons Your Marketing Fails. ROI. Every C-suite executive demands it, yet few marketers deliver it consistently. Six Reasons the Credit Union Blog Isn’t Dead. Bank and Credit Union Strategic Planning. Bank and Credit Union Creative Services. Bank and Credit Union Branding. Build a Lasting Brand Through Brand Identity, Naming and Brand Training. Bank and Credit Union Marketing Audit. Dynamic Bank and Credit Union Speakers. An Investment Beyond Your Upcoming Event.