Liste des crises monétaires et financières. Bulle (économie) 27 Visualizations and Infographics to Understand the Financial Crisis. I've said it before, and I'll say it again.

If there's anything good that has come out of the financial crisis it's the slew of high-quality graphics to help us understand what's going on. 9 Wall Street Execs Who Cashed in on the Boom—and the Bust. S.O.S. Now - Stop Oil Speculation Now. Destruction massive - Jean Ziegler. Toutes les cinq secondes un enfant de moins de dix ans meurt de faim, tandis que des dizaines de millions d’autres, et leurs parents avec eux, souffrent de la sous-alimentation et de ses terribles séquelles physiques et psychologiques.

Récession : la finance Ponzi planétaire, le crime organisé boursier et les dark pools… (On vous a parlé des origines de la crise de la dette souveraine avec son lot de super-arnaques depuis 40 ans pour contenter les rentiers du capital et autres politiciens profiteurs.

Et comme c’est bientôt Noël et que la récession a été officiellement déclarée depuis quelques jours, soyons beaux joueurs et allons jusqu’au bout de la chose. Insider trading. The authors of one study claim that illegal insider trading raises the cost of capital for securities issuers, thus decreasing overall economic growth.[1] However, some economists have argued that insider trading should be allowed and could, in fact, benefit markets.[2] Noted economist Milton Friedman has been quoted as saying "You want more insider trading, not less".[3] Trading by specific insiders, such as employees, is commonly permitted as long as it does not rely on material information not in the public domain.

However most jurisdictions require such trading be reported so that these can be monitored. Trading algorithmique : Manipulations financières ? Commodity Traitors: Financial Speculation on Commodities Fuels Global Insecurity. "Greed is Good" by Nathaniel Gold “Food is always more or less in demand,” wrote Adam Smith in The Wealth of Nations.

While the founder of modern capitalism pointed out that the wealthy consume no more food than their poor neighbors, because the “desire of food is limited in every man by the narrow capacity of the human stomach,” the desire for material luxury “seems to have no limit or certain boundary.” Hunger, therefore, is the foundation of wealth. “The poor, in order to obtain food,” Smith wrote, “exert themselves to gratify those fancies of the rich.” The modern investor, epitomized by the insatiable appetite of Gordon Gekko from the movie Wall Street, has taken Smith’s advice to heart.

Cash Investigation: la finance folle. Too Fast To Fail: Is High-Speed Trading the Next Wall Street Disaster? Illustration by Giacomo Marchesi At 9:30 A.M. on August 1, a software executive in a spread-collar shirt and a flashy watch pressed a button at the New York Stock Exchange, triggering a bell that signaled the start of the trading day.

Milliseconds after the opening trade, buy and sell orders began zapping across the market's servers with alarming speed. The trades were obviously unusual. Out of Control: The Destructive Power of the Financial Markets - SPIEGEL ONLINE - News - International. The enemy looks friendly and unpretentious.

With his scuffed shoes and thinning gray hair, John Taylor resembles an elderly sociology professor. Books line the dark, floor-to-ceiling wooden shelves in his office in Manhattan, alongside a bust of Theodore Roosevelt and an antique telescope. Taylor is the chairman and CEO of FX Concepts, a hedge fund that specializes in currency speculation. It's the largest hedge fund of its kind worldwide, which is why Taylor is held partly responsible for the crash of the euro. Algorithmic Trading is Not High Frequency Trading. September 13, 2011 It’s not every day I come across a widely-shared article whose first sentence is factually incorrect, but a 9/9/11 story in Computerworld UK, “Algorithmic stock trading rapidly replacing humans, warns government paper”, is just such a creature.

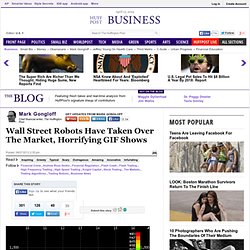

The first sentence begins, Broken Markets: How High Frequency Trading and Predatory Practices on Wall Street are Destroying Investor Confidence and Your Portfolio. A new digital ecology is evolving, and humans are being left behind. Mark Gongloff: Wall Street Robots Have Taken Over The Market, Horrifying GIF Shows. This is what it looks like when the robots take over the stock market.

The GIF, courtesy of market research firm Nanex, by way of Felix Salmon and ThinkProgress, shows the rapid rise of high-frequency trading in the past few years. It takes a while to get to the climax, but the fireworks display at the end is worth the wait. Along the horizontal axis are the hours in the market day. This Video Of One Half-Second Of High Frequency Trading Is Insane, Terrifying. You have no idea just how bonkers high-frequency trading is making the stock market until you actually see it in action.

A terrifying new video by the research firm Nanex offers just such an opportunity: It shows one half-second of trading in just one stock, boring old Johnson & Johnson, on May 2. The video slows down the trades so that the milliseconds -- thousandths of a second -- tick slowly by, and so that human eyes can comprehend what's happening. "speculation is good" Watch High-Speed Trading Bots Go Berserk. The animated .gif above shows the rise of high-frequency trading across several U.S. stock exchanges over the last five years. You’ll notice that there’s relatively little activity in 2007, followed by spikes in activity at the opening and close of the market starting in 2008. And then, sometime around the start of 2010, activity becomes much, much more frenetic and erratic.

The image was originally posted by Nanex, a company that provides market data to traders. The Benefits of Speculation. Dr. Block is Senior Economist, The Fraser Institute, 626 Bute Street, Vancouver, B.C., Canada V6E 3M1. Whenever housing prices rise we hear a chorus of complaints blaming the speculator. Speculators have always been vilified for high and rising prices. This view is incorrect. In fact, the opposite is true: speculation holds the rise of prices to less than would have prevailed without it. Spéculation financière. Un article de Wikipédia, l'encyclopédie libre. (*) Elle est alors appelée spéculation boursière Histoire des méthodes[modifier | modifier le code] Délit d'initié. Un article de Wikipédia, l'encyclopédie libre.

On dit d'une personne qu'elle est initiée soit en vertu de ses fonctions de direction d'une entreprise cotée en bourse, soit parce que, dans l'exercice de ses fonctions, elle est amenée à détenir des informations privilégiées. Le code des marchés financiers[1] réglemente le délit d'initié en disposant que l'initié qui aura réalisé ou permis de réaliser sur le marché boursier, directement ou par personne interposée, une opération avant que le public ait connaissance des informations privilégiées, commet un délit.

Le délit d'initié fait partie des situations couvertes par la Directive européenne sur les abus de marché. Aux Etats-Unis, l'une des plus grosses sanctions a été prononcée contre Michael Milken après la crise des caisses d'épargne américaines. Histoire[modifier | modifier le code] Computer Simulations Reveal Benefits of Random Investment Strategies Over Traditional Ones. Back in 2001, a British psychologist carried out an unusual experiment in which he asked three people to invest a virtual £5000 in the UK stock market. The three people were a professional trader, an astrologer and a 4 year old girl called Tia. The results were something of an eye-opener. Gestion du risque. A Tax That Could Change the Trading Game. High Frequency Trading. Catégorie:Spéculation. Spéculation.

Dans le domaine philosophique, on nomme spéculation le fait de s'interroger sur les conséquences d'une hypothèse si elle était vraie, sans nécessairement la considérer au départ comme telle. Sur un marché quelconque, on nomme spéculation par extension de langage « l'activité consistant à tirer profit par anticipation de l'évolution à court, moyen ou long terme du niveau général des prix ou d'un prix particulier en vue d'en retirer une plus-value ou un bénéfice. »[1]. que les mouvements spéculatifs sont utiles sinon inévitables en ce qu'ils détectent les déséquilibres existants ou potentiels d'un marché ;qu'en vertu de l'efficience du marché financier ces mouvements contribuent à la stabilisation des prix ou à l'atténuation de ses fluctuations.

Leur action sur la détermination des prix serait d'obtenir le niveau de prix assurant la meilleure allocation des ressources[2]. Critiques qui s'alimentent du constat de déséquilibres récurrents, notamment dans le domaine financier ou immobilier. Speculation. History[edit] With the appearance of the stock ticker machine in 1867, which abrogated the need for traders to be physically present on the floor of a stock exchange, stock speculation underwent a dramatic expansion through to the end of the 1920s, the number of shareholders increasing, perhaps, from 4.4 million in 1900 to 26 million in 1932.[1] Speculation and investment[edit]

"speculation is bad" Stop Speculation Now – Black on Black Thought « The SuperSpade. This is part of the bi-weekly Black on Black Thought feature. Guess what? Gas is expensive. Stop Speculation Now!