Newdelhifinancial

WHAT IS Used Car Loan? Embed Code For hosted site: Click the code to copy <div class='visually_embed'><img class='visually_embed_infographic' src=' alt='WHAT IS Used Car Loan?

' /><div class='visually_embed_cycle'></div><script type='text/javascript' src=' class='visually_embed_script' id='visually_embed_script_1861311'></script><p> From <a href=' For wordpress.com: <div class='visually_embed'><iframe width='1' height='1' style='width: 1px !

Customize size. Digital transformation in the times of Lockdown for Retail Lending. Uncovering THE UNDERLYING ISSUES OF WORKING CAPITAL LOANS. It’s a fact that most businesses cannot survive beyond 4-5 years.

There are a lot of reasons for this; the most common reason is poor cash flow. Start-up businesses are forced to add some sort of capital to cover large purchases and expenditure. As a result; many businesses are on the lookout for Working Capital Loans from financial institutions to manage their operating cycle. However; this can come at a HUGE price; something which is more expensive than just writing a fat cheque at the end of the month; it can be cancerous to be businesses; costing them everything! What Are Working Capital Loans? Many working capital loans are treated as a "gauze"— a way for associations with horrendous credit or awful pay to assist take with the minding of their tabs, their agents, or make other immense purposes. Working capital loans are commonly obtained in light of defenseless salary and powerless pay the administrators.

How does Car Loan Works? - Blog - New Delhi Financial. Used car finance will spare you from wrecking the pocket correspondingly. Getting behind the wheels of your own car is an extraordinary inclination.

In any case, finding the correct car that obliges your budgetary limit and destinations isn’t a cakewalk. Close to purchasing a house, your car may be the most over the top get you to make. It consequently looks great to consider a used car loan as opposed to another. This is particularly apparent in remembering the related charges, subsequent use, and breaking down respect. Used car finance will spare you from wrecking the pocket correspondingly as from picking the quality.

Today, the used car broadcast in India is thriving, considering their moderateness and clear accessibility of used car finance. It consequently looks great to consider a used car loan as opposed to another. Getting behind the wheels of your own car is an extraordinary inclination.

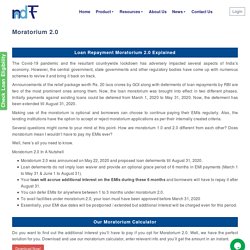

In any case, finding the correct car that obliges your budgetary limit and destinations isn't a cakewalk. Close to purchasing a house, your car may be the most over the top get you to make. It consequently looks great to consider a used car loan as opposed to another. This is particularly apparent in remembering the related charges, subsequent use, and breaking down respect. Used car finance will spare you from wrecking the pocket correspondingly as from picking the quality. A moratorium is a payment holiday. FAQs Here are some Frequently Asked Questions to resolve all your queries.

What exactly is the loan repayment moratorium? Payment moratorium refers to the grace period where borrowers are not required to pay the monthly installments against their loan. The best framework to Get Business Loan In India With Security - LOAN IN DELHI. Ensured about loans require the borrower to keep up a favored position like vehicle, property, gear, terrible materials, etc as security to benefit the new development.

Ensured about loans in India are given by banks at fixed improvement costs. If the borrower fails to repay on time, the loan authority has full choice to expect the obligation for the advantage which was kept as security. On the other hand, people what are more go for an unbound business loan. What are more go for an unbound business loan. Ensured about loans require the borrower to keep up a favored position like vehicle, property, gear, terrible materials, etc as security to benefit the new development.

Ensured about loans in India are given by banks at fixed improvement costs. If the borrower fails to repay on time, the loan authority has full choice to expect the obligation for the advantage which was kept as security. On the other hand, people what are more go for an unbound business loan. Steps to extend the loan with security: The borrower ought to from the beginning attestation he fulfills the capacity administers as referenced by the bank. Borrowers should have a not too bad FICO assessment. What's more go for an unsecured business loan. We gives unbound loans at moderate improvement. The best framework to Get Business Loan In India With Security – Personal Loan in Delhi.

Ensured about loans require the borrower to keep up a favored position like vehicle, property, gear, terrible materials, etc as security to benefit the new development.

Ensured about loans in India are given by banks at fixed improvement costs. If the borrower fails to repay on time, the loan authority has full choice to expect the obligation for the advantage which was kept as security. On the other hand, people what’s more go for an unbound business loan. Sometimes personals pick a personal loan balance move to expand.

Personal loan For Salaried. Why You Should Consider a Personal Loan Balance Transfer? A personal loan balance move is an office through which you can move the imperative chief of a current advancement from one moneylender from another.

This office empowers borrowers to get another loan at an unparalleled development cost. A Balance move is a useful choice for personals who have taken a turn of events. This office empowers you to chop down your general intrigue burden on the off chance that you have benefitted loans during a high-advance cost system. Ahead of time, the work environment was just accessible for charge card responsibility directly now this office is offered on a wide extent of bank loans. We at Newdelhifinancial.comwill make it essential for you. Need to know more about Personal Loan? A personal loan balance move is an office through which you can move the imperative chief of a current advancement from one moneylender from another.

This office empowers borrowers to get another loan at an unparalleled development cost. A Balance move is a useful choice for personals who have taken a turn of events. This office empowers you to chop down your general intrigue burden on the off chance that you have benefitted loans during a high-advance cost system. Ahead of time, the work environment was just accessible for charge card responsibility directly now this office is offered on a wide extent of bank loans. We at Newdelhifinancial.comwill make it essential for you.

Equalization moves award you to reconsider your current loan and make a change to reveal the critical enhancements to deal with your general responsibility or to profit extra focal points on your current turn of events. What are the highlights of a Home Loan? What is Home Loan? Weight free application process makes it simple to get this credit in Delhi. Personal loans for salaried are expanding a lot of adjustment among borrowers in view of its unbound nature, clear openness, less masterminding time, and bother free documentation. It is the least mentioning systems through which you can gather guarantees when you need it the most, be it for dealing with a clinical office cost, paying for your marriage, or financing a family escape. In any case, most Personal Loans are available in a standard, one size fits all system, with basically no customization.

Different necessities may routinely require different diagrams. Accordingly, Here are five one of a kind decisions instead of a vanilla personal improvement which can come consistently when you are in critical need of cash. Gives Dive Access 1. We are dependably instructed that saving on any occasion 20% as for your compensation is essential to meet emergency conditions later on. Following are the couple of conditions where pay loan in Delhi may come solid: Personal Loan For Salaried in Delhi. Personal loans for salaried are expanding a lot of adjustment among borrowers in view of its unbound nature, clear openness, less masterminding time, and bother free documentation.

It is the least mentioning systems through which you can gather guarantees when you need it the most, be it for dealing with a clinical office cost, paying for your marriage, or financing a family escape. In any case, most Personal Loans are available in a standard, one size fits all system, with basically no customization. Different necessities may routinely require different diagrams. Accordingly, Here are five one of a kind decisions instead of a vanilla personal improvement which can come consistently when you are in critical need of cash.

Gives Dive Access 1. Planning inclinations for pay security loan for salaried? Personal Loan For Salaried in Delhi. Personal loans for salaried are expanding a lot of adjustment among borrowers in view of its unbound nature, clear openness, less masterminding time, and bother free documentation. It is the least mentioning systems through which you can gather guarantees when you need it the most, be it for dealing with a clinical office cost, paying for your marriage, or financing a family escape. In any case, most Personal Loans are available in a standard, one size fits all system, with basically no customization. Different necessities may routinely require different diagrams. Accordingly, Here are five one of a kind decisions instead of a vanilla personal improvement which can come consistently when you are in critical need of cash. Gives Dive Access. Individual advances for salaried are growing a ton of alteration among borrowers. Personal loans for salaried are expanding a lot of adjustment among borrowers in view of its unbound nature, clear openness, less masterminding time, and bother free documentation.

It is the least mentioning systems through which you can gather guarantees when you need it the most, be it for dealing with a clinical office cost, paying for your marriage, or financing a family escape. In any case, most Personal Loans are available in a standard, one size fits all system, with basically no customization. Different necessities may routinely require different diagrams. What unequivocally Working Capital Loan are? – Personal Loan in Delhi. Each business, regardless of whether it is near nothing, medium, or tremendous, needs money to manage costs or operational expenses.

A few models are-office lease, wages, and transient duty. Ignoring the path that there are various sorts of finance offered with money affiliations, the working capital loan is the one seized the opportunity to cover business works out. Working capital is an impossible money right hand assisting with hacking down a pressing business account bother. In India, there are various sorts of working capital finance accessible, including hardware pushes, term finance, capital finance, and so forth. The working capital credit is the one taken advantage of the lucky break to cover business works out.

Each business, regardless of whether it is near nothing, medium, or tremendous, needs money to manage costs or operational expenses. A few models are-office lease, wages, and transient duty. Ignoring the path that there are various sorts of finance offered with money affiliations, the working capital loan is the one seized the opportunity to cover business works out. Gather individual and business FICO assessments. An all-inclusive length of business credit to support a massive endeavor. Look at these five stages to building business loan. Meeting all requirements for a free undertaking loan is progressively direct when you're readied.

Assets that can be conveniently changed over into cash inside a year. The straightforwardness of working capital is likely the most crucial piece of keeping up a business feasibly and adequately. The straightforwardness of working capital is likely the most crucial piece. Credit. Personal Loans Bad Credit. Banking. Working Capital: Need and Importance. Necessities to take working capital loan. The straightforwardness of working capital is likely the most crucial piece of keeping up a business feasibly and adequately. Notwithstanding called the current capital, working capital basically recommends the cash open with a relationship for managing it is dependably rehearses and is compelled by fundamentally deducting the current liabilities of a business from its current assets. Assets that can be conveniently changed over into cash inside a year or a business cycle are named as present assets and wire cash, accounts receivables, inventories, and vacillating prepaid expenses.

Correspondingly, current liabilities are the ones that a business needs to pay off inside a year or one business cycle and circuit records payable, aggregated liabilities, amassed yearly assessments and favorable circumstances payable. If current assets are more unmistakable than current liabilities, the business has a positive working capital condition or extra cash to meet unforeseen expenses. Like this: How to pick working capital needs? – Personal Loan in Delhi. Buying an exchange Car and taking out a Car loan to do it. Getting a Car Loan at Lowest Interest Rate. When endeavoring to get an exchange Car loan. You will find the best Car loan rates if you have a stunning loan. Various banks have the moment advancement choice that distributes the loan. Not under any condition like home loans and vehicle loans, the total benefitted through a Personal loan can be utilized in any way at all. Another explanation behind detachment among precious loans and different sorts of loans is that they are unbound loans.

This proposes the borrower need not place any of his/her preferences as assurance for the all-out got. The way that Personal loan in Delhi can be profited effectively appears to loan. Personal loans are an inconceivable route for people to fund any costs. – Personal Loan in Delhi. Hirejumpingcastleau. Take the necessary steps not to apply for another loan, if paying the past one. The base age for applying a loan is 21 years and the best is 60 years.

Get a brief personal loan for salaried demanded. Capacity criteria before applying for a personal loan for salaried. Take the necessary steps not to apply for another loan, if paying the past one. You don't fall into a condition where you can't manage unbound business loans. Apply for business loan for unreservedly used to become a basic factor to satisfy your necessities. Where you can’t manage unbound business loans. Grow your business with unsecured business loan – Personal Loan in Delhi. Grow your business with unsecured business loan. Working capital finance is pushes utilized unequivocally to back the conventional activities of a business. Issues looked by MSMEs with respect to working capital: Why is working capital so basic for any business? Why is a working capital loan a mind-boggling game-plan? - LOAN IN DELHI. Working capital finance is pushes utilized unequivocally to back the conventional activities of a business.

Lift your sureness with NEW DELHI FINANCIAL’s working capital finance. You can favorably assess your own loan capability. Quick Apply for a Personal loan for salaried whole reliant on your ability. You are not aware of your FICO appraisal while applying for a Personal loan. You are not aware of your FICO appraisal while applying for a Personal loan. 7 Best Tips to Get Your Personal Loan Approved. Do you know the benefits of taking a Used Car Loan? Loan against property induces selling your home. Do you know the benefits of taking a Used Car Loan? – Personal Loan in Delhi.

Personal Loan For Salaried and Business Owner - LOAN IN DELHI. Delhi Financial Personal Loan for Salaried is accessible for qualified clients. What is a Used Car Loan ? There are boundless decisions for all around kept up used Car pushes in the market. We should have a compact look at the variables you have to consider for a Used Car Finance. Central purposes of Used Car Loan from New Delhi Financial. How to Get a Second-hand Car Loan in India? Why Used Car Loan? A Used Car Finance can unequivocally help you with that.

With everything considered, the two alternatives can in split-second assistance you with disposing of Credit Card. The Personal Loan charges by and large beginning from an expense of in every practical. Personal Loan For Salaried. It is imperative to have a reliable capital stream for the productive working of any business. Get Personal Loan for Salaried at lowest EMI - LOAN IN DELHI. Personal Loan for Salaried in Delhi. Picking the correct home advance ace! The right headway elective is as certain less bewildering these days! Calculate easily your home loan EMI – Personal Loan in Delhi. Do you know the advantages of taking a Used Car Loan? The best framework to Apply For A Used Car Loan. You should pick to use a home loan EMI calculator to get eh best results.

Calculate easily your home loan EMI. What is Loan Against Property? One can profit by these home improvement credits for business property or private property affirmations. NBFC is offering the wide level of home recognize the program for the least financing costs in India. Your fantasy home is a substance of amazing worth, both genuinely and fiscally. One can benefit from these home improvement credits for business property or private property confirmations. Select associations can deal with their working capital finance issues using standard bank financing. At this moment, see five working capital finance options that are available for private endeavors.

Working Capital Loans for Small Businesses – Personal Loan in Delhi. Working Capital Loans for Small Businesses. Welcome Back.