Sole Proprietorships. Corporations. In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation's capital stock.

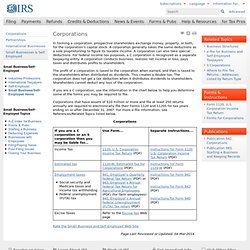

A corporation generally takes the same deductions as a sole proprietorship to figure its taxable income. A corporation can also take special deductions. For federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. A corporation conducts business, realizes net income or loss, pays taxes and distributes profits to shareholders. The profit of a corporation is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends. If you are a C corporation, use the information in the chart below to help you determine some of the forms you may be required to file. Corporations that have assets of $10 million or more and file at least 250 returns annually are required to electronically file their Forms 1120 and 1120S for tax years ending on or after December 31, 2007. Corporations. Disclaimer. Disclaimer. Types of Retirement Plans.

Checklist for Starting a Business. Skip Navigation Advanced Filing Payments Refunds Credits & Deductions News & Events Forms & Pubs Help & Resources for Tax Pros Small Business/Self-Employed Small Business/Self-Employed Topics Like - Click this link to Add this page to your bookmarks Share - Click this link to Share this page through email or social media Print - Click this link to Print this page Checklist for Starting a Business The checklist below provides the basic steps you should follow to start a business.

Information about specific industries can be found at the Industries/Professions Web page. Each state has additional requirements for starting and operating a business. Tax Years. You must figure your taxable income on the basis of a tax year and file an income tax return.

A “tax year” is an annual accounting period for keeping records and reporting income and expenses. An annual accounting period does not include a short tax year. The tax years you can use are: Calendar year - A calendar tax year is 12 consecutive months beginning January 1 and ending December 31. Fiscal year - A fiscal tax year is 12 consecutive months ending on the last day of any month except December.

Unless you have a required tax year, you adopt a tax year by filing your first income tax return using that tax year. Filed an application for an extension of time to file an income tax return. Generally, anyone can adopt the calendar year. You keep no books or records; You have no annual accounting period; Your present tax year does not qualify as a fiscal year; or You are required to use a calendar year by a provision of the Internal Revenue Code or the Income Tax Regulations. Business Taxes. 中文 | 한국어 | TiếngViệt | Pусский The form of business you operate determines what taxes you must pay and how you pay them.

The following are the four general types of business taxes. Estimated Taxes Income Tax All businesses except partnerships must file an annual income tax return. The federal income tax is a pay-as-you-go tax. Estimated tax Generally, you must pay taxes on income, including self-employment tax (discussed next), by making regular payments of estimated tax during the year. Business Structures. Skip Navigation Advanced Filing Payments Refunds Credits & Deductions News & Events Forms & Pubs Help & Resources for Tax Pros Small Business/Self-Employed Small Business/Self-Employed Topics Like - Click this link to Add this page to your bookmarks Share - Click this link to Share this page through email or social media Print - Click this link to Print this page Business Structures 中文 | 한국어 | TiếngViệt | Pусский.

Starting a Business. Listed below are links to basic federal tax information for people who are starting a business, as well as information to assist in making basic business decisions.

The list should not be construed as all-inclusive. Other steps may be appropriate for your specific type of business. Information about specific industries can be found on the Industries/Professions Web page. For information regarding state-level requirements for starting and operating a business, please refer to your state's Web site. Rate the Small Business and Self-Employed Web Site.