Financial illiteracy and the role of the blogosphere. One of the topics we touch on in our book is the abysmal state of financial literacy in America.

The fact of the matter is that some of the most basic financial decisions facing Americans are beyond their abilities. There are any number of explanations for this but to say that there is an obvious solution belies the complexity of problem. Tim Richards at the excellent Psy-Fi Blog has a post up talking about this very issue of numeracy. Numeracy, or the the ability to reason with numbers and other mathematical concepts, is important for the development of a capable workforce but also plays in their ability to deal with the many oftentimes complex financial decisions we all face in our lifetime. The problem is that it is not entirely clear that additional education will magically make individuals better decision makers. Richards rightly notes that we as a society continue to push more financial decisions down to the individual level.

Les plateformes de communiqués de presse et le référencement en 2012. Depuis quelques années maintenant, les plateformes de contenus (souvent nommées sites de communiqués de presse alors qu’aucun journaliste n’y a jamais mis les pieds) sont devenues un incontournable du SEO en France.

Aymeric Bouillat attirait notre attention sur celles-ci dans cet article CP, Digg Like, etc. Et l’utilisateur ? À quoi servent ces plateformes ? Quels sont leurs défauts et qualités ? Comment s’en servir ? À quoi sont-elles utiles ? « À choper du lien ma bonne dame ». Ces sites doivent leur succès à la baisse de popularité constatée sur certains annuaires qui ont pris des claques successives par Google durant les années passées. Alors, plateformes de contenus ou annuaires ? Pour ma part, je dirais les deux. Mais depuis, bon nombre d’annuaires proposent les mêmes fonctionnalités, la différence n’est donc plus aussi marquée. Qualités des plateformes de communiqués. Une des premières qualités est de pouvoir systématiquement placer des liens complètement intégrés à l’éditorial. The euro crisis: Europe's half-depression.

Beyond ETF Expense Ratios. Since ETF investors can’t own indexes directly, the next best thing is to choose a fund that has the smallest tracking error.

Generally, expense ratios are good indicators—all else being equal, smaller management fees usually give investors more returns. However, holding down costs, even in plain-vanilla ETFs, doesn’t necessarily translate into minimizing the difference between fund and index performance. What can help explain the differences between management fees and tracking error are two things: first, portfolio turnover; and second, securities lending. Let’s tackle portfolio turnover first. Last Rounds at the Bond Market's Big Bash. Consumer Still Doubts Bull Market. Below is the University of Michigan Consumer Sentiment Index overlaid on the S&P 500.

VIX At Multiyear Lows: What's Next? - MarketBeat. By Kaitlyn Kiernan and Chris Dieterich A jump in option activity in the Chicago Board Options Exchange’s Volatility index suggests some investors are betting on a rocky road this quarter.

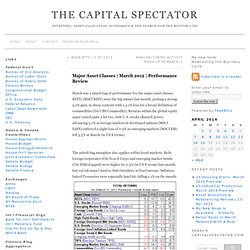

After stocks completed their best first quarter ever by some metrics, options traders today have snapped up upside bets in the VIX — known as the market’s fear gauge — on the first day of the second quarter. The VIX typically moves higher when stocks fall. June 55 call options traded 30,000 times early Monday, a bet that only profits should the VIX soar 260% over the next three months. The VIX, down 2.1% at 15.17 at last glance, last moved above 55 in December 2008 amid the depths of the financial crisis. June 42.50 calls are also active, being bought 15,000 times. The Capital Spectator: Major Asset Classes. March was a mixed bag of performance for the major asset classes.

REITs (MSCI REIT) were the big winner last month, posting a strong 5.2% gain, in sharp contrast with a 4.1% loss for a broad definition of commodities (DJ-UBS Commodity). Returns within the global equity space varied quite a bit too, with U.S. stocks (Russell 3000) advancing 3.1% as foreign markets in developed nations (MSCI EAFE) suffered a slight loss of 0.5% as emerging markets (MSCI EM) fell 3.3% in March (in US $ terms). The mixed-bag metaphor also applies within bond markets. Both foreign corporates (Citi Non-$ Corp) and emerging market bonds (Citi ESBI-Capped) were higher by 0.3% (in US $ terms) last month, but red ink wasn’t hard to find elsewhere in fixed income. Inflation-linked Treasuries were especially hard hit, falling 1.1% on the month. You Ain't Seen Nothing Yet - Part One. Submitted by Jim Quinn of The Burning Platform You Ain't Seen Nothing Yet - Part One.

Three Sources of Alpha: Informational, Analytical & Behavioral. We're compiling more articles on the timeless educational aspects of investing and thought this was worth highlighting.

The three sources of alpha is a concept explained in a paper by Russell Fuller of the asset management firm, Fuller & Thaler. In an old interview with Morningstar, Pat Dorsey of Sanibel Captiva Trust talked about the three sources of alpha and provides a brief overview. 1.