Samsung Pay Will Launch Online Payments In the U.S. Samsung Pay plans a major expansion in the United States next year.

Users will be able to make purchases on websites with Samsung Pay, which puts it into more direct competition with services like Paypal, Reuters reports. The mobile wallet platform will be also available on lower-end Samsung smartphones, not just flagship models like the Galaxy S6 Edge. In an interview with Reuters, Samsung global co-general manager Thomas Ko said Samsung Pay will roll out to more smartphone models next year. The payment platform launched in the U.S. in September and has an advantage over competitors because it can emulate magnetic stripe cards thanks to Samsung’s acquisition of LoopPay, in addition to using NFC technology like Apple Pay and Android Pay.

This means Samsung Pay works with a wider assortment of existing point-of-sale equipment than Apple Pay or Android Pay does. Walmart launches its own mobile payment system as turf war heats up. The mobile payment wars are heating up.

Walmart Stores, the world’s largest retailer, said it is testing its own mobile payment system that will allow shoppers to pay with any major credit or debit card or its own store gift card through its app at the cash register. It will start testing the new payment system on Thursday at its stores around Bentonville, Arkansas, where the retailer is based. It plans to launch the payment feature in all 4,500-plus US stores in the first half of next year.

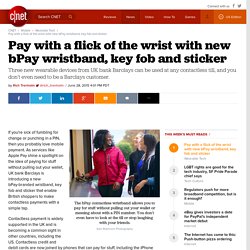

While some stores such as Starbucks or Dunkin’ Donuts allow customers to pay with gift cards, Walmart says it will become the first retailer to launch its own mobile payment system that works with an iPhone or Android device and with a major credit or debit card. It’s part of an overall mobile strategy to making shopping easier and faster, and it’s the latest feature to be added to its mobile app. “We are listening to the needs of the customer,” Eckert said. Pay with a flick of the wrist with new bPay wristband, key fob and sticker - CNET. If you're sick of fumbling for change or punching in a PIN, then you probably love mobile payment.

As services like Apple Pay shine a spotlight on the idea of paying for stuff without pulling out your wallet, UK bank Barclays is introducing a new bPay-branded wristband, key fob and sticker that enable British shoppers to make contactless payments with a simple tap. Contactless payment is widely supported in the UK and is becoming a common sight in other countries, including the US. Contactless credit and debit cards are now joined by phones that can pay for stuff, including the iPhone and Samsung Galaxy S6, as tech companies try and elbow their way into the retail and financial sectors.

Apple Pay is About to Expand Outside the U.S. Denmark May Go Cashless By January 2016, Reports Suggest. Samsung Pay delayed until September. Mobile payments are the latest trend to be fiercely contested by mobile OEMs with the likes of Apple and Google offering their own mobile payment systems.

Samsung introduced its Samsung Pay mobile payments service alongside the Galaxy S6 at Mobile World Congress in February but has been forced to delay the launch until September. Samsung Pay was meant to launch next month but Bloomberg reports that the Korean manufacturer has had to push the launch back its initial launch plans. Android Pay's debut means Google Wallet will live on as a P2P payments app. If you’re not reaching, engaging, and monetizing customers on mobile, you’re likely losing them to someone else.

Register now for the 8th annual MobileBeat, July 13-14, where the best and brightest will be exploring the latest strategies and tactics in the mobile space. Google yesterday announced Android Pay, a new payment feature coming to Android 4.4 KitKat and above. It’s supposed to be the successor to Google Wallet, but the company also announced yesterday that Google Wallet would be relaunching for both Android and iOS. With Android Pay, Google gets mobile payments right. Even though Google started the whole mobile payment thing years ago with Google Wallet, it never really took off with the masses.

Google's newly announced Android Pay, however, might. Instead of relying on you to load the app and unlock it with a PIN, Android Pay lets you simply tap your phone on an NFC terminal to approve the purchase. In addition, Google is also allowing Android Pay to be integrated in apps like Lyft, Grubhub and Wish, so users can easily use that to pay for things.

I just used Android Pay here at Google I/O, and I can say this: If it's as easy to use in real life, then I suspect mobile payments are about to be a lot more ubiquitous. Gallery | 13 Photos. Apple Pay Momentum Keeps Growing Despite Challenges In Stores. Alibaba Teams Up With China’s Largest Telecom To Sell Smartphones To Rural Customers. Alibaba has partnered with China’s biggest telecom operator to sell low-cost smartphones to people in rural areas for prices as low as 299 RMB ($48).

The deal with China Telecom, which has 186 million users, is part of a two-pronged strategy for the e-commerce giant, which sees smaller cities as key to its growth plans for its e-commerce business and operating system YunOS. A line of eight inexpensive smartphone models from obscure brands like Uniscope, Ctyon, and Kingsun will come loaded with YunOS, the operating system developed by Alibaba to compete with Android. Square acquires Canadian payments company Kili. Today Square announced it’s acquired Kili Technology, a payment processing company headquartered in Toronoto, Canada.

In a blog post announcing the deal, Square details its rationale: “The payments landscape is changing faster than ever — from EMV to NFC,” Square said. “That’s why we’ve acquired Kili Technology, a company that has developed silicon, electronics, and software that simplify and optimize payment processing.” A little background on Kili: The founding members of Kili started at cloud-based authentication company SecureKey. With Softcard's Demise, Another Mobile Wallet Officially Bites The Dust. Apple Pay: a new frontier for scammers. Criminals in the US are using the new Apple Pay mobile payment system to buy high-value goods – often from Apple Stores – with stolen identities and credit card details.

Banks have been caught by surprise by the level of fraud, and the Guardian understands that some are scrambling to ensure that better verification and checking systems are put in place to prevent the problem running out of control, with around two million Americans already using the system. The crooks have not broken the secure encryption around Apple Pay’s fingerprint-activated wireless payment mechanism. Instead, they are setting up new iPhones with stolen personal information, and then calling banks to “provision” the victim’s card on the phone to use it to buy goods.

Criminals with the stolen IDs are understood to have targeted Apple Stores in particular because they both accept Apple Pay and offer high-value items, which can then be sold on for cash. Uk.businessinsider. Google and Samsung are on a collision course when it comes to fighting Apple Pay. The security and ease of use behind Apple Pay unquestionably makes Apple’s own mobile payment service the best in the business.

Left to play catch-up, Samsung recently acquired LoopPay, a mobile payments company with technology that enables consumers to make payments via traditional credit card readers. Samsung’s efforts in the mobile payments space, however, are reportedly causing quite a bit of friction with Google. Google, remember, has its own mobile payments scheme with Google Wallet. While both Samsung and Google have remained diplomatic in the face of reports that they are increasingly finding themselves at odds, it’s becoming increasingly hard to ignore that the two companies are actively trying to lessen their reliance on one another.

The Wall Street Journal reports: For what it’s worth, Google, the report adds, curiously believes that multiple payment platforms can coexist on the same Android device. Social may be the tipping point in the m-commerce revolution. Obsessed with mobile growth? Join us February 23-24 when we reveal the best technologies and strategies to help your company grow on mobile. It all takes place at our 5th annual Mobile Summit at the scenic Cavallo Point Resort in Sausalito, CA. See if you qualify here. If entrepreneur Jesse Pujji’s prediction is right, 2015 will be the year of global mobile ecommerce (or m-commerce). And social companies like Facebook and Twitter may increasingly lead the way, he says.

Pujji is CEO of Ampush, an ad tech company specializing in reaching consumers on social platforms, and notes that of all time spent in mobile devices, 64 percent is dominated by time spent on mobile social platforms like Facebook and Twitter. GrabTaxi, Uber’s Rival In Southeast Asia, Prepares To Introduce Cashless Payments. GrabTaxi, the SoftBank-backed taxi-on-demand service in Southeast Asia, is preparing to introduce cashless payments to take it beyond cash-only fares and put it on par with Uber’s frictionless payment system. TechCrunch understands that cashless payments via credit card will become an option for GrabTaxi customers across its six countries in Southeast Asia within the next couple of months, but passengers will still be able to pay for their rides using cash if they prefer.

A GrabTaxi spokesperson confirmed what we’ve heard, telling TechCrunch in a statement: “GrabTaxi is in the midst of developing a cashless payment option, which will gradually be rolled out for beta testing in March in Singapore.” GrabTaxi, which covers 17 cities in the region, has already tested the water via an integration with DBS PayLah in Singapore. The upcoming beta test is not related to that rollout, however. Last year was a busy one for the company, which was initially founded in Malaysia. Square is working on its own tablet. Square, the mobile payments service found in countless coffee shops across the country, may be working towards becoming less reliant on Apple's products, according to a report from The Information. Square has allegedly been working on an Android tablet of its own that would replace the iPad-powered Square Registers used by many small businesses.

Square's plan would be to use the tablet to head off any complications that may arise should Apple decide to block compatibility with Square's Register and encourage the use of Apple Pay. The Information says that the project is currently in the early stages and may not go through to production. Aside from the difficulties with designing new hardware, there's also the hurdle of getting Square's many customers to adopt it in lieu of what they already have. LoopPay to partner with OEMs to bring mobile payment-enabled cases to Samsung devices. Not too long ago, we heard rumors that Samsung was in talks with mobile payment startup LoopPay to bring mobile payments to more smartphones. The big draw with LoopPay is that it works with legacy point of sale terminals, transferring payments via a small electromagnetic field that imitates a card swipe without actually having to swipe anything.

This already sounds better than using NFC payments, right? Mobile payments are about to get even better, because for their big CES announcement LoopPay has just unveiled their partnership with XPAL Power, a subsidiary of TennRich International (a Mophie and Belkin supplier), and Trident Case, a phone case manufacturer. The mobile payment startup and its new OEM partners plan to create LoopPay-enabled phone cases for the Samsung Galaxy S5 and Note 4, due out sometime in 2015. XPAL Power plans to create a back cover for the Galaxy S5, which should be available sometime in early 2015. UK banks in talks over Apple ‘wave and pay’ When Will Your Phone Replace Your Keys And Wallet? When I leave my home, I check that I have three things: keys, wallet, phone. How long will it be until the first two are obsolete? My wallet has only three things I actually need: credit cards, cash, ID. Any American with an iPhone 6 has already obsoleted credit cards, courtesy of Apple Pay. Line Pay, The Messaging App’s Mobile Payments Service, Will Make Its Global Debut Soon.

Line Pay, The Messaging App’s Mobile Payments Service, Makes Its Global Debut. Identity Wars: Why Apple Pay Is About More Than Payments. Editor’s Note: Patrick Salyer is the chief executive officer of Gigya, a customer identity management company. There’s been no shortage of attention paid to the launch of the new iPhones, with their array of shiny new features, bigger screens and better hardware. Early reviews seem to indicate that the company has, yet again, come through with another massive success. Many of those who stood in around-the-block lines or refreshed their Internet browsers incessantly just for the pleasure of pre-ordering probably were thinking about the differences between the two new phones: Do I get the model with the 4.7-inch screen or the 5.5-inch screen? Mobile sales creeping up in UK as Christmas approaches, benchmark suggests.

More traffic and more sales are coming from mobile devices in the UK than ever before, suggests the latest Benchmark from Affiliate Window – with 31,000 sales originating on a mobile or smartphone every day. According to the stats 41.75% of traffic originated from a mobile device – up from 40.47% in September. 21.85% of traffic came from a smartphone – up from 20.11% in September, leading to 34.23% of sales originating from a mobile device – up from 32.54% in September.14.34% of sales came from a smartphone – up from 12.93% in September Affiliate Window’s latest figures show that Android smartphones accounted for 27.80% of smartphone traffic and 26.48% of sales, while Android tablets accounted for 36.92% of tablet traffic, but only 20.57% of sales.

Download the full monthly benchmark here. Apple caught in feud between merchants, credit cards - CNET. Why CVS and Rite Aid are blocking Apple Pay. I drove my iPhone 6 to Walgreens last week to buy a tube of toothpaste. I usually buy that kind of stuff at CVS, which is closer and open 24 hours a day. Retailers are disabling NFC readers to shut out Apple Pay.

Apple Pay will go live Monday; new iPads support online payments. Apple’s new smartphone payment service, Apple Pay, will go live on Monday, allowing iPhone 6 and 6 Plus users to make credit or debit card transactions at 220,000 check-out terminals around the country with a wave of the handset. Apple's iWatch And Mobile Payments. Square Rolls Out New Analytics Suite. What Your Business Needs to Know About Mobile Payments. This post originally appeared on the American Express OPEN Forum, where Mashable regularly contributes articles about leveraging social media and technology in small business. Walmart, Target, and other big retailers are teaming up on mobile payments. tPago Expands Across LATAM. The Mobile Payments Committee: AT&T, Verizon, Sprint, T-Mobile unite for the future of payments. Ribbon, A “Bit.ly With Payments,” Brings Simplified Checkout To Any Platform.

Can companies wait on a mobile payments strategy? Experts say no. Mobile Payments: Take These Broken Wings and Learn to Fly! Mobile Payments: A Trillion Dollar Industry… Once Everyone Can Actually Make A Payment. Why Companies Want To Master Mobile Payments. Mobile phones are changing the world of retail – at a remarkable speed. Over a Third of All U.S. Residents Use Mobile Payments. Wallet, Wallet Everywhere: Making Sense of the Mobile Payment Wars. How Mobile Payment Solutions Increase Sales. Google Wallet: one year later. The Brains Behind Google Wallet Just Left. Google Wallet checkout gains support for mobile websites. Google Wallet update purportedly leaks plans for a real-world card, transfers and transit passes. Google's Osama Bedier: Why the Digital. Exactly How Screwed Is PayPal? (Hint: Very) PayPal Acquires Mobile Payments Startup Card.io.

PayPal Here Is Coming To The UK, Its First Mobile Payment Market In Europe, Armed With A New Way To Read Your Card. Baby Steps To NFC: PayPal InStore Hits The UK; Juniper Says 1 In 4 To Pay With NFC Phones By 2017. A tale of two iPhones — what an NFC-equipped iPhone would do to the mobile payments market. No More Waiting on Near Field Communication. MasterCard Approves More Devices for PayPass NFC. France's Toulouse-Blagnac airport to conduct NFC field trials for BlackBerry smartphones. Isis' NFC payments go live in Austin and Salt Lake City: 3 carriers, 9 phones, 1 long way to go (video) ISIS Mobile Payments To Launch On October 22, Aims To Be On 20 Handsets By Year’s End.

Isis mobile payment system primed for September launch, supported devices revealed. @Jack on Payments as Communication. LevelUp Now Has $21M To Take On The Squares Of The Mobile Payment World. BII REPORT: Why Square Is Winning The Mobile Payments Race. Square Getting $200 Million To Fight The Mobile Payments War: Report. Square brings its mobile payments powerhouse to Canada. Square And Starbucks Launch Payments. » How Will You Pay? Mobile Payments Go Mainstream With Square's Nationwide Starbucks Deal. Square and Starbucks Lead Transition to Mobile Payments. Starbucks Introduces Mobile Payments For Canada and UK. Starbucks generates 10pc of US revenue from mobile.

Starbucks Will Soon Let You Tip Your Barista From Your iPhone. Wendy's Updates iOS App to Enable Mobile Payments at U.S. Locations. iZettle, The ‘Square Of Europe’, Checks Out Mobile Payments In The UK With 3,000 Free Readers For SMBs. iZettle opens up beta testing for Android in Sweden. Mobile Payments Startup iZettle Expands Series B Of €25 Million, Adds American Express As Newest Investor, As It Preps Launch In UK. Mobile Payments Startup, iZettle, Partners With 4G Carrier EE For Formal U.K. Launch, Tells Square To Steer Clear Of Europe “Battle”

Paydiant raises $12M, tackles mobile payments like it ain’t no thang. LevelUp Raises $12M For Mobile Payments Platform. The Key to Monitise’s Virtual Wallet Workaround: Real World ATMs. How Venmo Made Payments Social. Opera Expands Its Mobile Payment Ecosystem in Latin America. Groupon Squares Up To Rivals With Groupon POS, An iPad App And Dashboard For On-Site, Mobile Payments.

Amazon Reportedly Buys Mobile Payments Startup Gopago, Working On An ‘Ambitious’ New Project. Amazon introduces 'Login and Pay with Amazon' service for buying from third-party sites. Mobile-Enabled Commerce Will Yield The Next $100B Startup. Beginning With An iWallet, Apple Could Revolutionize Personal Banking. With iOS 8, Apple Stands Ready To Ramp Up Consumer Purchasing Power. Why Apple Can Control Mobile Payments. Mobile Payments: The Case For Choosing An Open Platform. Alipay Launches Sound Wave Mobile Payments System In Beijing Subway. New Boston Fed Report on Mobile Payments Technology. O2, Visa & Global Payments Debut New UK Mobile Business Payment Service. How mobile phones are making cash obsolete in Africa. Visa’s digital wallet V.me launches publicly, plans in-store rollout in 2013. From Sweden with Love: Mobile Payments and QR Codes. Fortumo Brings Its Mobile Payments To Windows 8 — Carrier Billing FTW!