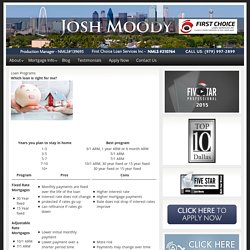

Josh Moody

First Choice Loan Services offers mortgage loans in Dallas to meet all your needs at low interest rates.

FHA Mortgage Austin. San Antonio Mortgage Brokers. Not all agents or brokers are REALTORS® As a prerequisite to selling real estate, a person must be licensed by the state in which they work, either as an agent/salesperson or as a broker.

Before a license is issued, minimum standards for education, examinations and experience, which are determined on a state by state basis, must be met. After receiving a real estate license, most agents go on to join their local board or association of REALTORS® and the NATIONAL ASSOCIATION OF REALTORS®, the world’s largest professional trade association. They can then call themselves REALTORS®. The term “REALTOR®” is a registered collective membership mark that identifies a real estate professional who is a member of the NATIONAL ASSOCIATION OF REALTORS® and subscribes to its strict Code of Ethics (which in many cases goes beyond state law). San Antonio Loans. Mortgage in Dallas. Sometime Back, the Texas monthly magazine named some of the top originators in Texas, Josh Moody was one of them.

On what basis did they do it? They did it on the basis of customer service surveys which asked thousands of buyers of home across the Texas State. We are a team of Mortgagers led by Josh Moody, our business of Mortgage in Dallas started in 2003. Josh Moody is a really efficient mortgager based in Texas who loves his job from the very beginning.

He understands the challenges and little guidelines of the loan business and FHA Loans in Houston. The reason Josh Moody is so successful is because he doesn’t take it as his job but an opportunity to responsibly educate the clients about finances, home buy and sell and loans. Like this: Loan Houston TX. Josh Moody First Choice Loan Services Home Mortgage SMARTblog Social Media Marketing Automation Loan Programs Which loan is right for me?

Connect With Me! Live Rate Quotes No social security number required Get Rate Quote Widget for your website. By using this form, you agree to receive email and/or a phone call from the sender, even though you may be registered on a Do Not Call list. Houston Home Loans. Houston Home Loans. Mortgage Loans for Texas. Chapter 1 — Updated May 23, 2015 — 2,482 characters Loan is a debt provided by one entity to another at an interest.

Austin Mortgage Lenders. Mortgage Rates Austin. What are my options if I have no down payment, or only a small down payment?

Some loans will do 100% financing. Another similar loan option is called a piggy-back loan, where you get approved for the first and second mortgage at the same time. FHA loans require only 3% down. No matter which of these types of loans you obtain, the payment will be larger, your interest rate will probably be higher, and you will be required to buy private mortgage insurance (PMI). What is private mortgage insurance (PMI)? Private mortgage insurance is required if you owe more than 80% on your house.

HUD (US Department of Housing and Urban Development) is committed to increasing home ownership for minorities and low-income Americans. FHA loans (offered by the Federal Housing Commission) are the most popular. VA (Veteran’s Administration) loans are really guarantees for loans obtained by certain qualified veterans or other qualifying home buyers or refinancers such as unmarried surviving spouses. Mortgage Refinance San Antonio. USDA Loan Texas. Houston Mortgage. In the state of Texas, everything is bigger, but that does not necessarily refer to the price of homes.

Beautiful homes in the state of Texas can be very affordable. Texas offers a variety of mortgage loans to homeowners, and the Mortgage Rate in TexasIn the state of Texas are comparable to the rest of the nation. An advantage of being a Texas resident is that Texas state laws are more favorable to those buying loans than in other states. There are more benefits provided to homeowners. Some of the Mortgage Rate in Texas: • Fixed Rate Mortgage-The fixed rate mortgage is perfect for those who intend to reside in their home for a long period of time. . • Adjustable-Rate Mortgage (ARM)-These loans start off with a lower fixed rate for a certain length of time, anywhere from one to five years, then after that amount of time has elapsed, the rate will change to variable, adjusting periodically.

Best Mortgage Rates in Texas. Mortgage Loans for Texas. Where should I start?

It is hard to know where to begin! There are so many options that it can be very confusing to find the right type of loan. You must first ask yourself many questions. Some of these are: How much can I afford to pay each month? The answer to these questions will help you know which loan will be best for you. The larger the down payment, the better your options are for payment size, interest rate, and length of time to pay back the loan.A fixed-interest rate will tend to be higher than an adjustable rate.The longer the term of payback, the smaller the payment.The smaller your payment, the larger the amount that is going to interest.The more that you pay to interest, the slower that you are building equity.

Houston Mortgage. Mortgage Rates Austin TX. Foreclosed Homes in Houston. When should I have a professional home inspection done?

An independent professional home inspection, done at the right time, could save you thousands of dollars. The results may influence your purchase price, the terms of or contingencies to the purchase agreement and the type of insurance coverage you decide is needed. Knowing the condition of the house before the settlement date may save you costly repairs later on. A formal offer should include an inspection contingency. Hire your own inspector to ensure that your interests are being protected.

Payday Loans Houston TX. Mortgage Companies in Houston.