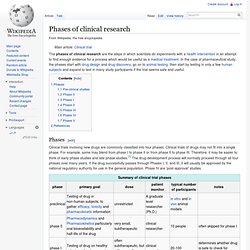

RealOptions-Pharma. 84710204. 06MAsong. 07. Real Options in Capital Investment: Models, Strategies, and Applications - Lenos Trigeorgis. Baker. Phases of clinical research. The phases of clinical research are the steps in which scientists do experiments with a health intervention in an attempt to find enough evidence for a process which would be useful as a medical treatment.

In the case of pharmaceutical study, the phases start with drug design and drug discovery, go on to animal testing, then start by testing in only a few human subjects and expand to test in many study participants if the trial seems safe and useful. Phases[edit] Clinical trials involving new drugs are commonly classified into four phases. Clinical trials of drugs may not fit into a single phase. For example, some may blend from phase I to phase II or from phase II to phase III. Pre-clinical studies[edit] Before pharmaceutical companies start clinical trials on a drug, they conduct extensive pre-clinical studies. Phase 0[edit] A Phase 0 study gives no data on safety or efficacy, being by definition a dose too low to cause any therapeutic effect. Phase I[edit] Single ascending dose. SCOPEGwinn_2-5-2012_ForWebsite. Clinical Trial Costs Are Rising Rapidly.

A Fuzzy Pay-Off Method for Real Option Valuation. FDA Approval Process. The FDA Drug and Biologic Approval Process: A hot topic The high cost of prescription drugs is a hotly debated issue and poses a significant burden to individuals, families, and the federal government.

Drug costs have led to Medicare Part D, a federally subsidized program meant to defray the costs of prescription drugs, particularly to the elderly. Though there are many contributing factors drug prices, their expense is due in part to the cost involved in completing the FDA approval process. In order for pharmaceutical and biotech companies to market their drugs and biologics, companies must receive FDA approval, a rigorous, expensive, and time consuming process that can take over a decade to complete. Of 5000 compounds discovered in the pre-clinical stage, only about 5 will make it through the entire FDA approval process.

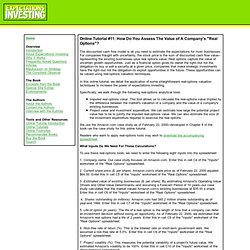

The Phases in the FDA Approval Process. Success rates for experimental drugs falls -study. Bio-ceo-biomedtracker-bio-study-handout-final-2-15-2011. Members_view_all. Real Options Theory. Amram, M., N. Kulatilaka and C.J. Henderson, “Taking an Option on IT,” CIO Magazine, 12 (17), 1999, pp. 46-52. Benaroch, M. and R.J. 50-2-1. Online Tutorial #11: How Do You Assess The Value of A Company's "Real Options"? The discounted cash flow model is all you need to estimate the expectations for most businesses.

For companies fraught with uncertainty, the stock price is the sum of discounted cash flow value--representing the existing businesses--plus real options value. Real options capture the value of uncertain growth opportunities. Just as a financial option gives its owner the right--but not the obligation--to buy or sell a security at a given price, companies that make strategic investments have the right--but not the obligation--to exploit opportunities in the future. These opportunities can be valued using real-options valuation techniques. Real Options Valuation, Inc. - Whitepapers and Case Studies. Campbell R. Harvey's Identifying Real Options. Campbell R.

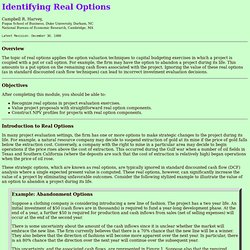

Harvey, Fuqua School of Business, Duke University, Durham, NC National Bureau of Economic Research, Cambridge, MA Latest Revision: December 30, 1999 Overview The topic of real options applies the option valuation techniques to capital budgeting exercises in which a project is coupled with a put or call option. For example, the firm may have the option to abandon a project during its life. Objectives. Valuing Real Options: Frequently Made Errors by Pablo Fernandez.

The Promise and Peril of Real Options by Aswath Damodaran. New York University - Stern School of BusinessJuly 2005 NYU Working Paper No.

S-DRP-05-02 Abstract: In recent years, practitioners and academics have made the argument that traditional discounted cash flow models do a poor job of capturing the value of the options embedded in many corporate actions. They have noted that these options need to be not only considered explicitly and valued, but also that the value of these options can be substantial. Number of Pages in PDF File: 75 working papers series Suggested Citation. Publications - Top. Applications of Real Options. Real options valuation. Types of real option[edit] The flexibility available to management – i.e. the actual "real options" – generically, will relate to project size, project timing, and the operation of the project once established.[6] In all cases, any (non-recoverable) upfront expenditure related to this flexibility is the option premium.

Real options are also commonly applied to stock valuation - see Business valuation #Option pricing approaches - as well as to various other "Applications" referenced below. Options relating to project size[edit] Where the project’s scope is uncertain, flexibility as to the size of the relevant facilities is valuable, and constitutes optionality.[7] Options relating to project life and timing[edit] Where there is uncertainty as to when, and how, business or other conditions will eventuate, flexibility as to the timing of the relevant project(s) is valuable, and constitutes optionality.