Bric nations become increasingly interdependent. China plays host on Thursday to the third summit of Bric nations, as it and other emerging economies increasingly drive global growth.

The leaders of Brazil, Russia, India and China will meet on Hainan Island, along with potential new member, South Africa. The term Bric was coined in 2001 by Goldman Sachs economist Jim O'Neill to group together the four fast-rising economies. In recent months their economic might has been matched by their growing political influence. Viewpoint: India - a BRIC between China and US. Economic activity is unmistakably shifting towards emerging economies.

In the last 50 years of the 20th century, the Western economies came together because they were leading the growth process. Now there has been a paradigm shift. The Mint countries: Next economic giants? In 2001 the world began talking about the Bric countries - Brazil, Russia, India and China - as potential powerhouses of the world economy.

The term was coined by economist Jim O'Neill, who has now identified the "Mint" countries - Mexico, Indonesia, Nigeria and Turkey - as emerging economic giants. Here he explains why. So what is it about the so-called Mint countries that makes them so special? Why these four countries? A friend who has followed the Bric story noted sardonically that they are probably "fresher" than the Brics. This is the envy of many developed countries but also two of the Bric countries, China and Russia. Something else three of them share, which Mexican Foreign Minister Jose Antonio Meade Kuribrena pointed out to me, is that they all have geographical positions that should be an advantage as patterns of world trade change.

For example, Mexico is next door to the US, but also Latin America. And as we all know, Turkey is in both the West and East. He's right. Move Over, BRICs. Here Come the MISTs. In 2001, Jim O’Neill kicked off a decade-long investment boom with a catchy acronym for the four largest emerging-market economies—Brazil, Russia, India, and China.

The Goldman Sachs Asset Management chairman is now promoting a new foursome of fast-track countries: Mexico, Indonesia, South Korea, and Turkey. In terms of GDP and fund holdings, the MIST nations are the biggest markets in Goldman Sachs’s N-11 Equity Fund. Launched in February 2011, the fund has $113 million in assets (as of June 30) spread out across 73 stocks. So far this year, N-11 has outperformed Goldman Sachs’s $410 million Brazil, Russia, India, and China fund, climbing 12 percent, compared with a 3.2 percent gain for the BRICs. “We see steady inflows into the Next 11 fund each week,” says O’Neill, who isn’t involved in managing either fund. Watch Out, World Bank: Here Comes the BRICS Bank. The five countries represent a fifth of global GDP and share high growth and geopolitical importance in their separate regions, but have struggled to find common ground that would convert their economic weight into joint political clout.

The two biggest economies of the group, China and Brazil, marked their determination to make changes in the world's trade and financial architecture by signing a three-year currency swap agreement covering up to $30 billion a year in bilateral trade. Brazilian officials said the aim was to ensure their fast-growing commercial ties would not suffer if a new banking crisis caused dollar trade finance to dry up. "Our interest is not to establish new relations with China, but to expand relations to be used in the case of turbulence in financial markets," Brazilian Central Bank Governor Alexandre Tombini told reporters after the signing. Brazilian officials have said they hope to have the trade and currency deal operating in the second half of 2013. China: A Third Generation NIC.

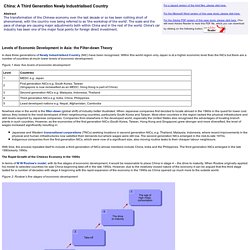

Levels of Economic Development in Asia: the Filter-down Theory In Asia three generations of Newly Industrialised Country (NIC) have been recognised.

Within this world region only Japan is at a higher economic level than the NICs but there are a number of countries at much lower levels of economic development. Figure 1 Asia: five levels of economic development Nowhere else in the world is the filter-down (global shift) of industry better illustrated. When Japanese companies first decided to locate abroad in the 1960s in the quest for lower cost labour, they looked to the most developed of their neighbouring countries, particularly South Korea and Taiwan. Japanese and Western transnational corporations (TNCs) seeking locations in second generation NICs, e.g. GroupDownloadFile. Gf690. NAFTA GEOFACT. BBC Bitesize - Higher Geography - World trade patterns - Revision 1.

Changing Patterns of World Trade. World trade patterns. The global economy has grown continuously since the Second World War.