Central Planning Update (In Theory And Practice) - You Are Here. Submitted by Jeffrey Snider of Atlantic Capital Management Volatility Is The Price Of Real Progress As we all ponder what may come at us in 2012, the ongoing volatility in almost every corner of every marketplace is certainly concerning, as it should be. This record volatility has enormous implications for any investor, but especially those in leveraged ETF’s. Volatility is the anathema to these vehicles, as has been well discussed, but that does not diminish their targeted usefulness. As a portfolio manager I use leveraged inverse ETF’s as hedges against the dramatic downside.

I willingly pay that cost because I have no concrete idea when another fit of sustained selling will actually take place, but I have more than an inkling that it will. Without the guiding hand of the educated economist, capitalist, free market economies are believed to be wrought with the danger of total collapse, unable to escape from their own emotional whimsies.

It was hubris of the highest order, of course. Mettre la spéculation hors la loi. Au début, la spéculation a généré la crise.

Désormais, la spéculation veut tirer profit de la crise. En attaquant aujourd'hui la Grèce, et demain d'autres pays peut-être, elle mord la main qui l'a tirée du naufrage. La crise n'est pas terminée, mais les opérateurs financiers ont déjà tourné la page du sauvetage des banques qui aura coûté 3.770 milliards d'euros en Europe et 12.800 milliards de dollars aux Etats-Unis selon les chiffres publiés par l'Agefi, agence spécialisée dans l'information économique et financière. Ils ont vite oublié qu'ils n'existent plus que grâce aux flots de liquidités injectées par les Etats pour empêcher le blocage des économies.

Et que les Etats, pour remédier à leurs excès, ont été contraints d'accumuler de la dette. Publicité Spéculation et complaisance Les spéculateurs font ainsi un bras d'honneur aux Etats qui sont venus à la rescousse d'un système dont ils ont abusé. Le propos peut paraître réducteur. Un rôle de prédateur A l'épreuve des souverainismes.

Debt: The first five thousand years - David Graeber. Throughout its 5000 year history, debt has always involved institutions – whether Mesopotamian sacred kingship, Mosaic jubilees, Sharia or Canon Law – that place controls on debt's potentially catastrophic social consequences. It is only in the current era, writes anthropologist David Graeber, that we have begun to see the creation of the first effective planetary administrative system largely in order to protect the interests of creditors. What follows is a fragment of a much larger project of research on debt and debt money in human history. The first and overwhelming conclusion of this project is that in studying economic history, we tend to systematically ignore the role of violence, the absolutely central role of war and slavery in creating and shaping the basic institutions of what we now call "the economy".

What's more, origins matter. Let me start with the institution of slavery, whose role, I think, is key. The reason I stress this is because this logic is still with us. I. Le capitalisme et la mort. Did a productivity slowdown cause the financial crisis? Most narratives of the crisis start with problems in the financial sector that then spilled over into the real economy.

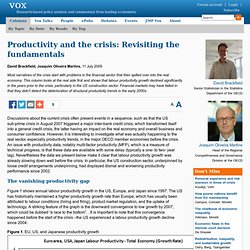

This column looks at the real side first and shows that labour productivity growth declined significantly in the years prior to the crisis, particularly in the US construction sector. Financial markets may have failed in that they didn’t detect the deterioration of structural productivity trends in the early 2000s. Discussions about the current crisis often present events in a sequence, such as that the US sub-prime crisis in August 2007 triggered a major inter-bank credit crisis, which transformed itself into a general credit crisis, the latter having an impact on the real economy and overall business and consumer confidence. However, it is interesting to investigate what was actually happening to the real sector, especially productivity trends, in the major OECD member economies before the crisis.

Figure 1. Source: OECD ULC Database Figure 2. Figure 3. Figure 4. Sarkozy - Toulon. Reconnaissant que la crise « aura des conséquences dans les mois qui viennent sur la croissance, sur le chômage, sur le pouvoir d’achat, » Nicolas Sarkozy constate que « l’idée que les marchés ont toujours raison était une idée folle, » et juge que « le laissez-faire, c’est fini. » Mais attention : « la crise financière n’est pas la crise du capitalisme. » C’est la crise d’un système qui s’est éloigné de ses « valeurs les plus fondamentales ». Que faire ? Trouver un « nouvel équilibre entre l’état et le marché, » réguler la finance, réformer le système monétaire international lors d’un nouveau Bretton Woods, bousculer les dogmes de l’Europe. Vaste programme. SBS Dateline - Lagarde. RBA GFC causes. The curious paradox of Hedging & Regulation is a case for Common.