Infographic: State of the Mobile Wallet. Consumer interest in the mobile wallet is still in its infancy in the United States, according to findings from the 2013 First Data Universal Commerce Tracker Study.

Following the introduction of a variety of consumer offerings including Google Wallet, iPhone Passbook, and others, the US consumer continues to be relatively unenthused. The research suggests that consumers are satisfied with their current payment methodologies, and that the mobile wallet is seen as being a better alternative on a few key dimensions. The infographic displays the detailed results, as well as comments on the findings from members of the Universal Commerce Innovation Exchange: IBM, Kohl’s, RSA, and First Data. The Universal Commerce Innovation Exchange, sponsored by First Data, is a group of industry thought leaders that provides insights and information to encourage and aid organizations to build high-value Universal Commerce business strategies. Click below to enlarge the infographic. Barclays makes mobile payment and purchasing easy with ‘mobile checkout’ and ‘buy it’ Businesses, such as retailers, are now able to offer their customers two new mobile payment solutions which provide a fast, easy and secure way to pay for goods and services.

Unlike many alternative payment methods, ‘mobile checkout’ is optimised for a mobile experience, with only a few clicks required to make an instant settlement via a ‘Pay with Barclays Pingit’ button. It eradicates the need for the entry of long or large amounts of personal details, which can be challenging and time consuming on small handsets. Mike Walters, Head of UK Corporate Payments at Barclays said: “For mobile enabled businesses, this is a great way to increase sales conversion by reducing payment input errors and increased consumer assurance at checkout. For new players to the market, it is an easy, low risk way to enter into mobile commerce.”

The advent of the ‘buy it’ feature on Barclays Pingit enables instant purchases from traditional advertising collateral. Contactless. Www.berginsight.com/ReportPDF/ProductSheet/bi-mobilewallet-ps.pdf. Www.gsma.com/digitalcommerce/wp-content/uploads/2012/10/GSMA-Mobile-Wallet-White-Paper-Version-1-0.pdf. Www.icmunlimited.com/data/media/pdf/ICM-Is-2013-the-year-of-the-Mobile-Wallet.pdf.

Forget mobile payments. The future is the mobile wallet. In some circles, the notion of a smartphone acting like a credit or debit card is fascinating, and you see story upon story about mobile payment-enabled smartphones and the potential rise of PayPal, the telcos, and such as the new payment processors.

Who cares? Even if Visa and MasterCard were somehow to let go of that billion-dollar processing business, you're merely replacing one financial processor with another. The fact that a smartphone could act as a card is an inconsequential change. You still have to carry a wallet, and as long as that's the case, a simple plastic card remains easier to use, given that the technology for reading them is universal and all the proposed mobile alternatives require new, often separate, readers and work only with certain vendors -- you'll still be carrying plastic for the other banks' and merchants' systems. Www.pwc.com/sg/en/tice/assets/tmtnews201304/pwc-consumer-intelligence-series-mobile-wallet.pdf. Wp-content/uploads/2013/07/Mobile-Shopping-Cart-Abandonment.pdf.

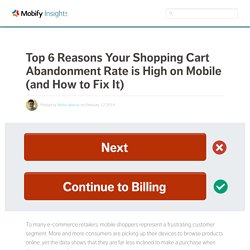

Push Notifications For Abandoned Carts: A Guide For Retailers Going Mobile. Top 6 Reasons Your Shopping Cart Abandonment Rate is High on Mobile (and How to Fix It) To many e-commerce retailers, mobile shoppers represent a frustrating customer segment.

More and more consumers are picking up their devices to browse products online, yet the data shows that they are far less inclined to make a purchase when they are using a phone. Retailers are left scratching their heads — as traffic from mobile devices continues to increase, what are the best ways to improve the customer experience such that visitors are more likely to complete a purchase on the device they have in hand?

And where is the best place to start, given the complexity of mobile optimization? The good news is, there’s one part of your website you can start optimizing which will deliver immediate and guaranteed improvements in your mobile metrics. It is, of course, the mobile shopping cart. You can make some really key, tactical improvements to the shopping cart alone that are likely to give you a decent boost in conversion rates for mobile (and especially smartphone) transactions. Should the 97% Shopping Cart Abandonment Rate on Mobile Devices Concern You?

The average shopping cart abandonment rate is 72% across all devices*.

But mobile devices (excluding digital downloads), have an astounding 97% abandonment rate*. Recently, several people have asked me about the difference and whether or not they should be considering separate mobile device strategies. My short answer is ‘Yes’ and ‘No,’ because there are really two answers. Before I explain, let’s take a quick look at why customers abandon shopping carts in the first place and what makes the mobile experience so different. Then we can explore specific techniques for improving the mobile shopping experience. Apple Pay is only the start: Mobile wallets are about to take off. It’s here folks.

Well, in the US at least. Yesterday, a string of American retailers (including Bloomingdale’s, Foot Locker and Toys R Us) started accepting Apple Pay transactions, allowing consumers to make payments through credit card information stored on the new iPhone. Exciting stuff, but haven’t people been predicting the end of cash for some years now? Despite new developments like Apple Pay, talk of a “mobile wallet” revolution (with smartphones becoming the primary means of payment) has so far failed to translate into a mass movement. Is this set to change? Analysts at Transparency Market Research confidently predict that the global mobile wallet market will be worth $1.6bn (£991m) by 2018.

Will the Apple Pay Mobile Wallet Kill the Plastic Credit Card? Apple wants the plastic credit card to become as rare as the paper check.

On Tuesday, the company announced Apple Pay, a digital payment system that lets people pay for retail store purchases using their phones rather than cash or credit cards. The service, which will work both with iPhones and Apple's new Watch, is backed by a host of big retailers, along with most major banks and credit card issuers, including Visa, MasterCard and American Express. The Modern Wallet: Mobile Payments are Making Life Easier. There’s no denying the impact that digital connectivity is having on our daily routines.

It’s changed how we watch video, keep tabs on our health—even the way we connect with our favorite World Cup players. And more recently, digital is starting to transform how consumers pony up cash for their everyday purchases. And for consumers using mobile payment technology, digital is already the norm. In fact, according to Nielsen’s Q2 2014 Mobile Wallet Report, 40 percent of mobile wallet users say they use mobile methods as their primary mode of payment. Barclays Pingit Mobile Payments Infographic and Research.

Apple Pay Gives Glimpse of Mainstream Appeal for Mobile Payments. For years, tech companies have dreamed of a future in which people ditch their wallets and pay for things with their smartphones.

And for years, that has not happened. But Apple may be on to something. In the three weeks since the company released Pay, its first stab at a mobile wallet, some major retailers are seeing a wave of consumers eager to check out at the register with their iPhones. Mobile Payments to Rise 40% This Year, Juniper Research Finds. Average Spend via Tablets Now Exceed Desktop PC Levels Hampshire, UK – 8th April 2014: A new report from Juniper Research has found that the value of global payments via mobile devices will reach around $507 billion this year, a rise of nearly 40% year-on-year.

The Painfully Slow (but Incredibly Valuable) Rise of Mobile Payments. Welcome to Forbes. Pay. Zapp - The best way to pay is coming. Barclays Pingit. With Apple Pay Mobile Payments in the US Have Arrived. Apple Pay to Open New Era for the digital payment in the UAE.