Reasons to avail personal loan from RBL -Letzbank. RBL, earlier known as Ratnakar Bank Limited was incorporated in the year 1943.

The bank is one of the swiftly growing commercial banks in the country. The bank witnessed a turnaround with in 2010 and with its tie up with Royal Bank of Scotland. RBL has been rated as “India’s Best Bank (Growth)” in mid-sized bank category by Business Today – KPMG study 2012 and 2013. The bank is spread across the country and has been operating through its 183 branches and 351 ATMs spread across 13 states in India.

Reasons to avail personal loan from Bajaj finance limited. Bajaj Finance is one of the largest and most profitable financier, financing various consumer durables through the country.

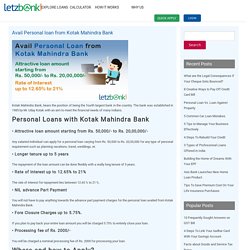

Bajaj Finance Limited offers and lends finance to a wide range of consumers from all walks of life. Bajaj Finserve came into existence in the year 2007 originating from its parent organization as a self governing body offering financial services to many consumers. Bajaj Finserve has been operating autonomously and offering its services such as lending, wealth management, asset management, and insurance. Avail Personal loan from Kotak Mahindra Bank. Kotak Mahindra Bank, bears the position of being the fourth largest bank in the country.

The bank was established in 1985 by Mr. Uday Kotak with an aim to meet the financial needs of many Indians. Avail Personal loans up to Rs 15 Lac from Tata Capital. Tata Capital Limited was incorporated in the year 2007 with an effort to provide financial solutions to many and thereby helping masses to achieve their goal.

Tata Capital being one of the subsidiaries of Tata Sons Limited has been making keen efforts since its inception to render financial services to masses and to live up to its name. Tata Capital Financial Services Limited is a one stop shop for the financial solutions catering for the financial needs of corporate, retail as well as institutional customers across the country. Personal Loans at Tata Capital Financial Services Limited Tata Capital provides personal loans for your instant personal requirements, which can be availed instantly without much hassle.

Personal loan with Tata capital can be availed for planning your vacations abroad, repayment of an existing loan, weddings, buying gifts, and so on without worrying about where the finance will come from. Personal Loans up to Rs. 15,00,000. Reasons to avail Home loan from Bajaj Finance Limited. Bajaj Finance Limited is one of the leading brands in the field of consumer financing.

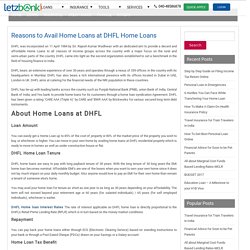

Bajaj Finance has grown drastically by gaining immense profits, by financing various consumer durables across the country. Bajaj Finserve emerged as a separate entity of Bajaj Finance in the year 2007 in order to offer independently financial services to many lives across the nation. Bajaj Finserve is an autonomously operating body offering its services such as asset assessment, insurance, lending, as well as wealth management. About Home Loans at Bajaj Finserve Home Loans at Bajaj Finserve are the financial products that are offered to salaried as well as self employed professionals to ensure your dream of a dream home comes true.

Reasons to Avail Home Loans with Citibank - Letzbank. Citibank is a century old bank in India which was incorporated the year 1902. Kolkata based bank is today a leading player in the Indian financial market. Citibank as a promoter has played a vital role over a century in development of Indian Financial Sector through innovations in in the field of finance and successfully helped in establishing credit bureau, clearing, depositories, and payment institutions. At present the bank operated through its 45 branches located in 28 cities across the country. Citibank is one of the most preferred banker to around 45,000 small as well as middle sized organizations across the country. Reasons to Avail Home Loans at DHFL Home Loans. DHFL was incorporated on 11 April 1984 by Sri.

Rajesh Kumar Wadhwan with an dedicated aim to provide a decent and affordable Home Loans to all classes of income groups across the country with a major focus on the rural and semi-urban parts of the country. DHFL came into light as the second organization established to set a benchmark in the field of housing finance in India. DHFL bears an extensive experience of over 30 years and operates through a nexus of 359 offices in the country with its headquarters in Mumbai.

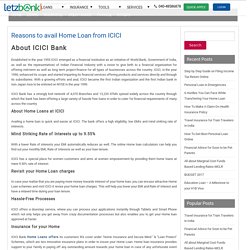

DHFL has also bears a rich international presence with its offices located in Dubai in UAE, London in UK. Reasons to avail Home Loan from ICICI - Letzbank. About ICICI Bank Established in the year 1955 ICICI emerged as a financial institution as an initiative of World Bank, Government of India, as well as the representatives of Indian Financial Industry with a vision to give birth to a financial organization for offering mid-term as well as long term project finance for all types of businesses across the country.

ICICI, in the year 1990, enhanced its scope and started imparting its financial services offering products and services directly and through its subsidiaries. With a growing efforts and zeal, ICICI became the first Indian organization and the first Indian bank in non-Japan Asia to be enlisted on NYSE in the year 1999. Reasons to avail Home Loan from Kotak Mahindra Bank. About Kotak Mahindra Bank Kotak Mahindra Bank is the fourth largest bank in India was incorporated in the year 1985 by Mr. Uday Kotak to offer infinite solutions and possibilities for financial needs of Indian lives. Kotak Mahindra Finance Limited (KMFL) the flagship organization for Kotak group received its banking license from the Reserve Bank of India (RBI) in February, 2003. With the license obtained by KMFL, KMFL merged as the first non-banking organization to be transformed into a bank now known as Kotak Mahindra Bank Limited (KMBL).

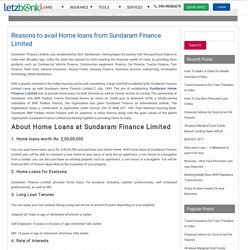

As per the study of Brand Finance Banking 500, that was published in February 2014 by Banker Magazine, KMBL ranks 245 among leading 500 banks in the world with its brand evaluation of around half a billion dollars ($481) and brand rating of AA+ . Kotak acquired ING Vysya Bank dated 1 April 2015. Reasons to avail Home loans from Sundaram Finance Limited. Sundaram Finance Limited, was established by Shri.

Santhanam. Having begun its journey with hire-purchase finance in India over decades ago, today the bank has spread its roots meeting the financial needs of many by providing them products such as Commercial Vehicle Finance, Construction equipment Finance, Car Finance, Tractor Finance, Tyre Finance, Fleet Card, General insurance, Mutual Funds, Housing Finance, Business process outsourcing, Information technology, Retail distribution. With a greater potential in the Indian housing sector and considering a large shortfall residential units Sundaram Finance Limited came up with Sundaram Home Finance Limited 2 July, 1999. Reasons to avail Home Loans from LIC - Letzbank. LIC Housing Finance Ltd. is one the leading Housing Finance organization in India.

LIC Housing Finance Ltd. was established dated 19 June, ¸under the Companies Act, 1956. Reasons to avail Home Loan from SBI - Letzbank. About State Bank of INDIA State Bank of India - The bank every Indian trusts is India’s own and nationalized bank serving community in comprehensive and complete manner and enabling nation building through its financial services. Being a nationalized bank, the bank offers Rate of interests, EMI and tenure anyone would opt for. Get to know about your SBI Home Loans: SBI Home Loan has been awarded as "THE MOST PREFERRED HOME LOAN PROVIDER" at AWAAZ Consumer Awards. In a survey conducted by TV 18 in association along with AC Nielsen-ORG Marg held across 21 cities in India, the bank was awarded with "THE MOST PREFERRED BANK AWARD"

. • Low Processing Charges • Low interest rates which is charged on the daily reducing balance. • Package of exclusive benefits. • One advantage of choosing SBI is that there are no hidden costs or administrative charges towards your loan amount. • You can reach out to SBI anywhere and everywhere with over 15,969 well-spread nationwide. Reasons to avail Home Loan from Axis Bank - Letzbank. About Axis Bank Axis Bank is one of the largest and finest banks in the country.

Axis Bank, then known as UTI bank, started its operations in the year 1994 and today holds the position of being the third largest private sector banks in India. As on date Axis bank operates through a nexus of 2589 branches, 12355 ATM’s as well as its extension branches which are well spread across the country. The bank thrives to meet the financial endeavours of masses through its smart and upbeat financial services. The bank has also been offering financial services to a large set of customers from Large and Mid-Corporate, Agriculture, MS-ME and Retail Sector. Reasons to take Home Loan from IndiaBulls. About India Bulls Indiabulls Housing Finance Ltd. (IBHFL) ranks as the 2nd largest private sector housing finance organization in India. Indiabulls is regulated by the National Housing Bank (NHB). The organization bears the highest rating of AAA from CARE ratings and Brickwork ratings. Indiabulls offers home loans at go-getter rates for you to en cash them with Home Loan offers up to Rs. 1.5 crores.

The specially trained staff at Indiabulls provides sincere counselling to its customers about various stages of their home loan, right from the initial application process of your home loan till the time customers take the possession of their dream home. Top 5 Banks for Home Loans - Letzbank. Are you dreaming of your owned house? Then we are here to offer you easy Home Loans with rich features and benefits. We have variety of Home Loan products from various banks which are designed keeping in mind the various requirements of our valuable customers.

Also, in the past one year Reserve Bank of India (RBI) has reduced the interest rate by 25 basis points. Get to know how to choose the best home loans. Owing your owned house is one of the dreams which every individual sees. The increasing property rates and to get all the tax benefits, opting for Home Loans is a common option one looks for. When you plan to avail a Home Loan don’t just be confined to your thought that cheaper the rate of interest , best is the deal offered. Choose the Best Home Loan Offers - Letzbank. A dream that every individual sees is his own house. Banks are making it much easier for such individuals to own his house without any hassle. Home Loan Eligibility For Salaried - Letzbank. Owing your owned house is one of the dreams which every individual sees. The increasing property rates and to get all the tax benefits, opting for Home loan is a common option one looks for.

Personal Loan Eligibility For Salaried - Letzbank. Get Home Loan eligibility for Firm & Companies. Owing your owned house is one of the dreams which every individual sees. The increasing property rates and to get all the tax benefits, opting for Home Loans is a common option one looks for. Benefits to have Home Loans for Self Employed. Home Loans are loans that can be availed by all self-employed professionals who want to purchase a house of any kind ranging from a house, villa, flat, plot for construction of a house. etc. Benefits of applying for Personal Loans for Salaried. Everything You Need To Know About Personal Loan Refinancing. All You Need To Know About Home Loan. The boom in real estate in the recent years has seen a steep rise in the home loan graph. With affordable interest rates and low down payment, every middle class is finally finding it easier to fulfil the dream of their own home. However, before you go down the lane of a home loan, here are a few things you must keep in mind to ensure that you are able to make a sound financial decision.

Personal Loans Simplified for you! A few decades ago, borrowing a loan was not only difficult to get but was also considered an awkward social norm. All you need to know about Personal Loans. How to Choose your Home Loan? As we are talking about “Home”; Oliver Homes Wendell once mentioned - “Home” is a place where your feet may leave but not our hearts. All that you need to know about Personal Loans in Chennai. Get The Highest Loan Amount With Bajaj Finserv Personal Loan. Say Yes To Yes Bank Home Loans @ Lowest ROI. Apply Canara Bank Home Loans @ Lowest ROI. Get The Best Home Loan Offer With IndusInd Home Loan. Get IDBI Home Loans @ lowest ROI And No Pre-closure charges! Known All about Personal Loan EMI Calculator. 10 Things To Watch When You Take A Personal Loan. Easy known All About Home Loan EMI Calculator. Personal Loan Myths Debunked! Easy known Weigh Your Home Budget Quotient.

Known about Should You Rent Or Buy A House? All about Special Home Loans for Women. Easy known What NOT To Do With A Personal Loan. Easy to known about Home Loan options in India. Known about How To Calculate EMI On Personal Loan. Top 12 Terms related to Home Loan! @ Letzbank. Easy to understand credit Card vs Personal Loan. Current Home Loan Rate in India. Easy To Get Instant Cash With HDFC Personal Loans. Easy to get Personal Loans For Women To Support. Get 5 Tips To Know Before You Take Personal Loan. Get to know Personal Loan – Which Bank To Choose? When Is The Right Time For A Personal Loan? @ Letzbank. The Go-To Guide for A Home Loan Beginner @ Letzbank.