Franklin Run, LLC / Real Estate Solutions.

Sarasota Florida Real Estate Owned Properties. Foreclosure Due Diligence: Investigate Property Liens. It makes no difference whether you intend to purchase a home through conventional channels or bid on a foreclosed property at auction, it’s up to you or your representative to perform a thorough check of local municipal records for outstanding liens on the property.

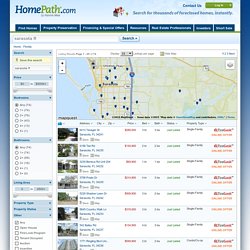

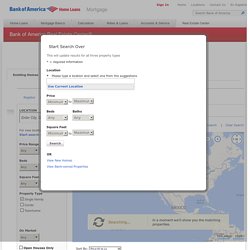

Bank REOs: Locate Bank Owned REO Properties & Foreclosure Listings. Looking for Bank Owned REO Properties?

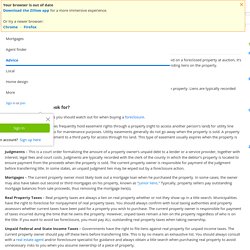

We’ve scoured the web to find banks that post REO properties on their sites and we’ve assembled other sites that also compile REOs to aid in your search. This might be the easiest way to find and acquire foreclosures. Real estate auction, foreclosure listings. Sarasota fl - Fannie Mae REO Homes For Sale. Important Reminder HomePath and this downloading function are only for individual, non-commercial use and for individuals and entities transacting business with Fannie Mae.

You may not use any robot, spider or other automated device, process, or means to access HomePath contents. You may not republish, offer for sale, or otherwise make publicly available HomePath contents, or use HomePath contents for marketing purposes, without Fannie Mae's prior specific written approval. No valid entry. Please try again or refresh image.

Generating file Please wait a minute as we create your custom report. Sarasota County. Real Estate Center. Refinancing Paying off one loan with the proceeds from another loan, generally using the same property as collateral.

Lender. Bank REOs: Locate Bank Owned REO Properties & Foreclosure Listings. New listings - Gary Emigh - Matrix Portal. Sarasota, FL HUD Homes. Homes for Sale in Sarasota. Sign In I forgot my passwordRegenerate Validation Email Unfortunately right now the forgot password, register and validation link for mobile experience is not available.

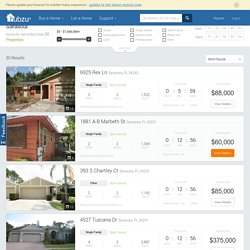

Quick Flipping Property Search / Become the Real Estate Market Expert – Tip #3. Quick flipping property search Investing in real estate can be a scary process for new investors.

There are so many questions and concerns that run through a new investors mind. One of the biggest hold ups a new investor can make is to over analyze a potential opportunity, waste valuable time, and lose out on a deal. Defining Target Areas for Quick Flips / Become the Real Estate Market Expert – Tip #1. Leverage a Real Estate Agent and become the real estate market expert Do you know which areas are best to invest in and which areas to stay away from?

If you are on the road to becoming a successful real estate investor, the answer will be “yes”. To be more informed than the average real estate investor, first, define your target area, then view and assess monthly real estate market reports to determine what is happening in that market. Defining Target Areas If your plan is to buy a home and fix it up for a quick turn around, the areas of target will be the working class and middle income neighborhoods. If you are not sure where these target areas are located, then your first step will be to start segmenting the city. Absorption Rate / Become the Real Estate Market Expert – Tip #2. Become the real estate market expert – Tip #1 What is absorption rate?

The absorption rate is the rate at which the currently active inventory is turning over– or how fast homes are selling in relation to new listings on the market. It is calculated by taking the current number of available homes, and dividing it by the average number of sales per month. For example, let’s say that there are 1,000 active listings in a particular city and they are selling at 100 per month. Divide the current number of listings (1000) by the number of sales per month (100). Additional homes are coming onto the market and being sold all the time. Quick Tips Foreclosure Buying Guide. True or false?

Investors should go after foreclosure properties because they can purchase them at a deep discount. Foreclosure and bank owned properties may be priced at lower than similar fair market properties, but be careful because you may get what you pay for. Buying foreclosure homes requires research and experience. Sarasota Foreclosures & Short Sale Real Estate: Sarasota REO Properties.

REOFinder.com. What is the best source to find Foreclosures to buy? Every website I see out there just wants your monthly - Trulia Voices. Deb London - that doesn't really answer the question, does it?

Sam - information on foreclosures is tricky business. The problem is, it's a lengthy process, and there's a lot that can happen during that process that can hang things up a bit when viewed from the perspective of a potential buyer. When dealing with sites like RealtyTrac - or other aggregators that spew foreclosure info, because of the lengthy process, and all that can happen between the lender and owner - thier information is sketchy at best. Foreclosures require a bit of public disclosure to get the ball rolling, but really nobody wants to give out a lot of private info beyond the basic public filings.

That makes getting any solid actionable information even more difficult. Be prepared to put in a lot of work and face a good amount of rejection here and there if you're looking at bank owned property though. Repo Cars For Sale in FL, REO Property Auctions & More - RepoFinder.com America's FREE Source For Bank & Credit Union Repo Sales - RepoFinder.com. What is the best source to find Foreclosures to buy? Every website I see out there just wants your monthly - Trulia Voices.