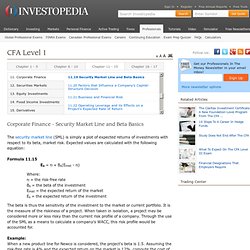

Security Market Line and Beta Basics - CFA Level 1. The security market line (SML) is simply a plot of expected returns of investments with respect to its beta, market risk.

Expected values are calculated with the following equation: Formula 11.15 Where: rf = the risk-free rate Bs = the beta of the investment Emkt = the expected return of the market Es = the expected return of the investment The beta is thus the sensitivity of the investment to the market or current portfolio.

It is the measure of the riskiness of a project. Example: When a new product line for Newco is considered, the project's beta is 1.5. Answer: Cost of equity = rf + Bs(Emkt - rf) = 4% + 1.5(12% - 4%) = 16% The project's required return on retained earnings is thus 16% and should be used in our calculation of WACC. Estimating BetaIn risk analysis, estimating the beta of a project is quite important. The two most widely used methods of estimating beta are: 1.

Suppose Newco would like to add beer to its existing product line of soda. Investopedia. Investopedia. Investopedia. Standard Deviation and Variance. Deviation just means how far from the normal Standard Deviation The Standard Deviation is a measure of how spread out numbers are.

Its symbol is σ (the greek letter sigma) The formula is easy: it is the square root of the Variance. So now you ask, "What is the Variance? " Variance The Variance is defined as: The average of the squared differences from the Mean. To calculate the variance follow these steps: Work out the Mean (the simple average of the numbers)Then for each number: subtract the Mean and square the result (the squared difference).Then work out the average of those squared differences. Example You and your friends have just measured the heights of your dogs (in millimeters): The heights (at the shoulders) are: 600mm, 470mm, 170mm, 430mm and 300mm. Investopedia. Survival of the Richest. In financial markets, as in many human endeavors, there’s a battle between reason and madness.

On one side are the disciples of the efficient-markets hypothesis: the notion that markets fully, accurately, and instantaneously incorporate all relevant information into prices. These adherents assume that market participants are rational, always acting in their own interest and making mathematically optimal decisions. On the other side are the champions of behavioral economics: a younger discipline that points to bubbles, crashes, panics, manias, and other distinctly unreasonable phenomena as evidence of irrationality. It’s hard to deny that investors act irrationally from time to time, yet behavioralists have so far failed to offer an alternative to supplant the efficient-markets hypothesis, which does brilliantly explain many economic occurrences and has had an enormous impact on modern financial theory and practice.

Under the adaptive-markets hypothesis, behavioral biases abound. Efficient Markets Hypothesis financial definition of Efficient Markets Hypothesis. Efficient Markets Hypothesis finance term by the Free Online Dictionary. Understanding Risk And Return Investment Analysis and Portfolio Management Business Management. Investment Analysis & Portfolio Management (FIN630) Lesson # 31 Two key concepts provide the foundation for the field of finance.

The first is A dollar today is worth more than a dollar tomorrow, and is often called the time value of money. The second is a safe dollar is worth more than a risky dollar. The universal application of these statements and rational decision making. Between risk and return is the principles theme in the investment decision. Most people are risk averse, which does not mean, however, they will not take a risk. Means the only take a risk when they expect to be rewarded for taking it. Different degrees of risk aversion; some are more willing to take a chance than are others. People invest because they hope to get a return from their investment. Stuff that makes people feel better or improves their standard of living.

Of risk averse person seeks to avoid. Anyone who seeks more than a trivial rate of return. Some return measures are more useful than others. Bonds. . %. Investopedia. Definition of market efficiency. Investopedia.