Actuary job profile. As an actuary, you'll learn how to analyse data, evaluate financial risks, and communicate this data to non-specialists… An actuary evaluates, manages and advises on financial risks.

Actuary: job description. What does an actuary do?

Typical employers | Qualifications and training | Key skills Actuaries evaluate complex risks and assess the probability and potential financial consequences of those risks. Although the majority of actuaries work in traditional fields, actuaries are increasingly stepping outside of these specialisms to work in other areas of risk evaluation, such as the effects of climate change. The work carries a high level of responsibility, and the decisions of actuaries affect thousands of people. In insurance-related specialisms actuaries must ensure that premium rates are set accurately and that adequate funds exist to meet claims. Career progression is encouraged through direct client responsibility, specialisation, management or partnership.

Most positions occur in towns and cities throughout the UK, and opportunities for international and self-employment also exist. Typical employers of actuaries Qualifications and training required Professional study is well supported. Actuary job information. Page Content Actuary Hours30-40 per weekStarting salary£30,000 + per year.

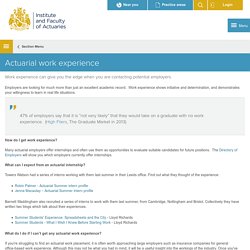

ActuaryInsurancePensions ActuarialWork. Actuarial Careers Guide to the Actuarial Profession. Institute and Faculty of Actuaries. Employers are looking for much more than just an excellent academic record.

Work experience shows initiative and determination, and demonstrates your willingness to learn in real life situations. 47% of employers say that it is “not very likely” that they would take on a graduate with no work experience. (High Fliers, The Graduate Market in 2013) How do I get work experience? Many actuarial employers offer internships and often use them as opportunities to evaluate suitable candidates for future positions.

Where do actuaries work? The business world today is becoming more complex, fraught with uncertainty and often with conflicting pressures.

Where actuaries fit in The need for a business to perform competitively, to respect the interests of its customers and that of the economy in which it operates poses some special problems. Actuaries have the skills for tackling the issues that financial businesses face, in the interest of both customers and owners. As the skills of an actuary are increasingly being recognised, the range of employment opportunities for actuaries is growing.

The Actuary, the official magazine of the Institute and Faculty of Actuaries. Welcome. Discover Risk. Laura Molloy - Actuary. I made the decision to become an actuary when I was five years old… Okay, no, I didn’t.

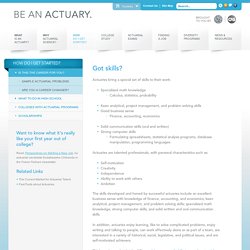

Until a couple of years ago, like most people, I had no idea what an actuary was. However, upon the harsh realisation that my life as a university student would soon come to an end, I began to research the opportunities that would be available to me upon completion of my degree. Actuarial science immediately appealed to me as it seemed to offer the stimulation, challenge and prospects I hoped to find in a career, whilst allowing me to utilise the mathematical skills I had spent four years developing! Joining the team My first encounter with Hymans Robertson was at an open evening held in their Glasgow Office. Is This the Career For You? Actuaries bring a special set of skills to their work: Specialized math knowledge Calculus, statistics, probability Keen analytical, project management, and problem solving skills Good business sense Finance, accounting, economics Solid communication skills (oral and written) Strong computer skills Formulating spreadsheets, statistical analysis programs, database manipulation, programming languages Actuaries are talented professionals, with personal characteristics such as: Self-motivation Creativity Independence Ability to work with others Ambition.

Skills you need to be an actuary. What are the skills you need to impress future employers?

In the actuarial profession, numerical aptitude is a given, but you also need softer skills in order to analyse and communicate complex concepts. Dr Geraldine Kaye advises on the qualities you need to develop in order to be a successful actuary. Maths was always my favourite subject. Institute and Faculty of Actuaries. Institute and Faculty of Actuaries. ACA - Find Our Members. Actuarial Education Company. ACA - Welcome. Be an Actuary. Financial Reporting Council. Institute and Faculty of Actuaries. Homepage. The Institute of Risk Management (IRM) MENU – HOME (EN) The Royal Statistical Society. Actuary. Actuaries are typically graduates with a 2:1 in a numerate subject (others may be suitable), good communicators with excellent business acumen and a love of logic and problem solving.

Most employers are looking for graduates with at least a 2.1 degree and excellent A levels or equivalent. The minimum requirements for admission as a student of the Actuarial Profession are: Maths A level (or equivalent) at grade B, together with a second A level (or equivalent) in any subject at grade C Three Scottish National Qualifications Authority Higher passes, one of which must be in mathematics at Grade A; or The Irish Leaving Certificate in at least five subjects; one of the passes must be in Mathematics at Grade A; or The Actuarial Profession’s CT1 exam taken as a non-member; or Other qualifications which are considered to be equivalent to the above.

For holders of a second class honours degree or above in a non-mathematical subject, the Mathematics A-level requirement is reduced to a grade C. SIAS. Home.