The Largest Heist in History. October - December 2008 When the financial crisis erupted at the end of September 2008, there was an unusual sense of incredible panic among banking executives and government officials.

These two establishment groups are known for their conservative, understated approach and, above all, their stiff upper lip. Yet at the time they appeared to the public running about like headless chickens. It was chaos. A state of complete chaos. But what really caused such an incredible panic in the establishment well known for its resilience? Money Making Machine. Memorandum from Greg Pytel. Loan to deposit ratio and banks liquidity. (This article is a technical analysis dedicated to John Varley, the CEO of Barclays Bank, of one of the largest and most famous banks in the world, referred to in the article“Liquidity risk”, who took care to write to the author of this blog.)

The key issue about banks liquidity is money multiplier. Money multiplier is a ratio of banks balance sheets to cash in circulation. Q&A: Northern Rock crisis. The Bank of England has given emergency financial support to the UK's fifth-largest mortgage lender, the Northern Rock.

This has made the Newcastle-based firm the highest-profile UK victim of the global credit crunch, triggered by the sub-prime mortgage crisis in the US. Why does the Northern Rock need to be bailed out? Essentially, the firm needs to secure access to a greater flow of cash so that it can continue its business. Unlike most banks, which get their money from customers making deposits into savings accounts, Northern Rock is built around its mortgage business. Liquidity risk. In response to the assertion by the author of this blog that the financial system was turned into a pyramid scheme, the CEO of one of the world largest and best known banks wrote to the author, justifying his denial of this assertion (calling it ”completely baseless” ): "Banks certainly undertake a process of maturity transformation – that is the fundamental responsibility of banks: to borrow short and lend long.

In doing so, banks take what I would call liquidity risk: the risk that at any point in time a creditor might demand repayment, but the bank is unable to provide that because it does not have cash to hand because the borrower is not due to repay their loan for some time. That is wholly different from a pyramid scheme where the borrower has no idea where the funds are going to come from when the obligation is constructed. " The author of this blog responded: How does it work? For those who cannot visualise how lending with loan to deposit ratio above 100% pumps out cash of bank reserves and creates a financial pyramid below is a simplified example based on two banks financial system.

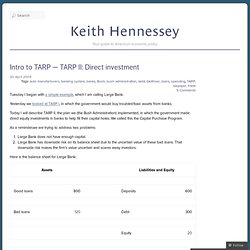

Please go with pen and paper line by line and follow the growth of bogus balance sheets. 1. Two Banks A and B are set up. Both have zero on deposit and loan books. Bank A has $104.91 and Bank B has 166.38 cash reserves. Bank A:- Capital reserves: $104.91 cash and $0 non-cash- Deposits: $0- Loans: $0 Bank B:- Capital reserves: $166.38 cash and $0 non-cash- Deposits: $0- Loans: $0. How to read balance sheet. Intro to TARP — Summary of the series Intro to TARP — TARP II: Direct investment Tuesday I began with a simple example, which I am calling Large Bank.

Yesterday we looked at TARP I, in which the government would buy troubled/toxic assets from banks. Today I will describe TARP II, the plan we (the Bush Administration) implemented, in which the government made direct equity investments in banks to help fill their capital holes. We called this the Capital Purchase Program. 011209.jpg (JPEG Image, 713×533 pixels) The reckless, irresponsible seizure of Washington Mutual: please. I lost money on this – so you can take my analysis with the caveat of a slightly angry grain of salt.

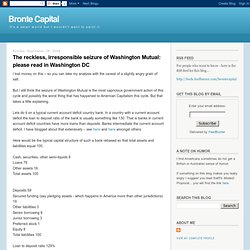

But I still think the seizure of Washington Mutual is the most capricious government action of this cycle and possibly the worst thing that has happened to American Capitalism this cycle. But that takes a little explaining. Lets do it on a typical current account deficit country bank. Deflation and bank bailouts in Japan. Given what is happening with Fannie Mae at the moment I should share a little of the history of non-US bank bail outs.

I will start with and later do . was an unusual bank collapse. It happened despite excess savings in the system. This is really strange. Most bank collapses happen when there is a lending binge that drives excess or investment or consumption and with a current account deficit. Japanese banks always had (at least collectively) sufficient deposits. But the Japanese banks lent very badly indeed. The Norwegian bank collapse – a fixed currency model with a curr. In my post about the Japanese bank collapse I showed how insolvent banks could remain liquid and hence operating for decades provided that they had (a) sufficient deposit funding and (b) low enough interest rates.

[Please read the Japan post before you read this one.] Given that the Japan situation required sufficient deposit funding I argued the Japanese deflation model was not a good model for how the situation would wind up. I promised to talk about the Scandinavian bank collapse in a follow up post. As I wrote this post I realised that I did not know enough about the Scandinavian collapse generally to write a useful post. But I know plenty about the Norwegian collapse. Quelle Surprise! Big Banks Who Got TARP Funds Reduced Lending « Before we get to the particulars of tonight’s Wall Street Journal story, we need to step back a second.

Just like the war in Iraq, which had a ton of justifications served up by the Bush Administration, none of which added up (and the most obvious one, that the Bushies wanted to control the second biggest oil reserves on the planet, somehow never gets mentioned in polite company in the US), we’ve also had too many rationales offered for the TARP in its very short life. The one that has stuck with Congress and in the public’s mind is that it was meant to get banks lending again. And the Journal tells us that measured against that benchmark, it hasn’t worked. The Federal Reserve Bank Discount Window & Payment System Risk W. March 30, 2009 Announcement regarding Changes to the Discount Window & Payment System Risk Collateral Margins Table In 2005, the Federal Reserve announced the implementation of separate valuation processes for loans pledged in a designated format through our Automated Loan Deposit process (ALD) or "individually deposited," versus loans pledged in an alternative format or "group deposited.

" At that time, it was also noted that lendable values for group deposited loans would be based on assumptions regarding the average risk characteristics of the loans and subject to periodic changes. Calculated Risk. Bank Balance Sheet: Liquidity and Solvency, Par. By Bill McBride on 4/26/2009 11:57:00 AM Note: I took some short cuts to make this simple - think of this conceptually. I'm intentionally mixing financial institutions. Bank Balance Sheet: Liquidity and Solvency, Par. By Bill McBride on 4/26/2009 03:26:00 PM In the previous post, I tried to present a conceptual overview of a liquidity crisis using a bank's balance sheet: Bank Balance Sheet: Liquidity and Solvency, Part I.

Note: I combined various types of financial institutions to illustrate a few points. As we continue the story, the bank has suffered some losses, but the bank run has been halted by the efforts of the FDIC (increasing insurance limit), or the Fed (by providing liquidity). Click on graph for larger image in new window. This time we look at the bank's assets.

Economic Letter: Capital Structure in Banking (2009-37, 12/7/200. Capital Structure in Banking Simon Kwan Capital structure theories seek to explain why businesses choose different mixes of debt and equity to finance their operations. Bank Lialabilities. Improving bank capital structures. 18 Jan 2010 Speech by Thomas F.

Huertas, Director, Banking Sector, FSA and Vice Chairman, CEBSLondon School of Economics, London In a perfect world, capital structures do not matter. MLC - News and information - Evolution of the MLC Diversified De. Alternative debt strategy While MLC takes a strategic approach to investing, we recognise the value that can be generated by investing opportunistically in attractive assets. Google Image Result for. Intro to Capital Structure. Return on Equity - The DuPont Model. As you learned in the investing lessons, return on equity (ROE) is one of the most important indicators of a firm’s profitability and potential growth.

Companies that boast a high return on equity with little or no debt are able to grow without large capital expenditures, allowing the owners of the business to withdrawal cash and reinvest it elsewhere. Many investors fail to realize, however, that two companies can have the same return on equity, yet one can be a much better business. For that reason, according to CFO Magazine, a finance executive at E.I. du Pont de Nemours and Co., of Wilmington, Delaware, created the DuPont system of financial analysis in 1919. Weighted Average Cost of Capital - An Explanation of Weighted Av.

Dividend Stocks For Dummies Cheat Sheet. Cheat Sheet Dividend stock investing may seem daunting, but with a little knowledge of how to find and pick promising dividend-paying stocks, you can invest in these stocks and reap dividends like a pro. Your portfolio will thank you. Researching Your Dividend Stock Picks with Important Formulas As with all stocks, you should research the dividend stocks you’re considering before you buy them to ensure they’re good investments. These formulas help you determine whether a stock’s dividend and other markers are sufficient to meet your needs. Dividend Per Share (DPS) Total Dividends ÷ Total Shares = Dividend Per Share (for the quarter) Investing Classroom. Morningstar.com's Interactive Classroom. Cash Flow vs. Earnings: Which Is More Meaningful? Be Defensive: Use Stop Orders1084by Randy FrederickApril 11, 2014 Stop orders may help you obtain a predetermined entry or exit price, limit a loss or lock in a profit.

All-new On Investing® for iPad® app. Now get access to Schwab experts’ ideas, plus new tools and checklists to help you take action. Beginners' Guide to Financial Statements. The Basics If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements. If you can follow a recipe or apply for a loan, you can learn basic accounting.

Principles of Accounting. Shedlarz_presentation_012207.pdf (application/pdf Object)