LawyerINC

LawyerINC is dedicated at providing the best legal aid possible at best reasonable prices to every person by building an interactive online platform to understand your legal query and requirement. We have a team of renowned lawyers and experts with expertise in Corporate, Criminal, Civil, Contract, IPR, Taxation laws etc. to guide you step-by-step towards the legal recourse you seek while keeping your best interest in mind.

Legal Steps for Starting a Business in India. With the passage of years, we see that new start-ups are blooming across the country, ranging in every field from the software industry, food processing industries to the pharmaceutical industries.

But most of them do not have the idea of the legal aspects involved in the business. Legal steps for starting a business in India is quiet tiresome and hectic. Company filings and Regulations are not the easy part of any startup or a new business venture. In addition, it digs a great hole in the personal finances of the company. Registration of a Private Limited Company in India - Step by Step Procedure. A company needs to register itself as a private Limited Company because it has several advantages.

Private Limited Company registration in India is governed by the Ministry of Corporate Affairs, Companies Act, 2013. A private Limited Company can have a minimum of 2 members and a maximum of 50 members. Pvt. Ltd. It offers limited liability to its shareholders. Marriage Registration Lawyer, Online Marriage Certifiacte Procedure India. Get Your Marriage Registration Done Without Any Hassle Full major requirements/documents for marriage registration Criteria for Marriage Registration under Special Marriage Act, 1954 Criteria for Marriage Registration under Hindu Marriage Act, 1955 Benefits of getting marriage registered Prohibited relationships After the marriage is solemnized there are certain requirements that must be fulfilled in order to give it a legal standing or to make it valid under Indian laws.

The major requirement is marriage registration under either the Special Marriage Act, 1954 or Hindu Marriage Act, 1955. All About Marriage Law in India. Food Safety License Registration - LawyerInc. Food Industry is a diverse industry which includes the manufacturing, storage, distribution, sale and import of all possible food articles.

This industry subjects to some regulations for the purpose of safety, hygiene and quality. And FSSAI authority acts as a single reference point for every subject matter relating to food safety, food standard at multiple levels. It lays down guidelines and an appropriate system of enforcing such guidelines and standards. FSSAI Registration - Get FSSAI Food License Online. Trademark Registration. Protect your Brand by registering your Logo, Brand name and Slogan with LawyerINC.

Start now, avail our services and get your trademark registered hassle free. Trademark is a unique expression which relates to the product or service that distinguishes it from the others. This expression can be a word, logo, graphic or any other combination. What Is Infringement Of Trademark - LawyerINC - Trademark. NBFC Takeover Procedure - NBFC for Sale with RBI Guidelines. A Non-banking financial company (NBFC) is a company which is registered under the Companies Act, 1956.

Basically it’s a financial institution that offers various kinds of banking services but they are not Bank. It engaged in the financial transactions like business of loans, provide credit facilities, acquisitions of shares, stocks, bonds, debentures etc… issued by the Government, currency exchange, retirement planning, money markets, chit funds. Generally, these kinds of institutions are not allowed to take traditional demand deposits—readily available funds, such as those in checking or savings accounts—from the public. Due to these limitations they are outside the scope of conventional oversight from state and federal financial regulators.

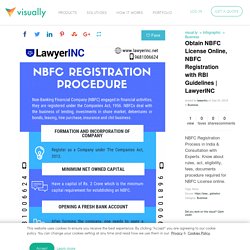

Step by Step Process - LawyerINC - NBFC Registration nbfc takeover nbfc. Obtain NBFC License Online, NBFC Registration with RBI Guidelines. Embed Code For hosted site: Click the code to copy <div class='visually_embed'><img class='visually_embed_infographic' src=' alt='Obtain NBFC License Online, NBFC Registration with RBI Guidelines | LawyerINC' /><div class='visually_embed_cycle'></div><script type='text/javascript' src=' class='visually_embed_script' id='visually_embed_script_1370728'></script><p> From <a href=' For wordpress.com:

Obtain NBFC License Online, NBFC Registration with RBI Guidelines. Non-Banking Financial Company (NBFC) engaged in financial activities, they are registered under the Companies Act, 1956.

NBFCs deal with the business of lending, investments in share market, debentures or bonds, leasing, hire purchase, insurance and chit business. Irrespective of their financial activities they do not possess a banking license. NBFC cannot accept demand deposits or issue cheques. Unlike banks, the deposits in NBFC are not insured. As per RBI Act, 1934, a company cannot function as an NBFC without a certificate of registration and without having net owned funds worth Rs. 2 crores. Net owned funds is the balance of “owned funds” minus the amount of investment in shares of subsidiaries, companies in the same group and all other NBFCs, book value of debentures, bonds, outstanding loans and advances including hire purchase and lease finance made to and deposits with subsidiaries and companies in the same group.

Everything you should Know about NBFC Registration Process in India - LawyerINC - NBFC Registration. 4.

Infrastructure Finance CompanyInfrastructure finance companies provide infrastructure loans for the development of transport, water &sanitation, energy, communication, social and commercial infrastructure. The companies need to follow the following stipulations to be considered as infrastructure finance company they need to deploy at least minimum of 75% of total assets in infrastructure loans, and the net worth of the company must be Rs. 300 crore. How to Send a Cheque Bounce Notice? - LawyerINC. With the boom in the economy, the cheque bounce cases have increased.

There are over 40 lakh cheque bounce cases clogging the legal system in India according to Supreme Court. In order to deal with bouncing of cheque, one needs to send a cheque bounce notice. This means taking legal action against the issuer of cheque. How to Reactivate Strike-Off Company? - LawyerINC. The Ministry of Corporate Affairs (MCA) is taking strict actions against shell companies and companies which do not file their financial statements and annual returns regularly with ROC (Registrar of companies).

Last year alone, it struck off lakhs of companies under section 248(1) of Companies Act, 2013. The government is still cleaning up the corporate field. But it has come up with a procedure to reactivate strike off company. Introduction. Director Disqualification: Remedies for Disqualified Directors - LawyerINC. Over the last few years, the Ministry of Corporate Affairs (MCA) has actively taken action against shell companies. They have disqualified over 3,00,000 directors under section 164(2)(2) of the Companies Act, 2013.

After disqualification of directors, the directors cannot use the DIN and DSC, and such directors need to resign from the company. Let’s have a deep dig into the remedies for disqualified directors and get to know the procedure for removal of disqualification. How to apply for renewal of FSSAI License? - LawyerINC. In India, it is important for a food business operator to get an FSSAI License before starting a food business. Most people don’t know that the renewal of the FSSAI license is also important. FSSAI License is valid for a period of 1 to 5 years. How To Remove Director Disqualification Without Revival of Company. There was a major wobbling in the industry when around 3 lakhs of Directors were disqualified by Registrar of Companies (ROC) under Section 164(2) and Section 167(1) (a) of the Companies Act, 2013.

Additionally, around 2.30 lakh companies were struck off by ROC branding them as ‘Shell Companies’. So what was the radical reasoning behind them, it was just on account of non-compliance by the companies or was there any other reasoning behind that and is there any way to Remove Director Disqualification?

Dos and Don'ts in Cheque Bounce Case- 10 Key Points - LawyerINC. Even though online banking is prospering, some people still opt for the traditional way of transferring money through cheques. Due to this, one needs to know the details of dishonour of cheque and the dos and don’ts to be followed in a cheque bounce case. Here in this article, we’ll be discussing about cheques, the dos and don’ts when there is dishonour of cheque and much more.

Cheque and dishonour of cheque A Cheque is a negotiable instrument which directs banks to pay a sum of money from the person in whose name the cheque is issued. Cheque bounce occurs when there is an unsuccessful processing of the cheque due to various reasons. How to send a Legal Notice in India?- Legal Notice Format & Procedure - Legal action can be initiated upon an individual or an entity only when you send a legal notice to them. It is this process which brings the matter to the Court. The intimation sent to the person is known as legal notice. The legal notice format is easy as it is the most basic document in the legal field. Here in this article, we are discussing legal notice, its importance, the procedure to send a notice, format of legal notice and other important facets of a legal notice. Steps for Voluntary Winding up of A Company.

Divorce by Mutual Consent in India - LawyerInc.net. Removal of Directors Disqualification After COD Scheme - LawyerINC. Many directors have been disqualified over the last few years by Ministry of Corporate Affairs for not performing or following the rules & regulations mentioned under Companies Act. Each director has their unique Director Identification Number. But once director get disqualified, their Director Identification number also get deactivated. Almost Lakhs of DIN were deactivated which caused damage to corporate sector. Comprehensive Guide for Cheque Bounce in India - LawyerINC.

Industrial Revolution brought changes in the market field. Therefore, there has been an increase in transactions on a daily basis. Guide for Trademark Registration Process In India - LawyerINC. Trademarks are unique expressions relating to different products and services which helps customers to distinguish it from others. Top 9 Things About NBFC Registration Process - LawyerINC. FSSAI License for Restaurant- A Complete Guide - LawyerINC. FSSAI License or Registration is a compulsory requirement for all food business operators in India under The Food Safety and Standards Act, 2006. It also lay out specific guidelines for running a restaurant in India. Nowadays, the Food Safety Authorities are becoming more and more vigilant and shutting down restaurants not having FSSAI License.

Therefore for avoiding this situation, every restaurant should necessarily follow the guidelines and get FSSAI registration. Is NBFC More Profitable Than Bank? Advantages Of NBFC. The NBFC sector is growing at the cost of banks in India, which are saddled by bad loans and poor profitability.