Weather derivative. Overview of uses[edit] Heating degree days are one of the most common types of weather derivative.

Typical terms for an HDD contract could be: for the November to March period, for each day where the temperature rises above 18 degrees Celsius keep a cumulative count of the difference between 18 degrees and the average daily temperature. Depending upon whether the option is a put option or a call option, pay out a set amount per heating degree day that the actual count differs from the strike. History[edit] The first weather derivative deal was in July 1996 when Aquila Energy structured a dual-commodity hedge for Consolidated Edison Co.[1] The transaction involved ConEd's purchase of electric power from Aquila for the month of August.

Derivative (finance) Many money managers use derivatives for a variety of purposes, such as hedging — by taking a position in a derivative, losses on portfolio holdings may be minimized or offset by profits on the derivative.

Likewise, derivatives can be used to gain quicker and more efficient access to markets; for example, it may be easier and quicker to purchase an S & P 500 futures contract than to invest in the underlying securities.[3] Derivatives are a contract between two parties that specify conditions (especially the dates, resulting values and definitions of the underlying variables, the parties' contractual obligations, and the notional amount) under which payments are to be made between the parties.[4][5] The most common underlying assets include commodities, stocks, bonds, interest rates and currencies, but they can also be other derivatives, which adds another layer of complexity to proper valuation.

Still, even these scaled down figures represent huge amounts of money. Nadex. History[edit] "Hedgelets" come in two varieties: binary options and capped futures.[4] Binary options are bets on outcomes, "yes/no" contracts, that pay out a small dollar amount (e.g. $100) if final price of an instrument is above the strike price and nothing if below.

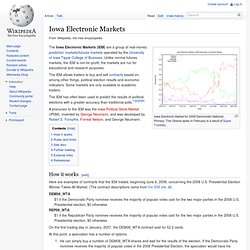

For instance, HedgeStreet launched Germany 30 Binary Options in 2008. Iowa Electronic Markets. Iowa Electronic Market for 2008 Democratic National Primary.

The Obama spike in February is a result of Super Tuesday. Stock valuation. In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks.

The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged undervalued (with respect to their theoretical value) are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will, on the whole, rise in value, while overvalued stocks will, on the whole, fall.

Warren Buffett: How He Does It. It's not surprising that Warren Buffett's investment strategy has reached mythical proportions.

A $8,175 investment in Berkshire Hathaway (NYSE:BRK.A) in January 1990 was worth more than $165,000 by September 2013, while $8,175 in the S&P 500 would have grown to $42,000 within the aforementioned timeframe. But how did Buffett do it? The rise of the machines. Artificial intelligence applied heavily to picking stocks - Business - International Herald Tribune. NASDAQ:IRBT: 33.83 -1.41 (-4.00%) - iRobot Corporation. Arbitrage. Arbitrage-free[edit] Conditions for arbitrage[edit] Arbitrage is possible when one of three conditions is met: Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time.

The transactions must occur simultaneously to avoid exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Keynesian economics. The theories forming the basis of Keynesian economics were first presented by the British economist John Maynard Keynes in his book, The General Theory of Employment, Interest and Money, published in 1936, during the Great Depression.

Keynes contrasted his approach to the aggregate supply-focused 'classical' economics that preceded his book. The interpretations of Keynes that followed are contentious and several schools of economic thought claim his legacy. Keynesian economists often argue that private sector decisions sometimes lead to inefficient macroeconomic outcomes which require active policy responses by the public sector, in particular, monetary policy actions by the central bank and fiscal policy actions by the government, in order to stabilize output over the business cycle.[2] Keynesian economics advocates a mixed economy – predominantly private sector, but with a role for government intervention during recessions.

Overview[edit] Theory[edit] Momentum (finance) In finance, momentum is the empirically observed tendency for rising asset prices to rise further, and falling prices to keep falling.

For instance, it was shown that stocks with strong past performance continue to outperform stocks with poor past performance in the next period with an average excess return of about 1% per month.[1][2] Efficient-market hypothesis. In finance, the efficient-market hypothesis (EMH), or the joint hypothesis problem, asserts that financial markets are "informationally efficient".

In consequence of this, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis, given the information available at the time the investment is made. Historical background[edit] The efficient-market hypothesis was developed by Professor Eugene Fama at the University of Chicago Booth School of Business as an academic concept of study through his published Ph.D. thesis in the early 1960s at the same school. The efficient-market hypothesis emerged as a prominent theory in the mid-1960s. Paul Samuelson had begun to circulate Bachelier's work among economists.

It has been argued that the stock market is “micro efficient” but not “macro efficient”. CFA Institute Publications: Financial Analysts Journal - 51(4):21 - Abstract. Although earnings surprises have been studied extensively, they have not been examined in the context of contrarian strategies. Positive and negative earnings surprises affect “best” (high-P/E) and “worst” (low-P/E) stocks in an asymmetric manner that favors worst stocks. Security (finance) A security is a tradable asset of any kind.[1] Securities are broadly categorized into: The company or other entity issuing the security is called the issuer. A country's regulatory structure determines what qualifies as a security. For example, private investment pools may have some features of securities, but they may not be registered or regulated as such if they meet various restrictions.

Securities may be classified according to many categories or classification systems: Securities are the traditional way that commercial enterprises raise new capital.