WeChat SA launches mobile wallet: includes P2P payments, SnapScan integration. By Stuart Thomas: Senior Reporter on 24 November, 2015 100.

Cashless future for Sweden? Published Oct 14, 2015.

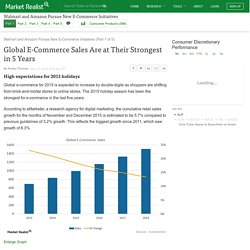

Global E-Commerce Sales Are at Their Strongest in 5 Years - Market Realist. Walmart and Amazon Pursue New E-Commerce Initiatives (Part 1 of 5) Global E-Commerce Sales Are at Their Strongest in 5 Years By Parker Thomas • Dec 15, 2015 9:53 am EST High expectations for 2015 holidays Global e-commerce for 2015 is expected to increase by double-digits as shoppers are shifting from brick-and-mortar stores to online stores.

The 2015 holiday season has been the strongest for e-commerce in the last five years. According to eMarketer, a research agency for digital marketing, the cumulative retail sales growth for the months of November and December 2015 is estimated to be 5.7% compared to previous guidelines of 3.2% growth. Enlarge Graph M-commerce and social media will drive e-commerce Online transactions through mobile commerce (m-commerce) gained momentum in the 2014 holiday season, and it continues to move with the same pace in 2015.

US consumers are getting more comfortable using mobile devices instead of traditional desktops. 13 B2B Payment Companies to Watch out For. B2B payments have been known to be inefficient and expensive.

Customers believe that there is an immense need for streamlining of settlements and reconciliation of business commerce. The current challenges are poor working capital optimization, zero cash visibility and friction in buyer-supplier relations. In this article, we will discuss 13 companies that are coming up with innovative services addressing the $250-billion B2B payments market. What's Driving China's Booming Mobile Payments Market? China’s mobile payment market saw a 140% year-over-year growth in transaction volume in the first quarter of 2015, excluding the traditional services of Chinese banks and China UnionPay.

According to a report by market research firm iResearch, the early-year boost was thanks to “lucky money” fever during the 2015 Chinese New Year holidays in February, a feature where real money transfers are gamified, building on the Chinese new year tradition of lucky money. Under the feature, a user can add a red envelope, or ‘hongbao’ to their chat, contributing an amount of real RMB. Friends can then select the envelope, and a random algorithm determines how big of a share each recipient takes. The massive success of the gamified lucky money feature by Tencent’s messaging app WeChat helped WeChat Payment sign up an unprecedented numbers of users. They are now seizing on that momentum with an additional wave of targeted payment-related functions and features. Source: iResearch. Money with no middleman. Bitcoin may be a risky investment, but the technologies that underpin it are a safe bet to disrupt the finance sector The price of Bitcoin, the best known and most widely used example of a cryptocurrency, has followed a roller coaster trajectory in the past 18 months.

This erratic behavior, combined with Bitcoin’s reputation as an enabler for criminal activity, means that serious investors may not consider cryptocurrencies to be an asset class worth considering. However, the technology that underpins Bitcoin may prove highly disruptive to the way the financial services industry works. The investment community would be wise, therefore, to keep one eye trained on developments in the cryptocurrency space. Swatch launches pay-by-wrist watch in China. Zwipe Grabs More Cash For Biometrics. Zwipe, a Norwegian startup that uses biometrics — specifically fingerprints — to authenticate card transactions, has garnered $5 million in Series B funding.

TechCrunch reported Wednesday (Oct. 14) that the company, battling against the traditional bulwarks of PINs and passwords, received the money from Photon Future, which itself is wholly owned by China’s Kuang-Chi Group, a holding company. As a result of the investment, Kuang-Chi is the largest Zwipe shareholder, having grabbed a 20 percent stake in the company. Total funding now comes to $11 million, and the latest round is tied to various business activities.

Starbucks launches new mobile payment services in the UK and Canada, and partners with Apple Pay » PaymentEye. Following the recent launch of Starbucks Mobile Order & Pay service across 7,400 stores across the US, the coffee chain is continuing to expand its mobile payment services with new product launches in Canada, the UK, and a partnership with Apple Pay.

Mobile Order & Pay comes to the UK Starbucks is launching Mobile Order & Pay in the UK, allowing customers to pre-order drinks and food in over 150 London stores. The mobile app allows customers to select their food and beverages and pay for them in advance of their visit to a Starbucks branch. What are the consumer attitudes to payments? (Infographic) » PaymentEye. With so many payment innovations being churned out, it is important to keep track of what consumers think about them and more importantly how the innovations change their behaviour.

For example, the most popular apps within payments are budgeting, balance checking and loyalty/rewards schemes, according to research from Vocalink/One Poll. This reveals that people are becoming more conscious of their spending, but at the same time value recognition for their spending. Moreover, over half of the 2,000 people surveyed said that they would be interested in using a payment or banking app of some kind. In terms of actual innovations, only 17 per cent of people have paid using a mobile phone. Facebook continues to expand into e-commerce territory » PaymentEye. Facebook continues its push into e-commerce by testing several new ad features that will allow users to buy products without ever having to leave the app.

The social media giant has been gradually expanding into payment/e-commerce territory as a way of diversifying its platform’s capabilities. Earlier in the year it started allowing people to make payments over Facebook Messenger and started testing its buy-button in the summer. Biometrics 2015 roundup » PaymentEye. Autumn has seen some pretty exciting news coming out of the biometrics arena. First Bank of America integrating Apple’s Touch ID technology into its mobile banking app, then Visa introducing a new biometric specification for chip card transactions that can enable palm, voice, iris, or facial verification which is designed to work with the EMV chip industry standard to make solutions more easily scalable. More recently, a report revealed that by 2020, more than $5.6 trillion of payments will be secured by biometric technology, a biometric authentication company raised $5m to accelerate the commercialisation of its biometric authentication technology, and Japanese card scheme JCB incorporated Fujitsu’s palm vein authentication technology into its global payment network.

“Identity theft is a major concern” The first seminar PaymentEye attended was presented by Reiko Yasue executive operating officer & director of Global Business Division, Fujisoft. US Law Commission to Debate Model Digital Currency Bill in DC. The Uniform Law Commission (ULC), a nonprofit dedicated to creating consistency among US state laws, is set to discuss a draft version of a model law meant to guide states in the formation of regulation for virtual currencies such as bitcoin this week. Set to take place from 9th to 11th October at the Hyatt Regency in Washington, DC, the three-day event will bring together the ULC's Study Committee on Alternative and Mobile Payment Systems for discussions on specifics of the bill's current provisions, including its recommendations to state legislatures on capital requirements and the cost of licensing. Originally tasked with considering the need for more uniform state legislation on alternative and mobile payment systems in 2014, the group eventually chose digital currencies as its area of emphasis.

Android Pay, ISIS and the road to mobile payments ubiquity. At the Mobile Payments Conference in Chicago last month, Jack Connors, Google's head of commerce partnerships, told attendees that Android Pay would launch "very soon. " A week later, Google announced a soft rollout of its revamped mobile wallet. Android Pay is 100 percent focused on the merchant relationship with their customer, Connors said at the conference. Are biometrics the next big thing in payments? Are biometrics the next big thing in payments?